See other Resistance Articles

Title: WIRE: Fed's secretive $300B CITIBANK bailout...

Source:

Bloomberg

URL Source: http://www.bloomberg.com/news/2010- ... ons-make-foia-meaningless.html

Published: Oct 25, 2010

Author: Bob Ivry

Post Date: 2010-10-25 10:59:22 by HAPPY2BME-4UM

Keywords: None

Views: 62

Comments: 3

A Citi logo appears on a flag flying outside the Citigroup Inc. headquarters in New York. Photographer: Daniel Acker/Bloomberg Finance professor at the Ourso College of Business at Louisiana State University Joseph Mason, seen here, said more openness concerning the causes of the crisis and the government’s response would help the economy recover. Photographer: Chris Keane/Bloomberg The late Bloomberg News reporter Mark Pittman asked the U.S. Treasury in January 2009 to identify $301 billion of securities owned by Citigroup Inc. that the government had agreed to guarantee. He made the request on the grounds that taxpayers ought to know how their money was being used. More than 20 months later, after saying at least five times that a response was imminent, Treasury officials responded with 560 pages of printed-out e-mails -- none of which Pittman requested. They were so heavily redacted that most of what’s left are everyday messages such as “Did you just try to call me?” and “Monday will be a busy day!” None of the documents answers Pittman’s request for “records sufficient to show the names of the relevant securities” or the dates and terms of the guarantees. Even so, the U.S. government considers the collection of e-mails a partial response to an official request under the federal Freedom of Information Act, or FOIA. The Justice Department in July cited an increase in such responses as evidence that “more information is being released” under the law. President Barack Obama vowed to usher in a new era of open government. On Jan. 21, 2009, the day after his inauguration and a week before Pittman submitted his FOIA request, Obama directed agencies to “adopt a presumption in favor of disclosure, in order to renew their commitment to the principles embodied in FOIA.” Limits of Transparency The saga of Pittman’s request shows that the promise of transparency has its limits when it comes to the government’s intervention in the financial industry, which at its peak reached $12.8 trillion in commitments. From the 2008 Bear Stearns Cos. rescue to the Federal Reserve’s policy of quantitative easing in 2010, the Obama administration has delayed disclosures and defended its right to secrecy in court, said Tom Fitton, president of Judicial Watch Inc., which describes itself as a conservative foundation. “This is an unprecedented crisis for open government,” said Fitton, whose Washington-based organization sued the Bush administration more than 200 times over disclosure issues. “When it comes to the bank bailout, the Obama administration has made a decision to err on the side of secrecy.” The Justice Department, which oversees disclosure for the executive branch, is “working specifically to encourage agencies to be as transparent as possible and release as much as possible,” said Melanie Ann Pustay, director of the department’s Office of Information Policy. “We view our efforts as an ongoing process.” Openness Aids Recovery More openness concerning the causes of the crisis and the government’s response would help the economy recover, said Joseph Mason, a finance professor at the Ourso College of Business at Louisiana State University in Baton Rouge. “Investors who don’t have information are investors who refuse to place funds in markets,” Mason said. “If we want investment and economic growth to resume, we want to be forthright about what happened. The longer we keep investors in the dark, the longer that low economic growth will persist.” The public has a particular interest in transparency regarding the government’s unprecedented intervention in capital markets because of its sheer size, said U.S. Representative Darrell Issa of California, the ranking Republican on the Committee on Oversight and Government Reform. He called the Obama administration “woefully inadequate” at fulfilling its promise of transparency. Right to Know “At a time when the role of government and more specifically the Treasury Department, through bailouts and stimulus, is responsible for administering trillions of dollars, there couldn’t be a more important time to uphold the American people’s right to know,” Issa said in an e-mail. On Jan. 28, 2009, Pittman asked Treasury officials for details related to guarantees the agency had provided on securities held by Citigroup, American International Group Inc. and Bank of America Corp. Among other things, he asked for any contracts with outside firms hired to calculate the assets’ values. In its response, Treasury said AIG didn’t participate in its Asset Guarantee Program. Likewise, despite some negotiations, the government and Charlotte, North Carolina-based Bank of America “never entered into a definitive agreement,” the response said. Citigroup’s Largest Shareholder That left Citigroup, in which the U.S. government was the largest shareholder as of Oct. 1, according to regulatory filings. Taxpayers’ stake, 12.4 percent, was three times the second-largest investor’s. In the 560 pages of e-mails exchanged in the last two months of 2008 and January 2009, Treasury employees and their colleagues at the Federal Reserve Bank of New York discuss with attorneys the department’s $20 billion investment in New York- based Citigroup and the $301 billion in guarantees. Both followed an initial $25 billion investment in Citigroup