See other Business/Finance Articles

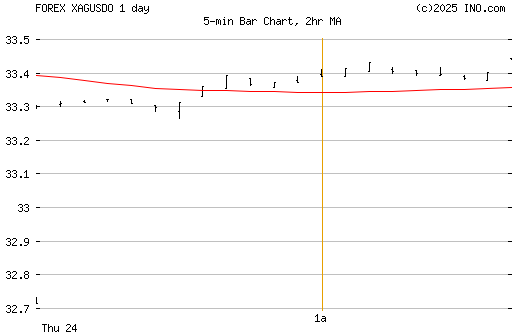

Title: 22 Year High Today: Ag

Source:

Kitco.com

URL Source: http://www.kitco.com/charts/livesilver.html

Published: Mar 21, 2006

Author: buckeroo

Post Date: 2006-03-21 21:48:34 by buckeroo

Keywords: Today:, Year, High

Views: 12656

Comments: 53

Poster Comment:

Good news for some of us. For the rest of you fine people, its going up so buy all you can.

(1 image)

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: buckeroo (#0)

I didn't see a disclaimer there saying that your post did not constitute financial advice, so if I buy a pile and it goes down, then I can sue you. Sell, sell, sell! Nobody wants to be long on anything at a 22-year high--take the money and run!

I love children, but I can never finish a whole one.

I plan on buying Gold and Silver as well as some guns. I know it's a futile attempt to stop the "order" that is coming, but I don't plan on going down without a fight.

God is always good! I have no professional fees attached, Indrid Cold .. so feel free to enjoy my sound recomendation(s) or leave it.

Leaving...

I love children, but I can never finish a whole one.

Why do you suppose Ag is rising so rapidly in price?

I don't know. I do know the dollar is going to crash in the not too distant future though, so converting your dollars to anything else, just makes common sense.

God is always good! My bet is "buy." Lots of good reasons for it. So tell me why your would sell in this market?

It already crashed. Thats why housing is so expensive simultaneously with rising fuel costs; its the reason why average income wages for a family of four has been declining for years in America.

Did you sell your house? Is its price not higher than it was 22 years ago?

When prosperity comes, do not use all of it. - Confucious Because I'm a precious metals dealer. No effing way do I want to be buying at a 22 year high, watch the market tank, and then be stuck with cruddy silver for the next 22 years until I can unload it at break-even again. I'll take a safe, locked-in profit over trying to guess the market top any day. Buy low, sell high, that's my motto. Plenty of other stuff out there that I can get "bought right".

I love children, but I can never finish a whole one.

No it hasn't. It will though, and believe me, everyone will know about it when it does.

God is always good! C'mon, Mark, don't give me that. Silver is MUCH more volatile than real estate. RE goes down, sure, sometimes dramatically (Flint, MI), but typically it's on a fairly steady upward jag. Silver goes way the fuck up, then way the fuck down. I wouldn't be surprised if we had $4.00/oz silver within 2 years. And I *hate* real estate, BTW. Too illiquid.

I love children, but I can never finish a whole one.

I wouldn't be surprised if it was 40 dollars and ounce within two years. It's not that silver, gold, or anything else will actually be gaining any value over this time, but that the dollar will be crashing in value.

God is always good! Ummm, yyyyyyeah.... Actually the dollar was lower in '92 and '95 than its recent lows in 2004. And since late '04, it's been going up, not down. But thanks for playing. Link: http://www.futuresource.com/charts/charts.jsp?s=DX&o=&a=M&z=800x550&d=medium&b=bar&st=

I love children, but I can never finish a whole one.

C'mon, Mark, don't give me that. Hey Indrid, I was just messin' with you. You did say you didn't want to be long on ANYTHING at a 22-year high. ;) Just because precious metals stank for 20+ years, does not mean they can't keep up with inflation at some point. They did enter a bubble in the 1970s. This is true. People lost confidence in US dollars. It is very hard for any of us to say when the last remnants of that bubble are gone. It is safe to say that those that bought silver at the peak around 1980 have lost, even at today's prices, 90% of their investment (adjusted for inflation). It was a lousy investment. However, people are clearly losing confidence in US dollars again. Where or how it ends only hindsight will tell us. We've got $9 trillion in debt, tens of trillions in long-term obligations, our trade deficit is approaching $1 trillion annually, and we're sending our money to the very people who love gold and silver. Further, we're fighting a "forever war" and wars are typically inflationary. Silver might correct, probably even correct, but back to $4? I guess we'll just have to wait and find out. I don't believe our dollar is getting stronger. I believe the other currencies are actually getting weaker. It is all relative and we are now in competitive devaluation mode. There is the risk that we'll someday be using wheelbarrows full of cash to buy bread. We wouldn't be the first country to do it. All it would take is never ending deficit spending, a concept our government feels all too comfortable with. That's just my 2 cents.

