See other Business/Finance Articles

Title: Goldman Spots A Huge Problem For The Fed

Source:

[None]

URL Source: https://www.zerohedge.com/markets/goldman-spots-huge-problem-fed

Published: May 15, 2020

Author: Tyler Durden

Post Date: 2020-05-15 23:22:22 by Horse

Keywords: None

Views: 800

Comments: 1

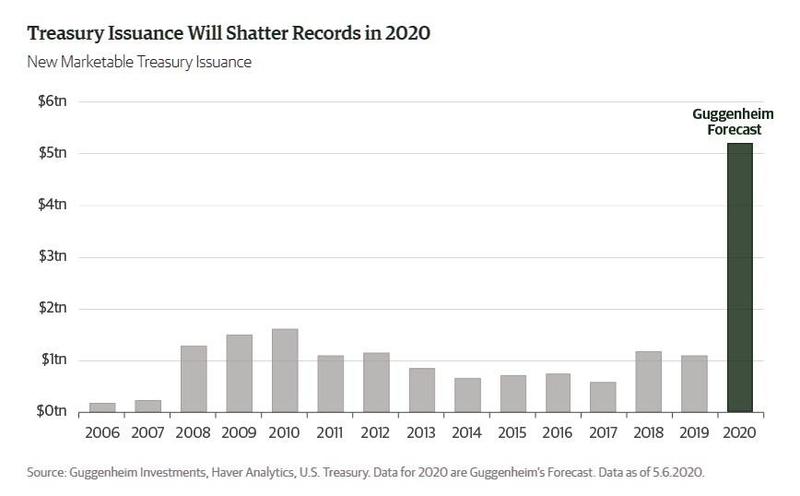

Last week, the Treasury shocked the world when it announced that in the current quarter (the 3rd of the fiscal year), the US will need to sell a mindblowing, record $3 trillion (pardon, $2.999 trillion) in Treasurys to finance the US money helicopter. This, after selling $807 billion in the first half of the fiscal year, and another $677 billion in the quarter ending Sept 30. And since it is just a matter of time before Congress has to pass yet another fiscal package which will be at least another trillion dollars, and up to $3 trillion if the Democrats get their wish, one can say that Guggenheim's projection of over $5 trillion in debt issuance this calendar year will be wildly conservative. Now here's the thing: as Deutsche Bank recently showed, so far this new debt avalanche was entire monetized exclusively by the Fed, whose debt purchasing operations have been far greater than the net Treasury issuance. But this was only the case when the Fed was buying a massive $75 billion in TSYs per day in the late March crash, when Powell dumped a monetary nuclear bomb on the market to stabilize the biggest panic selling an entire generation of traders had ever seen, and nearly doubling the Fed's balance - which is now just shy of $7 trillion, in a few months: Since then, however, the Fed's daily and weekly POMO has shrunk substantially, and as discussed earlier, it is down to just $30BN in Treasury purchases per week as of next week, which amounts to around $1.5 trillion per year. There's just one problem: $30BN per week in TSY monetization is nowhere near enough to consume the trillions in Treasury issuance that is about to hit. In fact, all else equal, the Fed will very soon have to find a pretext to aggressively ramp up its treasury purchases. As Goldman writes overnight, putting the problem in its proper context, "Central banks have been purchasing sovereign bonds at a rapid pace (Exhibit 1), faster than past QE programs in most cases. These purchases are occurring against a backdrop of a surge in fiscal deficits, which will require enormous amounts of additional sovereign supply to finance them." Which makes sense, of course: after all helicopter money, which is what we have now that MMT (Magic Money Theory) has been shoved down everyone's throat without any debate, only works when there is coordination between the Treasury and the central bank. And while until now Fed purchases have generally offset Treasury issuance, that coordination is about to end. As Goldman puts it, "Central bank buying should absorb a substantial amount of upcoming issuance, though we expect increases in “free float” across most markets, most notably in the US, which adds to the medium-term case for higher yields and steeper curves there." Next, Goldman estimates this so-called free float, defined as the amount of sovereign debt outstanding less central bank and foreign official holdings, across major DM markets, and shows it in the chart below. Through the end of last year, free float was on a downward trend in Germany and Japan, as ECB and BoJ purchases absorbed the bulk of new supply. In contrast, free float had been trending higher for much of the year in the US and UK. So with record fiscal deficits and resumption of asset purchases in several markets, where is free float headed this year? In Exhibit 3, Goldman lays out its expectations for total purchase amounts on a net basis along with net supply. It finds the largest increase in free float in the US, as Fed purchases continue to slow; in fact according to Goldman calculations the US public (now that foreign investors have hit the breaks on US TSY purchases), will be on the hook to fund the $1.6 trillion needed to bridge the full amount of US funding needs. A similar picture emerges in the Euro area, where supply is also expected outpace ECB purchases, particularly in Italy, Spain and France (absent further increases in ECB purchases). Bizarrely, a similar picture emerges in Japan where even the always ravenous BoJ is expected to absorb a large portion (about ¥25tn) of incoming supply in the upcoming year as Japan is boosting its debt sales by 18.2 trillion yen ($170 billion) to fund a spending package equivalent to a fifth of its annual economic output; but according to Goldman, the scale of supply is likely to exceed even the BOJ's QE purchases. It continues: foreign-ownership of New Zealand sovereign debt has fallen to 50% from 70% just five years ago as central bankers in Wellington snap up bonds as part of a quantitative-easing program. In short, even with central banks unleashing $7.9 trillion in QE so far in 2020 (according to Bank of America calculations) of which the Fed accounts for over $2.8 trillion in debt purchases alone, this won't be enough to monetize the tsunami of debt that is coming to fund the biggest global rescue operation in history, and if investors find that suddenly the bond market has to clear without the only true backstop - the central bank - willing and able to mop up all the supply, a critical precondition for the continuation of "helicopter money", the outcome could be disastrous. Incidentally, we first warned about the urgent need for the Fed to aggressively step up and boost its QE (instead of continuing to taper it by $1 billion week after week as it did again today) on Wednesday when we quoted Curvature Securities' rates strategist and repo expert Scott Skyrm, who calculated that "there are $689 billion net new Treasurys settling during the month of May and $992 billion net new Treasurys settling between now and June 15. Yes, almost one trillion new Treasury securities hitting the market within the next month!" His conclusion: "That means the market needs to come up with about one trillion