NEW YORK: Like Noah building his ark as thunderheads gathered, Bill Gross has spent the past two years anticipating the flood that swamped Bear Stearns nearly two weeks ago. As manager of the world's biggest bond fund and custodian of nearly a trillion dollars in assets, Gross amassed a cash hoard of $50 billion in case trading partners suddenly demanded payment from his firm, Pacific Investment Management Co.

And every day for the past three weeks he has convened meetings in a war room in Pimco's headquarters in Newport Beach, California, "to make sure the ark doesn't have any leaks," Gross said. "We come in every day at 3:30 a.m. and leave at 6 p.m. I'm not used to setting my alarm for 2:45 a.m., but these are extraordinary times."

Even though Gross, 63, is a market veteran who has lived through the collapse of other banks and brokerage firms, the 1987 stock market crash and the near meltdown of the Long-Term Capital Management hedge fund a decade ago, he said the current crisis feels different - in both size and significance.

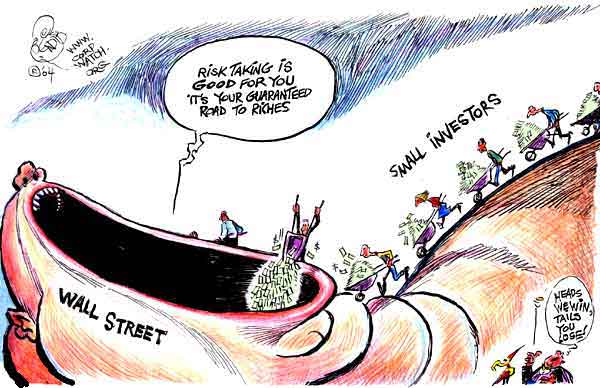

The U.S. Federal Reserve has not only taken action unprecedented since the Great Depression - by lending money directly to major investment banks - it has also put taxpayers on the hook for billions of dollars in questionable trades that these same bankers made when the good times were rolling.

"Bear Stearns has made it obvious that things have gone too far," said Gross, who planned to use some of his cash to bargain-shop. "The investment community has morphed into something beyond banks and something beyond regulation. We call it the shadow banking system."

It is the private trading of complex instruments that lurk in the financial shadows that worries regulators and Wall Street. Economic downturns and panics have occurred before, of course. Few, however, have posed such a serious threat to the entire financial system that regulators have responded as if they were confronting a potential epidemic.

As the U.S. Congress and Republican and Democratic presidential administrations pushed for financial deregulation over the past decade, the biggest banks and brokerage firms created a dizzying array of innovative products that experts now admit were hard to understand and even harder to value.

On Wall Street, of course, what you do not see can hurt you. In the past decade, there has been an explosion in complex derivative instruments, like collateralized debt obligations and credit default swaps, that were intended primarily to transfer risk.

These products are virtually hidden from investors, analysts and regulators, even though they have become among Wall Street's most outsized profit engines. They do not trade openly on public exchanges, and financial services firms disclose few details about them. Wall Street dynamite

Used judiciously, derivatives can limit the damage from financial miscues and uncertainty, greasing the wheels of commerce. Used unwisely - when greed and the urge to gamble with borrowed money overtake sensible risk-taking - derivatives can become Wall Street's version of nitroglycerin.

Bear Stearns's vast portfolio of these instruments was among the main reasons for the bank's collapse, but derivatives are buried in the accounts of just about every Wall Street company, as well as those of major commercial banks like Citigroup and JPMorgan Chase. What is more, these exotic investments have been exported all over the globe.

With Bear Stearns forced into a sale and the entire financial system still under the threat of further losses, Wall Street executives, regulators and politicians are scrambling to figure out what went wrong and how it can be fixed.

But because the forces that have collided in recent weeks were set in motion long before the subprime mortgage mess first made news last year, solutions will not come easily or quickly, analysts say.

In fact, while home loans to risky borrowers were among the first to go bad, analysts say that the crisis did not stem from the housing market alone and that it certainly will not end there.