When prosperity comes, do not use all of it. - Confucious I would totally LOVE that, and so would most Americans. Because we're all debtors. My 4 stores will probably gross almost a million dollars this year, and yet I have control over prices--I can raise my prices twice a day if I want to. My bank, to which I owe some $400,000, is not so lucky. They've contracted for such-and-such amount of principle at such-and-such a rate. If the dollar totally tanks, I'll be able to pay off my debt in a couple of weeks, since I owe dollars which are constantly decreasing in value, yet I'm charging more dollars for my goods and services in order to keep up with inflation.

I love children, but I can never finish a whole one.

Hey, if you want to hold on to green paper printed by the most hated nation on Earth, then more power to you. But I'm not taking that gamble.

God is always good!

The CPI was about 140 in 1992. The average thing costs about 42% more now than it did in 1992. The only reason you don't see the dollar's weakness on that chart is because the dollar is being compared to other currencies which are also losing their purchasing power. Things generally cost more. Silver is a thing. In 1964 the 90% silver quarter had 25 cents worth of silver in it. In 2006 that same 90% silver quarter has $1.88 worth of silver in it. That's mostly just 42 years of inflation. Inflation averaged 4.5% per year over the period, and silver has averaged 5%. It had an incredible run up during the 70s bull market in precious metals and an incredible hardship during the 80s and 90s secular bear market in precious metals. There's a decent chance it might actually be fairly valued right now. Time will tell.

When prosperity comes, do not use all of it. - Confucious Because we're all debtors. My 4 stores will probably gross almost a million dollars this year, and yet I have control over prices--I can raise my prices twice a day if I want to. My bank, to which I owe some $400,000, is not so lucky. They've contracted for such-and-such amount of principle at such-and-such a rate. If the dollar totally tanks, I'll be able to pay off my debt in a couple of weeks, since I owe dollars which are constantly decreasing in value, yet I'm charging more dollars for my goods and services in order to keep up with inflation. Indeed. You would be in one of the better circumstances certainly, especially in your line of business. However, the average American is going to have some serious problems. Hyperinflation won't be kind to the average American worker nor will it be kind to the average company that can't raise prices twice a day. As for banks, ouch. Yep. Further, a lot of productivity would be lost simply changing prices. Take restaurants. It would stink to have the prices raised on you while you are eating, lol. ;)

When prosperity comes, do not use all of it. - Confucious In 1964 the 90% silver quarter had 25 cents worth of silver in it. In 2006 that same 90% silver quarter has $1.88 worth of silver in it. First point, yeah, you got me on the constant devaluation of all currencies. Second point, that's really only an impressive statement because of the silver market today. If you said it 4 years ago, then your silver quarter would only have like 45 cents worth of silver in it. Anyway, I didn't like it at 7, 8, or 9 dollars, and I'm sure not buying it at 10. Isn't it funny how people who advise you to buy silver "because it's going up" would think you were insane if you advised them to buy a large supply of unleaded gasoline "because it's going up"?

I love children, but I can never finish a whole one.

No, seriously, we're all debtors. Most all Americans are leveraged to the hilt. Their day-to-day prices might rise fantastically, but they could pay off their credit cards with like a day's pay. Also think of the tremendous returns they might get on any real property they might own, like guns or jet skis. And, yes, precious metals. Scenario: Bank loans you $60,000 to buy a Hummer H3. Hyperinflation hits. You sell the H3 for 3.5 million dollars. Pay the bank back its chumpy $60k. It's flawless! Of course you know the gov't will step in and ruin everything.

I love children, but I can never finish a whole one.