through the Troubled Asset Relief Program in October 2008. The Treasury Department also released 169 pages that included a “Securities Purchase Agreement” between the bank, the agency and the Federal Deposit Insurance Corp. The document had previously been disclosed in a Jan. 16, 2009, Citigroup regulatory filing -- almost two weeks before Pittman sent his request. Exemptions Cited The department held back 866 more pages, saying each was exempt from disclosure on one of four grounds: trade secrets, personnel rules and practices, memos subject to attorney-client privilege and violations of personal privacy. Treasury also cited the trade-secrets exemption in responding to a separate, similar FOIA request by Bloomberg News for details about Citigroup’s segregated bad assets. In that response, 73 of 104 pages were completely blacked out except for headings. Only six pages -- the cover, contents, a boilerplate list of legal disclosures and a paragraph titled “FOIA Request for Confidential Treatment” -- were free of redactions. The department’s reply to Pittman’s request will count statistically as a “partial response,” in government reports, said Hugh Gilmore, Treasury’s FOIA public liaison. The response “adhered to the rules, regulations, U.S. attorney general guidance and relevant case law that govern FOIA,” Steven Adamske, a Treasury spokesman, said in an e-mail. Right of Appeal People who aren’t satisfied with federal agencies’ responses under FOIA can appeal to them first, and then file civil lawsuits in U.S. District Court to try to force more disclosure. Bloomberg LP, the parent company of Bloomberg News, sued the Fed over another Pittman FOIA request that sought the names of banks that took emergency loans from the central bank. The company has prevailed in U.S. District Court and on appeal. The Fed, which has not released the information, has until tomorrow to decide whether to ask the U.S. Supreme Court to consider the case. Like the Treasury Department, the central bank cited the exemption for trade secrets, known as exemption 4, in withholding details about borrowers. Its lawyers argued that disclosing the banks’ identities would put the institutions at a competitive disadvantage and make them less likely to seek emergency loans in the future. In an Aug. 24, 2009, ruling, Chief U.S. District Judge Loretta A. Preska in Manhattan disagreed. ‘An Inherent Risk’ “The risk of looking weak to competitors and shareholders is an inherent risk of market participation; information tending to increase that risk does not make the information privileged or confidential,” Preska wrote. The Fed “would seemingly sweep within the scope of Exemption 4 all information about borrowers that anyone throughout the entire marketplace might consider to be negative. The exemption cannot withstand such inflation.” Pittman’s request for the Treasury Department records spent months in limbo, according to discussions with the agency’s employees. He had waited about 10 months for a response when he died on Nov. 25, 2009. Shortly afterward, Michael Galleher, an attorney working on contract for the Treasury Department, called Bloomberg News, asking where he could send the responsive documents. Attempts to return Galleher’s call failed; he couldn’t be found at the agency. A December call to Gilmore, the FOIA liaison, was returned by Daneisha White, a FOIA officer, who suggested calling Michael C. Bell, the FOIA manager in the Office of Financial Stability. Bell referred questions back to Gilmore. Meanwhile, that month, Citigroup repaid $20 billion of its bailout money and terminated the asset guarantees. Searching for Records Gilmore called back in January, saying Galleher had left the agency at the end of 2009. He and his colleagues would search for Pittman’s FOIA documents, he said, because they weren’t sure where they were. In April came a call from Galleher. He said that he had returned to work at Treasury’s FOIA office, that he had the relevant documents for Pittman’s request and that he would send them that week. “I need to clear the old requests,” he said. The office where Gilmore works, which has the equivalent of 26 fulltime employees, handled 890 FOIA requests in fiscal 2009, according to Treasury’s annual FOIA report to the attorney general. It had 1,766 requests pending at year’s end. Government bureaucracies often aren’t staffed enough to respond adequately to requests for public records, said Lucy Dalglish, executive director of the Reporters Committee for Freedom of the Press in Arlington, Virginia. In addition, she said, they’re simply not motivated to disclose. ‘Disappointed? Yeah’ “Agencies get in far more trouble for releasing information than they do for not,” she said. “Am I disappointed in the Obama administration? Yeah.” In May, Galleher reported that he would have something to send soon. He said the same thing in June, and then in July. Part of the holdup was caused by the governmentwide practice of giving private companies a chance to object to the disclosure of requested documents, he said. Doing so ensures that companies continue to cooperate with the executive branch by providing records without fear they’ll be made public without review, said Pustay of the Justice Department. Neither Citigroup nor the Treasury Department would discuss which redactions, if any, the bank sought on Pittman’s request. Shannon Bell, a spokeswoman for the bank, declined to comment. “We have no obligation to explain how much of Citi’s recommendations we accepted and in what ways we decided to differ,” Adamske, the Treasury spokesman, said in an e-mail.