"The problem has been spreading its wings and taking in markets very far afield from mortgages," Alan Blinder, former vice chairman of the Federal Reserve and now an economics professor at Princeton, said. "It's a failure at a lot of levels. It's hard to find a piece of the system that actually worked well in the lead-up to the bust."

Stung by the new focus on their complex products, advocates of the derivatives trade say they are unfairly being made scapegoats for the recent panic on Wall Street. "Some people want to blame our industry because they have a vested interest in doing so," said Robert Pickel, chief executive of the International Swaps and Derivatives Association, a trade group. "We believe that there are good investment decisions and bad investment decisions. We don't decry motor vehicles because some have been involved in accidents."

Already, legislators in Washington are offering detailed plans for new regulations, including ones to treat Wall Street banks like their more heavily regulated commercial brethren. At the same time, normally wary corporate leaders like James Dimon, the chief executive of JPMorgan Chase, are beginning to acknowledge that maybe, just maybe, new regulations are necessary.

"We have a terribly global world and, over all, financial regulation has not kept up with that," Dimon said on March 17, the day after his bank agreed to take over Bear Stearns. "I can't even describe the seriousness of that. I always talk about how bad things can happen that you can't expect. I didn't fathom this event."

Two months before he resigned as chief executive of Citigroup last year amid nearly $20 billion in write-downs, Charles Prince 3rd sat down in Washington with Representative Barney Frank, chairman of the Financial Services Committee of the House of Representatives. Among the topics they discussed were investment vehicles that allowed Citigroup and other banks to keep billions of dollars in potential liabilities off of their balance sheets - and away from the scrutiny of investors and analysts.

"Why aren't they on your balance sheet?" asked Frank, a Democrat of Massachusetts. Frank recalled that Prince had said doing so would have put Citigroup at a disadvantage with Wall Street investment banks that were more loosely regulated and were allowed to take far greater risks. (A spokeswoman for Prince confirmed the conversation.)

It was at that moment, Frank said, that he first realized just how much freedom Wall Street companies had, and how lightly regulated they were in comparison with commercial banks, which have to answer to an alphabet soup of government agencies like the Federal Reserve and the comptroller of the currency.

"Not only did Wall Street have so much freedom, but it gave commercial banks an incentive to try and evade their regulations," Frank said. When it came to Wall Street, he said, "we thought we didn't need regulation." Forgotten lessons

In fact, Washington has long followed the financial industry's lead in supporting deregulation, even as newly minted but little-understood products like derivatives proliferated.

During the late 1990s, Wall Street fought bitterly against any attempt to regulate the emerging derivatives market, recalled Michael Greenberger, a former senior regulator at the Commodity Futures Trading Commission. Although the Long-Term Capital debacle in 1998 alerted regulators and bankers alike to the dangers of big bets with borrowed money, a rescue effort engineered by the Federal Reserve Bank of New York prevented the damage from spreading.

"After that, all was forgotten," said Greenberger, now a professor at the University of Maryland. At the same time, derivatives were being praised as a boon that would make the economy more stable.

Speaking in Boca Raton, Florida, in March 1999, Alan Greenspan, then the Fed chairman, told the Futures Industry Association, a Wall Street trade group, that "these instruments enhance the ability to differentiate risk and allocate it to those investors most able and willing to take it."

Although Greenspan acknowledged that the "possibility of increased systemic risk does appear to be an issue that requires fuller understanding," he argued that new regulations "would be a major mistake."

"Regulatory risk measurement schemes," he added, "are simpler and much less accurate than banks' risk measurement models."

Greenberger, still concerned about regulatory battles he lost a decade ago, said that Greenspan "felt derivatives would spread the risk in the economy."

"In reality," Greenberger added, "it spread a virus through the economy because these products are so opaque and hard to value." A representative for Greenspan said he was preparing to travel and could not comment.

A milestone in the deregulation effort came in the autumn of 2000, when a lame-duck session of Congress passed a little-noticed piece of legislation called the Commodity Futures Modernization Act. The bill effectively kept much of the market for derivatives and other exotic instruments off-limits to agencies that regulate more conventional assets like stocks, bonds and futures contracts.