Also think of the tremendous returns they might get on any real property they might own, like guns or jet skis. And, yes, precious metals. Scenario: Bank loans you $60,000 to buy a Hummer H3. Hyperinflation hits. You sell the H3 for 3.5 million dollars. Pay the bank back its chumpy $60k. It's flawless! Of course you know the gov't will step in and ruin everything. Also think of the tremendous returns they might get on any real property they might own, like guns or jet skis. And, yes, precious metals. It is far too tempting for the government to let inflation solve debt problems. In the case of Weimar Germany, one person even hoarded bedpans. That's when you know you are WAY TOO late to the party, lol. Doh! ;) Of course you know the gov't will step in and ruin everything. Indeed. That's exactly why I think of precious metals as an insurance policy and not as a get rich quick scheme. I think the government will be slow to ruin everything (they are slow in general), but in the end I think we can pretty much count on it. If they keep raising interest rates like everything is just fine and dandy, eventually something is going to break, like perhaps the entire global economy. In that environment, silver won't look so attractive (at least in the short-term). The silver ETF hype is the one thing that makes me tempted to take some profits. However, I am only a seller from here on out. I refuse to play the trading game with it when the transaction costs for owning the physical metals are so high. Do I think silver will correct, maybe even substantially? Probably. Do I think years from now silver will be even higher if only because of inflation? Probably. If I was a trader would I buy now? Probably not. As an insurance policy for the long-term would today's price be acceptable? Maybe. It is down 90% from its high of $50 (adjusted for inflation). It has been inflating at roughly the same rate as most things since 1964. The path to get to this price was certainly not smooth though. As you say, it sure is volatile.

When prosperity comes, do not use all of it. - Confucious INO reporting somebody got a silver order filled at $9.14 today, which means they'd have been almost $7500 ahead per contract as soon as the order was executed. Damn, I never get fills like that. I'm sure the seller is looking for somebody's head on a plate, though.

I love children, but I can never finish a whole one.

Are you posting this because you want me to rub your nose in it when it does? Patience, my precioussssss. It'll happen on a Wednesday, when everyone's attention is elsewhere.

I love children, but I can never finish a whole one.

Since you are so confident about your predictions, maybe you can suggest by what mechanisms you have discovered a crystal ball. I wager you are wrong. I wager that profit taking continues while demand increases taking Au tanking. How much ya got to wager on a side note? All proceeds goto the forum for expenses on this wager. - buckeroo

BTW, Ag shall continue to rise in pricing because of demand. This means Ag shall rise in your beloved inflated dollars next Wednesday.

OK. Here's what I propose: April first, you "buy" one contract of silver (paper trading, no money, no comissions, no nothing) at the opening price (spot). I'll "sell" one contract at open. A year from then, we close out our positions at the closing price. One of us will be down money, one of us up. The loser donates $100 to 4um. Maybe Tauzero and/or imawit will referee.

I love children, but I can never finish a whole one.

You are side stepping your earlier argument for Wednesday. I don't understand why you want me to commit a contract for your side-stepping of current trend. Wednesday, March 29th 2006 is your wager from your earlier post upon this thread. I wager Ag rises in value. You say Ag falls in value. I say the loser of this wager pays Freedom4um in a gentleman's agreement. I commit $1,000 US dollars. What say you?

If I lose, all I need is a method of Paypal to ensure you fine folks get a jolt of bucks. As for Indrid Cold ... he must commit to my agreement; in any event freedom4um wins once the agreement is cast.

April first, you "buy" one contract of silver (paper trading, no money, no comissions, no nothing) at the opening price (spot). I'll "sell" one contract at open. A year from then, we close out our positions at the closing price. One of us will be down money, one of us up. The loser donates $100 to 4um. Maybe Tauzero and/or imawit will referee. I don't want to but in to y'alls thing here, but in the interest of supporting the 4um I'll take that bet. I understand, almost envy your position but I think your perspective is skewed by the business you are in, not that there is anything wrong with the business, it's just that the prices you pay don't reflect the real market (because of the customer base you deal with or how they obtained their PM's) or your overhead for that matter. Who is going to referee

“Of all the enemies to public liberty war is, perhaps, the most to be dreaded because it comprises and develops the germ of every other. War is the parent of armies; from these proceed debts and taxes...known instruments for bringing the many under the domination of the few…No nation could preserve its freedom in the midst of continual warfare.” – James Madison, Political Observations, 1795

this time next year silver will be closer to $40 than $4 That's my guess.

