See other National News Articles

Title: High Frequency Forex Manipulation Evidence

Source:

[None]

URL Source: [None]

Published: Sep 29, 2009

Author: Ted Twietmeyer

Post Date: 2009-09-29 20:30:58 by Horse

Keywords: None

Views: 303

Comments: 3

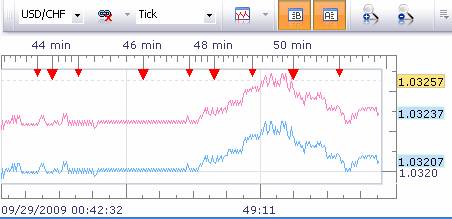

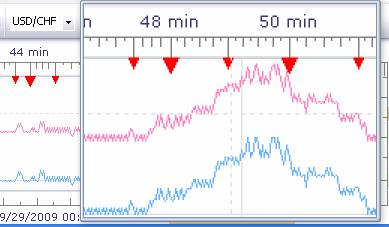

Several weeks ago, I heard the infamous and brilliant financial expert/stock broker Robert Chapman talk about stock market manipulation. Robert's track record is stellar for predicting what will happen to America economically - including revealing $80 oil several years before it happened. Mr. Chapman is well connected and aware of the NWO plans to take over the planet. On the radio show Robert discussed a large computer complex being constructed near Wall St. - for the sole purpose of high frequency trading. This type of ruthless trading can bring Wall St.to it's knees which just might be the purpose for doing it. It was brought to my attention today that over the weekend of Sept. 27 and 28, 2009 something had changed in the Forex (Foreign Exchange) market. On Sept. 29 making a profit suddenly became very difficult. Normal trading techniques that worked well in past weeks no longer seemed to work for this particular trader. Many people who haven't been able to make money in the stock market anymore have moved into the Forex market. Note- Forex is highly risky, and thousands of dollars can be lost in minutes or even seconds. Do not consider or use the above statement as a recommendation to enter the Forex market! But something has happened. I examined the Forex charts in the early morning hours to see if a pattern was visible. Here is what I found upon examing the data. A "tick" chart is considered the closest you can look at a currency pair which is trading live. (This is also terminology used in looking at real time trading charts for stocks.) 1. First, let's look at a normal tick chart: In the unaltered screen capture above, we can see the small variations of normal trading as clearly defined solid lines. This chart is for the US dollar vs. the Japanese Yen. The red line is the asking price, or the price a trader pays for the currency pair. The blue line is the bid price, or the price a trader gets when selling the currency pair. 2. Now let's look at another currency pair which clearly shows high frequency trading: In this unaltered screen capture we see a tiny square wave super-imposed upon the normal line showing the price. Note this is the US dollar vs. the Swiss Franc. Now let's look at the high frequency trading wave even closer: In the screen capture above is part the same trading chart magnified. It is physically impossible for anyone to trade like this manually without the use of a specially programmed high speed computer(s) to perform the trading. Someone would only need to manipulate one or more key currencies to manipulate the rest. All the western world's currencies are traded on Forex. So what's makes the Swiss Franc so special? At least one of the banks I know of in Switzerland certainly does not have a solvency problem - its net worth exceeds 3.5 TRILLION dollars. Now that couldn't have anything to do with Forex manipulation, could it?

Poster Comment: Forex does 3 trillion dollars a day in trades.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: Horse (#0)

Link to original article on Rense.com First chart: Second chart: Third chart:

| "Of all tyrannies, a tyranny exercised for the good of its victims may be the most oppressive. It may be better to live under robber barons than under omnipotent moral busybodies. The robber baron's cruelty may sometimes sleep, his cupidity may at some point be satiated; but those who torment us for our own good will torment us without end, for they do so with the approval of their own conscience." -- C. S. Lewis |

#2. To: Horse (#0)

I think they call it arbitrage.

#3. To: sourcery (#1)

This would only work for an outfit that pays no spreads or commissions. Of course a major Wall Street player would/could have that type of market access.

Top • Page Up • Full Thread • Page Down • Bottom/Latest