Supported by Phil Gramm, then a Republican senator from Texas and chairman of the Senate Banking Committee, the legislation was a 262-page amendment to a far larger appropriations bill. It was signed into law by President Bill Clinton that December.

Gramm, now the vice chairman of UBS, the Swiss investment banking giant, was unavailable for comment. (UBS has recently seen its fortunes hammered by ill- considered derivative investments.)

"I don't believe anybody understood the significance of this," said Greenberger, describing the bill's impact.

By the beginning of this decade, according to Frank and Blinder, Greenspan resisted suggestions that the Fed use its powers to regulate the mortgage market or to crack down on practices like providing loans to borrowers with little, if any, documentation.

"Greenspan specifically refused to act," Frank said. "He had the authority, but he didn't use it."

Others on Capitol Hill, like Representative Scott Garrett, a Republican of New Jersey and a member of the Financial Services banking subcommittee, reject the idea that loosening financial rules helped to create the current crisis.

"I don't think deregulation was the cause," he said. "And had we had additional regulation in place, I'm not sure what we're experiencing now would have been averted." Nips and tucks

Regardless, with profit margins shrinking in traditional businesses like underwriting and trading, Wall Street companies rushed into the new frontier of lucrative financial products like derivatives.

Three years ago, many of Wall Street's best and brightest gathered to assess the landscape of financial risk. Top executives from companies like Goldman Sachs, Lehman Brothers and Citigroup - calling themselves the Counterparty Risk Management Policy Group II - debated the likelihood of an event that could send a seismic wave across financial markets.

The group's conclusion, detailed in a 153-page report, was that the chances of a systemic upheaval had declined sharply after the Long-Term Capital bailout. Members recommended some nips and tucks around the market's edges, to ensure that trades were cleared and settled more efficiently. They also recommended that secretive hedge funds volunteer more information about their activities. Yet, over all, they concluded that financial markets were more stable than they had been just a few years earlier.

Few could argue. Wall Street banks were happy. They were posting record profits and had healthy capital cushions. Money flowed easily as corporate default rates were practically nil and the few bumps that occurred in the market were readily absorbed.

More important, innovative products designed to mitigate risk were seen as having reduced the likelihood that a financial cataclysm could put the entire system at risk.

"With the 2005 report, my hope at the time was that that work would help in dealing with future financial shocks, and I confess to being quite frustrated that it didn't do as much as I had hoped," said E. Gerald Corrigan, a managing director at Goldman Sachs and a former New York Fed president, who was chairman of the policy group. "Still, I shudder to think what today would look like if not for the fact that some of the changes were, in fact, implemented." Stealth market

One of the fastest-growing and most lucrative businesses on Wall Street in the past decade has been in derivatives - a sector that boomed after the near collapse of Long-Term Capital.

It is a stealth market that relies on trades conducted by phone between Wall Street dealer desks, away from open securities exchanges.

How much changes hands or who holds what is ultimately unknown to analysts, investors and regulators.

Credit rating agencies, which banks paid to grade some of the new products, slapped high ratings on many of them, despite having only a loose familiarity with the quality of the assets behind these instruments.

Even the people running Wall Street companies did not really understand what they were buying and selling, said Byron Wien, a 40-year veteran of the stock market who is now the chief investment strategist of Pequot Capital, a hedge fund. "These are ordinary folks who know a spreadsheet, but they are not steeped in the sophistication of these kind of models," Wien said. "You put a lot of equations in front of them with little Greek letters on their sides, and they won't know what they're looking at."

Blinder, the former Fed vice chairman, holds a doctorate in economics from the Massachusetts Institute of Technology but said that he had only a "modest understanding" of complex derivatives. "I know the basic understanding of how they work," he said, "but if you presented me with one and asked me to put a market value on it, I'd be guessing."

Such uncertainty led some to single out derivatives for greater scrutiny and caution. Most famous, perhaps, was Warren Buffett, the legendary investor and chairman of Berkshire Hathaway, who in 2003 said derivatives were potential "weapons of mass destruction."