“Of all the enemies to public liberty war is, perhaps, the most to be dreaded because it comprises and develops the germ of every other. War is the parent of armies; from these proceed debts and taxes...known instruments for bringing the many under the domination of the few…No nation could preserve its freedom in the midst of continual warfare.” – James Madison, Political Observations, 1795

What say you? Nooooo... I said "it'll happen on a Wednesday," not "it'll happen THIS Wednesday". I made that statement as an indication that the market will tank when nobody is expecting it. So I'll bet $100 that, a year from now, spot silver closes lower than where it is today. And I'm not making side bets with every damn silver bug on the site.

I love children, but I can never finish a whole one.

While I am in the scrap silver business, my perspective on this one is that of a commodity trader, not pawnbroker or PM dealer. Having traded such diverse things as orange juice, Fed Funds, the Eurodollar, sugar, canola, and corn for a couple of years, it seems to me that the market is going to do what the market is going to do, regardless of the underlying fundamentals. And when some commodity, any commodity is at a 22-year high, it makes sense to place one's bets as though it will be going down eventually. You can play along at home if you like, but I'm not taking side bets.

I love children, but I can never finish a whole one.

Cool! My perspective anymore is that I don't look at the prices or value of X going up or being at "22 year highs" (bullshit) I see it as the diminishing value of the $$$, and I don't expect that to change for the better in the future. Do you?????

“Of all the enemies to public liberty war is, perhaps, the most to be dreaded because it comprises and develops the germ of every other. War is the parent of armies; from these proceed debts and taxes...known instruments for bringing the many under the domination of the few…No nation could preserve its freedom in the midst of continual warfare.” – James Madison, Political Observations, 1795

wow, buck!

that's exactly what it is.

The dollar is going to fall, the only question is when. When it does, WW3 won't be far behind.

God is always good! When it comes I'll be on my porch, waving a flag and singing "....and the rockets red glare, the bombs bursting in air gave proof thr............" So nobody will think I'm a traitor.

“Of all the enemies to public liberty war is, perhaps, the most to be dreaded because it comprises and develops the germ of every other. War is the parent of armies; from these proceed debts and taxes...known instruments for bringing the many under the domination of the few…No nation could preserve its freedom in the midst of continual warfare.” – James Madison, Political Observations, 1795

Comments (42 - 53) not displayed.

Top • Page Up • Full Thread • Page Down • Bottom/LatestFor the rest of you fine people, its going up so buy all you can.

#2. To: buckeroo (#0)

"It was an interesting day." - President Bush, recalling 9/11 [White House, 1/5/02]

#3. To: Indrid Cold (#1)

#4. To: buckeroo (#3)

I have no professional fees attached, Indrid Cold .. so feel free to enjoy my sound recomendation(s) or leave it.

#5. To: RickyJ (#2)

#6. To: buckeroo (#5)

Why do you suppose Ag is rising so rapidly in price?

"It was an interesting day." - President Bush, recalling 9/11 [White House, 1/5/02]

#7. To: Indrid Cold (#4)

#8. To: RickyJ (#6)

I do know the dollar is going to crash in the not too distant future

#9. To: Indrid Cold (#1)

Sell, sell, sell! Nobody wants to be long on anything at a 22-year high--take the money and run!

The nation is prosperous on the whole, but how much prosperity is there in a hole? - Will Rogers

There are 9,000 hedge funds out there. There aren't that many smart people in the world. - Michael Driscoll, a trader at Bear Stearns & Co. in New York

Some days you just want to pull out the Bonehead Stick and beat people senseless. - mirage

#10. To: buckeroo (#7)

So tell me why your would sell in this market?

#11. To: buckeroo (#8)

It already crashed.

"It was an interesting day." - President Bush, recalling 9/11 [White House, 1/5/02]

#12. To: markm0722 (#9)

Did you sell your house? Is its price not higher than it was 22 years ago?

#13. To: Indrid Cold (#12)

I wouldn't be surprised if we had $4.00/oz silver within 2 years.

"It was an interesting day." - President Bush, recalling 9/11 [White House, 1/5/02]

#14. To: RickyJ (#13)

It's not that silver, gold, or anything else will actually be gaining any value over this time, but that the dollar will be crashing in value.

#15. To: Indrid Cold (#12)

Did you sell your house? Is its price not higher than it was 22 years ago?

