See other Business/Finance Articles

Title: Viewpoints: Trump and the Kondratieff Wave

Source:

[None]

URL Source: https://buffalonews.com/2019/04/14/viewpoints-2/

Published: Apr 14, 2020

Author: Patrick Reddy

Post Date: 2020-04-16 09:40:26 by BTP Holdings

Keywords: None

Views: 1773

Comments: 10

Viewpoints: Trump and the Kondratieff Wave President Trump's re-election chances in 2020 could depend on when the next economic recession arrives. (Getty Images) By Patrick Reddy Published April 14, 2019 “Unemployment is near lows not seen in half a century. The American economy is set for its best year since 2005. Large corporations are producing giant profits. Even wages are starting to rise. And the stock markets are a mess. … Stocks often act as an early warning system, picking up subtle changes before they appear in the economic data.” “Corrections come and go. I’m reading some of the weirdest stuff how a recession is in the future. Nonsense. Recession is so far in the distance I can’t see it. Keep the faith. It’s a very strong economy.” Republicans may have lost the midterm election of 2018, but the reasons were not economic. The autumn 2018 unemployment rate of 3.9% was the lowest since 1969 and the strong job market is pulling previously “discouraged” workers back into the labor force. The “labor participation rate” of over 63 percent is the best since the late 1990s. And as President Trump keeps reminding us, “the Trump Rally” in the stock market that began when his victory was confirmed on Nov. 9, 2016 has added over $5 trillion in national wealth. No, Republicans lost mainly because suburban women were offended by the president’s tone. But there is a much greater danger on the horizon for Republicans than angry suburban women: the chance that the economy could slip into a recession before 2020 and cost Trump the blue-collar support that won him key states like Pennsylvania, Michigan and Wisconsin. Many academic studies show that both short-term (5 to 8 years) and long-term (50 to 60) economic cycles have been an economic reality for centuries. The problem for President Trump is that both the short-term and long-term business cycles forecast a recession sometime in the next three years. Whether it hits before Campaign 2020 holds the key to his future. The theory of cycles The theory of economic/business cycles was first propounded by French economist Jean Charles Sismondi in 1819 and was refined by another Frenchman, Clement Juglar, to include a general business cycle of 7 to 11 years that consists of four phases: 1) expansion (or boom); 2) crisis (usually started by a crash in prices); 3) recession (or decline in economic activity); and 4) recovery. British economist Joseph Kitchin theorized a short-term business cycle of 3 to 5 years based on businesses reacting to new products. The Commerce Department records that there have been 33 recessions and expansions in America since 1854. The expansions have lasted almost twice as long as the recessions. Hence, the general improvement of American living standards over the past 165 years. The economist who discovered a long-term economic cycle or “wave” was the Russian Nikolai Kondratieff. In the 1920s, he identified several previous eras of great economic and social changes that seemed to occur about every 50 years or so. The first was the “Industrial Revolution” of the 1770s, when business shifted from hand production to machines. Then came the steam engine and railroads in the 1820s followed by the birth of the steel industry and other heavy manufacturing in the 1870s and the age of oil, electricity and cars around 1910. Kondratieff wrote that a long-term business decline would “probably begin” sometimes in the 1920s and, of course, the Great Depression began in October 1929 with the crash of the stock market. The next great wave started in the 1960s with the “Space Age” of computers and information technology, which we are obviously still living with. Soviet leader Josef Stalin asked Kondratieff in the 1930s if the Great Depression proved that capitalism was doomed. The good professor replied no, it was just part of the natural downward cycle and the Western countries would recover. In response, the Soviet leadership called him “reactionary and wrong.” The brutal Stalin then exiled Kondratieff to Siberia and eventually executed him. The Kondratieff Wave But the Kondratieff theory lived on. Austrian-born Joseph Schumpeter, perhaps the greatest “capitalist” economist of the 20th century, expanded on Kondratieff’s work. In addition to the long- term economic cycles, he also detailed shorter business cycles of 3 to 5 years and 7 to 10 years (named the “Kitchin” and “Juglar” cycles, respectively, after the men who discovered them). The massive defense spending for World War II pulled the Western World out of the Great Depression, what economic journalist Steve Cummings called “the New Deal on steroids.” By the 1960s, at the peak of America’s post-1945 boom, the business cycle theory was part of the conventional wisdom. (The former Soviet Union seemed to recognize this as well: Kondratieff was officially “rehabilitated” under Gorbachev in the 1980s.) All of this was detailed in a remarkable book from the early 1970s by United Press International writer James Shuman and investment banker David Rosenau titled “The Kondratieff Wave: The Future of America Until 1984 and Beyond.” They documented how various recessions (often called “panics” in the 19th century) occurred at almost predictable intervals with major recessions or depressions occurring in 1819, 1873, and 1929 or roughly every half-century or so. The authors wrote: “The test of a model, of course, is