Treasury Shields Citigroup as Deletions Undercut Disclosure

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

Begin Trace Mode for Comment # 3.

#2. To: HAPPY2BME-4UM (#0)

Notice that, despite widespread support, the idea of auditing the Fed has died.

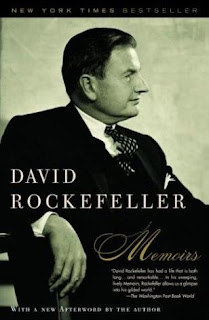

n David Rockefeller's book "Memoirs" he admits that he is part of a secret cabal working to destroy the United States and create a new world order. It would have been impossible for us to develop our plan for the world if we had been subject to the bright lights of publicity during those years. But, the work is now much more sophisticated and prepared to march towards a world government. The supranational sovereignty of an intellectual elite and world bankers is surely preferable to the national auto-determination practiced in past centuries." HINT: GLOBALIZATION = NEW WORLD ORDER (You can kiss America GOODBYE) David Rockefeller, has admittedly been behind most of the world's new Unions. He talks about this in detail at an honoring service in New York. History European Union *There is one central bank. (In Frankfurt.) African Union North American Union Pacific (Asian) Union In David Rockefeller's book "Memoirs" he admits that he is part of a secret cabal working to destroy the United States and create a new world order.

There are no replies to Comment # 3. End Trace Mode for Comment # 3.

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#3. To: farmfriend (#2)

For more than a century, ideological extremists at either end of the political spectrum have seized upon well-publicized incidents to attack the Rockefeller family for the inordinate influence they claim we wield over American political and economic institutions. Some even believe we are part of a secret cabal working against the best interests of the United States, characterizing my family and me as "internationalists" and of conspiring with others around the world to build a more integrated global political and economic structure - one world, if you will. If that's the charge, I stand guilty, and I am proud of it. -David Rockefeller"We are grateful to The Washington Post, The New York Times, Time Magazine and other great publications whose directors have attended our meetings and respected their promises of discretion for almost forty years.

~ David Rockefeller, founder of the Trilateral Commission, in an address to a meeting of The Trilateral Commission, in June, 1991. "We are on the verge of a global transformation. All we need is the right major crisis and the nations will accept the New World Order."

--David Rockefeller, founder of the Trilateral Commission

THE FIAT EMPIRE

Lou Dobbs on North American Union

(Video:

The Creation of the Global Union - Mr. Rockefeller speech starts 14 minutes & 10 seconds in.)

*There is only one legislation system.

*There is one EU Military

*One Central Bank

*One Court of Justice

*One Currency

-UNFINISHED - DETAILS TO COME AS IT HAPPENS

Replies to Comment # 3.