Behind the scenes, however, there was another player who was scrambling to assess the growing power, use and dangers of derivatives.

Timothy Geithner, a career civil servant who took over as president of the New York Fed in 2003, was trying to solve a variety of global crises while at the Treasury Department. As a Fed president, he tried to get a handle on hedge fund activities and the use of leverage on Wall Street, and he zeroed in on the credit derivatives market.

Geithner brought together leaders of Wall Street companies in a series of meetings in 2005 and 2006 to discuss credit derivatives, and he pushed many of them to clear and settle derivatives trading electronically, hoping to eliminate a large paper backlog that had clogged the system.

Even so, Geithner had one hand tied behind his back. While the Fed regulated large commercial banks like Citigroup and JPMorgan, it had no oversight on activities of the investment banks, hedge funds and other participants in the burgeoning derivatives market. And the industry and sympathetic politicians in Washington fought attempts to regulate the products, arguing that it would force the lucrative business overseas.

Geithner declined an interview request for this article. 'The shot across the bow'

In a May 2006 speech about credit derivatives, Geithner praised the benefits of the products: improved risk management and distribution, as well as enhanced market efficiency and resiliency. As he had on earlier occasions, he also warned that the "formidable complexity of measuring the scale of potential exposure" to derivatives made it hard to monitor the products and to gauge the financial vulnerability of individual banks, brokerage firms and other institutions.

When increased defaults in subprime mortgages began crushing mortgage-linked securities last summer, several credit markets and many companies that play substantial roles in those markets were sideswiped because of a rapid loss of faith in the value of the products.

Two large Bear Stearns hedge funds collapsed because of bad subprime mortgage bets. The losses were amplified by a hefty dollop of borrowed money that was used to try to juice returns in one of the funds.

All around Wall Street, dealers were having trouble moving exotic securities linked to subprime mortgages, particularly CDOs, which were backed by pools of bonds. Within days, the once-booming and actively traded CDO market - which in three short years had seen issues triple in size, to $486 billion - ground to a halt.

Jeremy Grantham, chairman and chief investment strategist at GMO, a Boston investment firm, said: "When we had the shot across the bow and people realized something was going wrong with subprime, I said: 'Treat this as a dress rehearsal. Stress-test your portfolios because the next time or the time after, the shot won't be across the bow.' "

In the autumn, the Treasury Department and several Wall Street banks scrambled to try to put together a bailout plan to save up to $80 billion in troubled securities. The bailout fell apart, quickly replaced by another aimed at major bond guarantors. That crisis was averted after the guarantors raised fresh capital.

Yet each near miss brought with it growing fears that the stakes were growing bigger and the risks more dangerous. Wall Street banks, as well as banks abroad, took billions of dollars in write-downs, and the chiefs of UBS, Merrill Lynch and Citigroup were all ousted because of huge losses.

"It was like watching a slow-motion train wreck," Grantham said. "After all of the write-downs at the banks in June, July and August, we were in a full- fledged credit crisis with CEOs of top banks running around like headless chickens. And the U.S. equity market's peak in October? What sort of denial were they in?"

Finally, last week, with Wall Street about to take a direct hit, the Fed stepped in and bailed out Bear Stearns.

Amid the regulatory swirl surrounding Bear Stearns, analysts have questioned why the Securities and Exchange Commission did not send up any flares about looming problems at that firm or others on Wall Street. After all, they say, it was the SEC, not the Federal Reserve, that was Bear's primary regulator.

Although SEC officials were unavailable for comment, its chairman, Christopher Cox, has maintained that the agency has effectively carried out its regulatory duties. In a letter last week to the nongovernmental Basel Committee of Banking Supervision, Cox attributed the collapse of Bear to "a lack of confidence, not a lack of capital."

It is still too early to assess whether the Federal Reserve's actions have succeeded in protecting the broader economic system. And experts are debating whether the government's intervention in the Bear Stearns debacle will ultimately encourage riskier behavior on the Street.

Poll: 3 in 4 think USA is in a recession

Poll: 3 in 4 think USA is in a recession