The nation is prosperous on the whole, but how much prosperity is there in a hole? - Will Rogers

There are 9,000 hedge funds out there. There aren't that many smart people in the world. - Michael Driscoll, a trader at Bear Stearns & Co. in New York

Some days you just want to pull out the Bonehead Stick and beat people senseless. - mirage

#16. To: markm0722 (#15)

There is the risk that we'll someday be using wheelbarrows full of cash to buy bread. We wouldn't be the first country to do it. All it would take is never ending deficit spending, a concept our government feels all too comfortable with.

#17. To: Indrid Cold (#14)

"It was an interesting day." - President Bush, recalling 9/11 [White House, 1/5/02]

#18. To: buckeroo (#0)

Once again, INO is showing a different result than Kitco. A 10 cent difference, currently, with INO near the daily peak

#19. To: Indrid Cold (#14)

Actually the dollar was lower in '92 and '95 than its recent lows in 2004.

The CPI is now 198.7.

The nation is prosperous on the whole, but how much prosperity is there in a hole? - Will Rogers

There are 9,000 hedge funds out there. There aren't that many smart people in the world. - Michael Driscoll, a trader at Bear Stearns & Co. in New York

Some days you just want to pull out the Bonehead Stick and beat people senseless. - mirage

#20. To: Indrid Cold (#16)

I would totally LOVE that, and so would most Americans.

The nation is prosperous on the whole, but how much prosperity is there in a hole? - Will Rogers

There are 9,000 hedge funds out there. There aren't that many smart people in the world. - Michael Driscoll, a trader at Bear Stearns & Co. in New York

Some days you just want to pull out the Bonehead Stick and beat people senseless. - mirage

#21. To: markm0722 (#19)

The average thing costs about 42% more now than it did in 1992. The only reason you don't see the dollar's weakness on that chart is because the dollar is being compared to other currencies which are also losing their purchasing power. Things generally cost more. Silver is a thing.

#22. To: markm0722 (#20)

However, the average American is going to have some serious problems. Hyperinflation won't be kind to the average American worker nor will it be kind to the average company that can't raise prices twice a day.

#23. To: Indrid Cold (#22)

No, seriously, we're all debtors. Most all Americans are leveraged to the hilt. Their day-to-day prices might rise fantastically, but they could pay off their credit cards with like a day's pay.

The nation is prosperous on the whole, but how much prosperity is there in a hole? - Will Rogers

There are 9,000 hedge funds out there. There aren't that many smart people in the world. - Michael Driscoll, a trader at Bear Stearns & Co. in New York

Some days you just want to pull out the Bonehead Stick and beat people senseless. - mirage

#24. To: markm0722 (#23)

#25. To: Indrid Cold (#10)

No effing way do I want to be buying at a 22 year high, watch the market tank ...

It ain't tanking yet, pal.

#26. To: buckeroo (#25)

It ain't tanking yet, pal.

#27. To: Indrid Cold (#26)

It'll happen on a Wednesday, when everyone's attention is elsewhere.

#28. To: Indrid Cold (#26)

#29. To: buckeroo, Tauzero, imawit (#27)

How much ya got to wager on a side note? All proceeds goto the forum for expenses on this wager.

#30. To: Indrid Cold (#29)

#31. To: Zipporah, christine, Indrid Cold (#30)

#32. To: Indrid Cold (#29)

OK. Here's what I propose:

#33. To: Hmmmmm (#32)

Who is going to referee

#34. To: buckeroo (#33)

#35. To: buckeroo (#30)

Wednesday, March 29th 2006 is your wager from your earlier post upon this thread. I wager Ag rises in value. You say Ag falls in value. I say the loser of this wager pays Freedom4um in a gentleman's agreement. I commit $1,000 US dollars.

#36. To: Hmmmmm (#32)

I understand, almost envy your position but I think your perspective is skewed by the business you are in...

#37. To: Indrid Cold (#36)

You can play along at home if you like, but I'm not taking side bets.

#38. To: buckeroo, Zipporah (#31)

#39. To: Hmmmmm (#37)

I see it as the diminishing value of the $$$, and I don't expect that to change for the better in the future.

#40. To: Hmmmmm (#37)

"It was an interesting day." - President Bush, recalling 9/11 [White House, 1/5/02]

#41. To: RickyJ (#40)

When it does, WW3 won't be far behind.

.

.

.