whether it works in actual practice.” Accordingly, Shuman and Rosenau predicted another major downturn for the U.S. economy around 1980 and sure enough, the unprecedented combination of simultaneous high inflation and unemployment known as “stag-flation” in the 1974-1980 years led to a 15 percent reduction in the average American’s standard of living – the worst economic performance since the Great Crash of 1929. These problems cost President Jimmy Carter his job in 1980, marking the only time in the 20th century that either party couldn’t win two straight terms. Shuman and Rosenau forecast that there would be a “cooling off” after the Vietnam War and it happened: the 1970s were known as the “Me Decade” for flamboyant lifestyles. They wisecracked that both the Progressive Era of the 1901-18 and the various social movements of the 1960s “started as crusades and ended as a party.” The authors also predicted a “return to normalcy” after Vietnam (just as after World War I) with a “peace dividend” that could be used to both cut taxes and balance the budget, resulting in both low inflation and unemployment. (That eventually happened in the 1990s when the Cold War ended). Peace “dividends” also tend to lead to new innovative products – see the internet/high tech boom. Another accurate prediction was that the post-war Nixon administration would end in scandal as did the Grant and Harding years. The human factor Why does the economic/business cycle theory work? The best explanation is probably the natural human habits of coasting during good times while working harder in tougher times. As Russell Fowler of Lyons, N.Y., wrote in a letter to the Wall Street Journal, “maybe the reason the business cycle endures is the economy is solidly based on human nature. When things are going good, some human reactions occur: overconfidence; complacency; poor workmanship; greed, overexpansion; mistakes – all bad and leading to a downturn. Then when things are going bad, there is a tendency to shape up and turn things around. Maybe that’s all there is to it.” So, if almost everyone agrees that the business cycle exists, where are we in the cycle? The Bureau of Labor Statistics defines a recession as “two or consecutive quarters of declining economic growth.” By that standard, the Great Recession of 2007-2010 ended sometime in the winter of 2009-2010. But the unemployment rate remained stubbornly high until 2012, so very few “grass-roots” Americans believe that. If the recovery actually began in 2013, then the 5-8 year cycle predicts a recession sometime around 2020. And the long-term cycle also forecasts a recession and eventual rise of new technologies in the 2020s. Trump and his supporters argue that the recovery really began in earnest the day after his election, when the “Trump Bump” sent the stock market soaring. And indeed, job creation has been consistently positive since 2016. A 5-to-8-year recovery that began in 2016 would easily get the Republicans through the 2020 election. The danger for this line of thinking is that several signs of a slowdown have appeared: • An “inverted yield curve” on interest rates: Interest rates on long-term loans are almost always higher than for the short-term because the longer a bank loans out money, the more likely their returns are to be eroded by inflation. So, a five-year bond will pay a higher interest rate than a 90-day one. But when short-term interest rates exceed the long-term rates, that means investors are anticipating recession and deflation. Since the fall of 2018, some short-term interest rates have begun to exceed long-term rates. This “inverted yield curve” has predicted every American recession since 1950. • The stock market has been unusually volatile lately, indicating jitters in the high-finance community. • A Reuters survey of 500 economists showed that the Federal Reserve’s recent interest rate hikes convinced leading economists that there is a 40 percent chance of a recession starting in the next year. • According to Money Magazine, yet another warning signal is an index that compares stocks with home prices. When the S&P 500 average is twice as high as the median national price for new homes, “a market crash can’t be too far off … Other years in which the index hit a level of two were 1906, 1928, 1937, and 1965 – all of which were followed by big stock market declines.” In addition, external events, which are usually unpredictable, like a new crisis with North Korea, a trade war with China or another war in the Middle East could sink the economy. Larry Summers, who served as Treasury secretary under Bill Clinton, says there is “50-50 chance” of a recession before 2020, citing Federal Reserve interest rate hikes and fears over international trade. He also said that the danger to worldwide economic growth now is too little government stimulus and governments should prepare to fight off what he sees as the inevitable next downturn. Dr. John Williams of the website “Shadowstats.com,” has published data showing that both industrial production and Christmas sales had declined in 2018 compared to the previous year. Combined with Federal Reserve money-supply tightening and political gridlock in Washington, Williams sees the next recession as already here. (He also called the Great Recession of 2008). So who is right, Larry Kudlow or the worried economists on Wall Street? That is the trillion-dollar question and Trump’s re-election in 2020 almost certainly hinges on it. There’s an old joke: “A recession is when your neighbor loses their job, a depression is when you lose your job.” A significant downturn before next year would almost certainly cost Donald Trump his job.