dollars to pay for those securities over the next month." Which, of course, is a euphemism because we all know who in the market needs to come up with one trillion dollar - the only one who literally prints money: the Federal Reserve. Conveniently, Goldman's argument allows us to recycle our conclusion from two days ago, in which we said that here is the layman's version of what was just said: "the Fed has flooded the system with liquidity... and it is not enough, because the way helicopter money works, is that liquidity supply (the Fed), and liquidity demand (Treasury via debt issuance) go hand in hand, and periods of too much supply, as was the cash with the Fed's massive QE in late March and early April, are promptly followed by periods of dramatic liquidity demand, such as the next month when $1 trillion in liquidity will be drained to fund the US government "money helicopter." Goldman's own calculations suggest that the shortfall net of the Fed's ongoing QE tapering could be as much as $1.6 trillion. As a result, Powell faces a two-fold problem: since the Fed chair has taken negative rates off the table, Powell has no choice but too boost QE again, and unleash another firehose of debt monetizing liquidity in the financial system. However, any such reversal to the Fed's current posture of shrinking QE will be met with howls of rage, especially among what's left of the conservative political establishment. Which means that, just like in March when the Fed used the first pandemic-induced market crash to unleash unlimited QE, the Fed will soon have to go for round 2 and spark a new market crash, one which it then uses as an alibi for the next massive liquidity injection. Failing to do that, watch as the dollar takes off as markets sniff out that another major dollar squeeze is imminent. And since this will accelerate the liquidity crunch, one way or another, the coming $1.6 trillion in Treasury issuance - which has already been generously greenlighted by Congress - will serve as a trigger for the next market shock, one which the Fed will quickly reverse by expanding the already unlimited QE by trillions on very short notice. The only question we have is whether this will be the market crash that the Fed uses to unveil it will also buy equity ETfs next, or if Powell will save this final bullet in its ammo for whatever comes next. Finally, it's not just us reaching this conclusion: yesterday - one day after our dire assessment - Bloomberg reached the same conclusion, and in "An $8 Trillion Spree Sets Clock Ticking for Bonds’ Judgment Day" in which it wrote that "investors are mopping up the sales as long as central banks engage in so-called quantitative easing, buying an unlimited amount of debt to counter the ravages of the pandemic. But at the first whiff of a recovery, or a pullback from policy makers, all bets may be off. Throw in the threat of inflation amid a global fiscal splurge exceeding $8 trillion, and bond investors look set for a toxic cocktail of risks in the not-too-distant future." Well, today we got another pullback when the Fed tapered its weekly QE to just $30BN from $35BN last week, and a record $75 billion per day two months ago. "Given the massive central bank easing, which includes a lot of bond-buying QE in many places, there will be a lot of demand right now to buy government bonds," said Eric Stein, co-director of global income at Eaton Vance Management, effectively describing what can simply be called "frontrunning" the Fed, a strategy that even BlackRock said is the only one left in this idiotic market. "However, if it was a year or two from now and the economy was picking up and inflation had started to pick up, the story could be different." Actually, the economy doesn't even have to be picking up: an unexpected - and unexplained - slowdown in the pace of the Fed's "unlimited QE" purchases would be sufficient to throw the bond market into unprecedented turmoil as all those socialists who pretend that MMT makes sense, realize that the only thing permitting their idiotic "theory" to persist is the Fed's money printer. Yet while the Fed's QE expansion is just a matter of time, whether catalyzed by another market crash or not, the bigger question is what happens after that? "Can governments continue to borrow at such record levels? No," said George Boubouras, head of research at hedge fund K2 Asset Management. "Central-bank support is key in the massive bond buying we’ve seen for now. But if they blink then at some point, in the medium term, it will all likely unravel - with unforgiving consequences for some countries." Ironically, this also means that an end to the coronavirus crisis is the worst possible thing that could happen to a world that is now habituated to helicopter money and virtually unlimited handouts, which however need a state of perpetual crisis. "Once there is an end to the crisis in sight, they will be less and less willing to provide support and it will fall more on the street to absorb paper," said Mediolanum money manager Charles Diebel, who’s adding bond steepeners in anticipation of a coming inflationary supernova. That, incidentally, would be the endgame for the current monetary regime, which is why anyone hoping that officials, policymakers and the establishment in general, will allow the coronavirus crisis to simply fade away, is in for the shock of a lifetime. Poster Comment: Two Takeaways: Ironically, this also means that an end to the coronavirus crisis is the worst possible thing that could happen to a world. "An $8 Trillion Spree Sets Clock Ticking for Bonds’ Judgment Day" I hope this does not go Boom until after the elections.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: All (#0)

Foreigners Dumped Record Amount Of US Treasuries Amid March Liquidity Crisis Saudi Arabia dumped a record $25.3 billion in US Treasuries... https://www.zerohedge.com/geopolitical/foreigners-dumped-record-amount-us-treasuries-amid-march-liqudity-crisis The Truth of 911 Shall Set You Free From The Lie

Top • Page Up • Full Thread • Page Down • Bottom/Latest