See other World News Articles

Title: If This Isn't A Blow-Off Top...

Source:

[None]

URL Source: https://www.zerohedge.com/markets/if-isnt-blow-top

Published: Feb 23, 2021

Author: Tyler Durden

Post Date: 2021-02-23 16:00:10 by Horse

Keywords: None

Views: 84

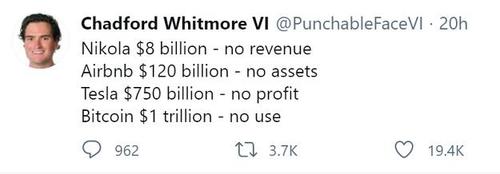

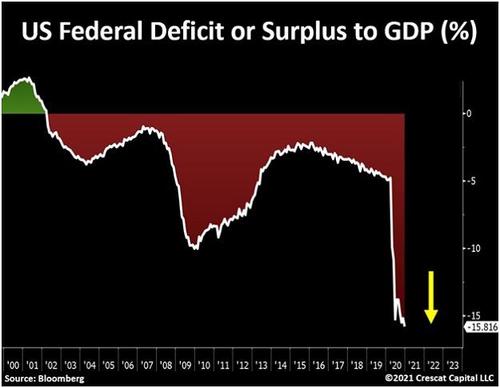

Financial history includes plenty of extreme years. That’s not surprising, since we’re emotional beings with short memories. Combine those two traits and you get cycles, many of which end with a bang. Even so, this one stands out. A full accounting of the ways in which today’s financial markets have exceeded previous bounds of rationality would tax the average reader’s attention span. So let’s just hit a few high points. Home prices up 14% during a recession In a typical downturn, housing tends to either stagnate or contract, depending on what it did in the preceding expansion. This time, home prices had been rising for a solid decade, to levels comparable to the bubble year of 2007. Then came the pandemic lockdowns and a deep recession … and home prices spiked. 14% in one year is epic when you consider that most houses are financed. If you put down 20% on something and it then rises by 14%, the return on the money you actually risked is 70%. In one year. While you’re living in it. Almost unprecedented. Option traders bet the farm While home prices were soaring, stocks were doing even better, quickly recovering from the “Oh my God it’s a pandemic” flash crash in March of 2020 to blow through all-time highs a few months later. Now, options traders – i.e., people who swing for the fences with leveraged bets – are all-in on the bull market. The ratio of puts (bets that stocks will fall) to calls (bets that stocks will rise) is the lowest since the 2000 dot-com mania. As with houses, everyone seems to think the good times are going to roll on, pretty much forever. Small businesses leverage themselves to the hilt Small businesses are either struggling to survive or have been gripped by the same euphoria as the rest of the financial system, because their debt to EBITDA (the broadest and most generous measure of cash flow) has spiked to levels last seen, well, never. As the Wall Street Journal recently put it: Companies Aren’t Saving Their Pennies as Markets Turn Bubbly Thrift is in a bear market as even the riskiest borrowers rush to issue new debt. That world may not last forever. When money is readily available and almost free, why bother saving for a rainy day? For corporations, the question is worth asking at a time when dollars might as well be falling from the sky. The average rate on so-called “high yield” bonds recently fell below 4% to a record low. In the late 1990s, even corporate borrowers with the best reputations paid average interest rates on the order of 7%. There is so much money looking for a place to go that companies are being contacted by investors asking if they would like to issue bonds rated below investment grade rather than the other way around. Buyers snarf up munis from near-bankrupt issuers The pandemic lockdown has decimated the finances of dozens of states and hundreds of cities. Yet it’s never been cheaper for the public sector to borrow money by selling municipal bonds. Today’s low muni-bond yields seem to imply that bond buyers are totally confident in the ability of states and cities to raise sufficient tax revenue to pay off those bonds. Why? Read on for the answer. Crazy valuation Hall of Fame Valuations in most markets are now extreme. But some things stand out even in this crowd. As a Twitter poster recently noted: Washington To the Rescue There’s a reason that global investors are willing to buy Italian bonds: The bonds aren’t really Italian. Germany, if it wants the eurozone to survive, has to stand behind the paper issued by every member. Which means Italian bonds are actually German bonds and are thus likely to pay their creditors on time and in full. The past year’s blow-off top in US financial assets can be explained in the same way: Tesla stock, a house in Denver, a Chicago muni bond, and a California small business loan will, in the coming mass-bail-out, become obligations of the federal government, which has a printing press capable of not just making the required payments but pushing the price of these things even higher than they are today. The problem, of course, is that our savior is itself broke despite the printing press. It is, in fact, the scene of its own blow-off top, in the form of a deficit that might exceed 15% of GDP in 2021 – for the second straight year — at a time when commodities are starting to spike. When those rising prices work their way into food, transportation, and other costs of living, it might be a lot harder to sell promiscuous bailouts as necessary to prevent a deflationary crash. Are we the greater fool? To sum up, with everyone everywhere throwing money at overpriced assets on the assumption that the government will bid those assets still higher, we’re witnessing the greater fool theory taken to its logical extreme. Unfortunately, since a national government doesn’t have money of its own, we taxpayers and savers are now the greater fool. Buy gold.

Post Comment Private Reply Ignore Thread