– The Nov. 21 New York Times on the stock market’s fall slump.

– President Trump’s economic adviser Larry Kudlow on the same day.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: BTP Holdings (#0)

Kondratieff Wave is BS.

The Truth of 911 Shall Set You Free From The Lie

So tell me which University you received your PhD in Economics? You recall back in the late 70s, the inflation rate was 21% and it cost Jimmy Carter his job as POTUS. That began the Reagan Revolution. ;) "When bad men combine, the good must associate; else they will fall, one by one." Edmund Burke

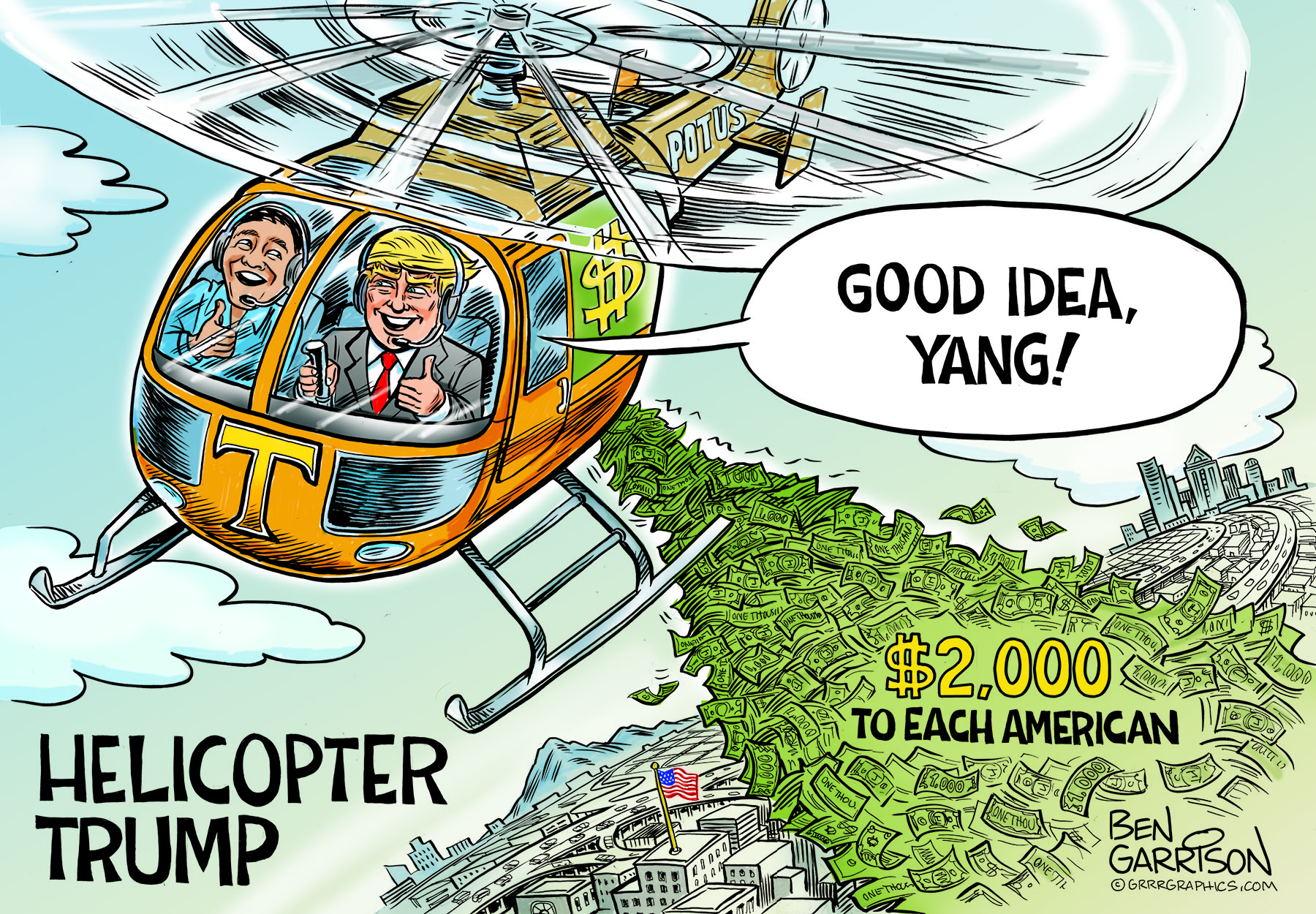

The Austrian School of Economics hard knox. Helicopter Trump and youz yangbangers sux. End the FED Is it just a laugher curve?

_____________________________________________________________ USA! USA! USA! Bringing you democracy, or else! there were strains of VD that were incurable, and they were first found in the Philippines and then transmitted to the Korean working girls via US military. The 'incurables' we were told were first taken back to a military hospital in the Philippines to quietly die. – 4um

Everything's a roller coaster, the stock market, the climate, life, everything. Believe it and get used to it. That is all. “The most dangerous man to any government is the man who is able to think things out... without regard to the prevailing superstitions and taboos. Almost inevitably he comes to the conclusion that the government he lives under is dishonest, insane, intolerable.” ~ H. L. Mencken

www.youtube.com/watch?v=ZuJhEG1U0HY

_____________________________________________________________ USA! USA! USA! Bringing you democracy, or else! there were strains of VD that were incurable, and they were first found in the Philippines and then transmitted to the Korean working girls via US military. The 'incurables' we were told were first taken back to a military hospital in the Philippines to quietly die. – 4um

That was so great, and Patsy was singing us the truth. Thanks. I'd never heard that song... “The most dangerous man to any government is the man who is able to think things out... without regard to the prevailing superstitions and taboos. Almost inevitably he comes to the conclusion that the government he lives under is dishonest, insane, intolerable.” ~ H. L. Mencken

