See other World News Articles

Title: We Are At The Early Stage Of The Biggest Cobra Effect In The History Of Economics

Source:

[None]

URL Source: https://www.zerohedge.com/markets/w ... cobra-effect-history-economics

Published: May 2, 2021

Author: Tyler Durden

Post Date: 2021-05-02 13:09:34 by Horse

Keywords: None

Views: 144

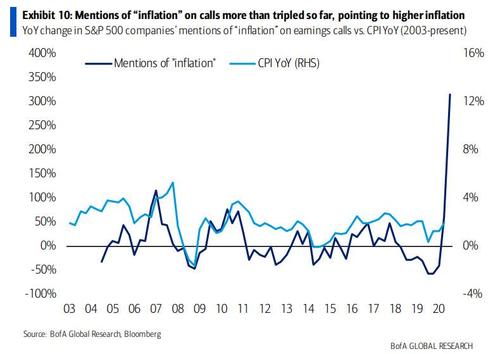

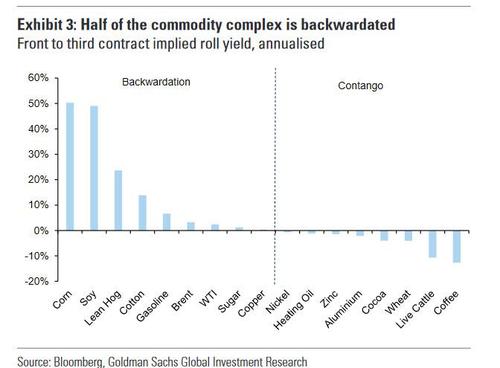

Submitted by Larry McDonald, author of The Bear Traps Report "We believe we are at the early stage of the biggest Cobra Effect in the history of economics. As the massive monetary and massive fiscal stimuli (over $15T globally) conjoin to save the economy from a deflationary depression, instead they risk hyperinflation - overweight commodities." Vaccination parties have broken out on many street corners as explosive human energy has come roaring out of the cage. To us, this is a preview of what is about to transpire around the planet and the "Cobra Effect" has entered the 4th inning. When governments tinker in capital markets there are always unintended consequences. Above all, we must keep in mind - what transpired in Q1 to Q4 2020 was NOT a mere tinkering. We have just lived through a colossal public-private experiment where fiscal and monetary policy globally have been unleashed at unprecedented proportions. It is easy to sit back and think the 2021-2022 recovery will be much like the 2009-2010 vintage. This is a mistake. A year ago when we laid out our high conviction reflation trade, inflation engines were limited to some supply chain disruptions. Today, we are looking at multiple inflation furnaces cooking away as we speak. First, Uncle Sam has dramatically altered the employment picture with the private sector going toe to toe with Mr. Stimmy. Breaking news, when you pay human beings NOT to work it is very hard to get them back into the labor force. Friday's employment cost index (ECI) print is simply an appetizer, with the main course shock coming to CPI (average hourly earnings) data in the months ahead. "That ECI number is solid big" - CIO NY Based Hedge Fund. ECI spike was driven by a 1.0% jump in wages and salaries. If this is repeated over the next three quarters, the y/y rate will reach 4.1% by Q4. The Fed does not look like it will have an easy summer communicating its approach to markets. ECI wages and salaries, which follow positions (less compositional skew) jumped 4.0% SAAR in Q1. Core PCE inflation rose 0.4% MoM, +2.6% SAAR over the last three months. Why work when u have stimmy, Uncle Sam is forcing wages higher. "The premium for commodities that can be delivered now versus later into the future is the highest it has been since at least 2007, signaling just how strong the world’s demand is for raw materials and how tight supplies are." - Family Office CIO. Keep in mind, it was hot AHE data that triggered the February 2018 thirteen percent drawdown in the Nasdaq 100 and knocked the XIV Short Volatility ETF into retirement. Today, we are looking at a whole new serpent, a far different beast. ESG inflation side effects are oozing through the commodity market (oil, gas, copper), and the agricultural inflation engine has rarely been stronger. Real GDP in 2Q is on pace to print 12% q/q annualized rate -nearly double 1Q’s performance –with weekly tax data, weekly rail traffic, and monthly regional manufacturing indices are all surging, inflation risk highest in a decade. For S&P 500 companies, the uncertainty factor on forward-looking profit margins has just moved from blue-sky to dark grey, in terms of true visibility. Up until now, all the inflation-reflation forces we have witnessed have been supply-driven. As vaccinations reach critical broad distribution targets. We have yet to see real, vaccine-fired demand-induced inflation. Risk:There’s a high probability this is it for the tech and the Nasdaq. Supply chains are a mess (disruption unquantifiable), labor shortages exploding as Uncle Sam is the private sector’s colossal drag, commodity inflation is entering a new phase, margin pressures across the SPX are developing exponentially. The Fed is digging in dovish heels which will just make all of the above-unintended consequences that much worse. It’s very similar to Q4 2018, tough guy Powell is playing a dangerous game. We remain short the NDX, long commodities (XLE, XME, etc). “Despite printing more than $80bn in revenue, +50% YoY, the FAAMNG companies really have not moved YTD. Arguably, these big Tech companies are the world’s best businesses and are failing to catch a meaningful, sustained bid.” - JPM Tech stocks will get destroyed as we move to the next act of this inflation beast. Poster Comment: What Are FAAMG Stocks? FAAMG is an abbreviation coined by Goldman Sachs for five top-performing tech stocks in the market, namely, Facebook, Amazon, Apple, Microsoft, and Alphabet’s Google. FAAMG may also go by the acronym, GAFAM. FAAMG originated from the original acronym FANG, which was coined by CNBC’s Jim Cramer. FANG did not include Apple and Microsoft but did include Netflix. The new variation of the biggest tech companies does not include Netflix because of its relatively small market capitalization compared to the other five companies in FAAMG. Another variation, FAANG, includes Netflix in place of Microsoft.

Post Comment Private Reply Ignore Thread