Do you know the story behind Nikolai Kondratieff? He was a Soviet Economist. He predicted the U.S. would emerge from their depression in the 1930s. When he was shown to be right, Stalin sentenced him to hard labor. That sentence was later changed to death. :-/ "When bad men combine, the good must associate; else they will fall, one by one." Edmund Burke

I knew the difference between interest bearing and non-interest bearing currencies when I was 9 years-old. A non-interest bearing currency which bans fractional reserve banking would never have a credit cycle. Only credit or debt based money with fractional reserve banking has credit cycles. But they ar a function of credit or debt burdens not a function of a 54 year long cycle invariably moving through time. Nothing to support their theories. Just claims. Dr Irving Fisher proposed 100% money in which the Treasury creates all paper money and checking account money. FDR turned him down in 1933 and let 3 million Americans starve to death. The Truth of 911 Shall Set You Free From The Lie

Of course that system would have aced out the Federal Reserve. And we all know how Wilson schemed to get that Act passed just before the Christmas holidays when many members had already left for the holidays. ;) "When bad men combine, the good must associate; else they will fall, one by one." Edmund Burke

#2. To: Horse (#1)

(Edited)

Kondratieff Wave is BS.

#3. To: BTP Holdings, yangbangers, Cooking the Books, End the FED (#2)

So tell me which University you received your PhD in Economics?

End the Orange Socialist

Ron Paul - Lake Jackson Texas Values

#4. To: Horse (#1)

#5. To: NeoconsNailed, Horse, 4um (#4)

#6. To: Lod (#5)

#7. To: NeoconsNailed (#6)

#8. To: NeoconsNailed (#4)

Is it just a laugher curve?

#9. To: BTP Holdings (#2)

#10. To: Horse (#9)

Dr Irving Fisher proposed 100% money in which the Treasury creates all paper money and checking account money. FDR turned him down in 1933 and let 3 million Americans starve to death.

Top • Page Up • Full Thread • Page Down • Bottom/Latest