See other Business/Finance Articles

Title: A Couple Things About Inflation

Source:

[None]

URL Source: https://www.zerohedge.com/markets/couple-things-about-inflation

Published: Jun 5, 2021

Author: Tyler Durden

Post Date: 2021-06-05 18:27:50 by Horse

Keywords: None

Views: 122

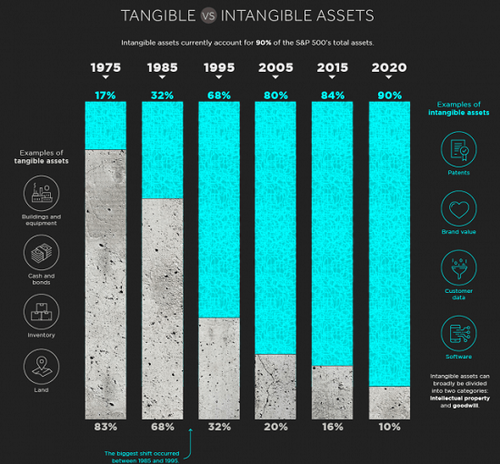

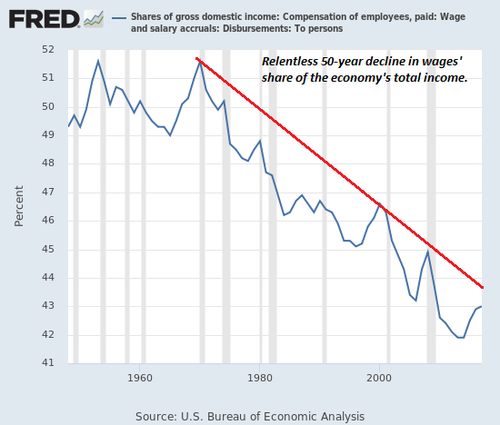

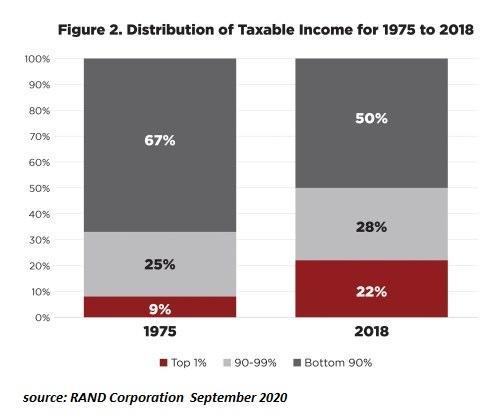

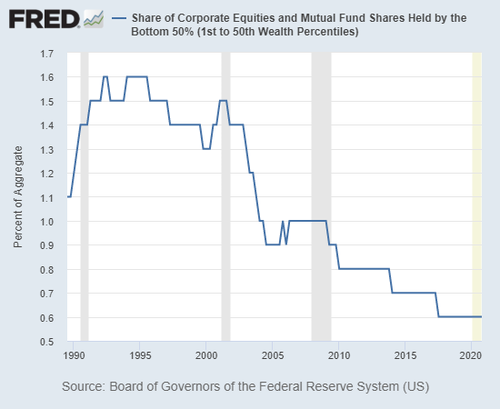

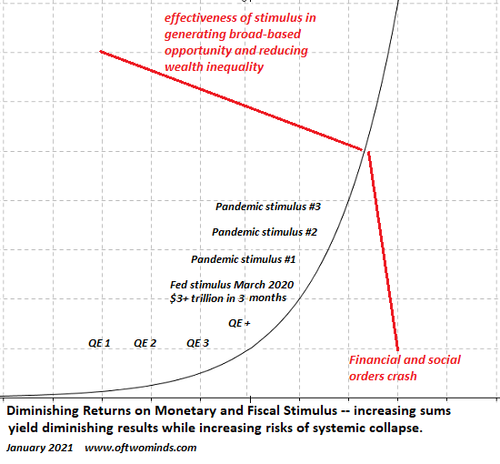

The higher they push phantom "assets" based on exponential increases in leverage, the greater the air gap between essential tangibles and fantasy. Inflation is in the news, but there are a couple of things about inflation that don't get much coverage. Let's start with the trope that inflation is always a monetary phenomenon. Actually, no. When nutrient-rich soil and fresh water reserves are depleted, crop yields decline and as human population and appetites for animal protein soar, food becomes scarce. When food becomes scarce, prices rise accordingly. It doesn't matter what you do with money supply, prices will rise in relation to everything used as "money:" gold, shells, paper with colorful pictures printed on it, giant stone disks, quatloos, cryptocurrencies, etc. You could eliminate "money" entirely and the relative cost of food would rise even in a barter-only system. What few seem to grasp is that there is a hierarchy of needs that ruthlessly separates "needs" from "wants," and the value of "wants" quickly drops to zero in real scarcities. When you're hungry, I mean really hungry, the value of your yacht, collectible muscle car, NFT, etc. falls to zero if those with food have zero interest in your "valuables." An ounce of gold for an egg? It all depends on what's actually a need. In a similar fashion, real scarcity separates phantom intangible assets from real assets. If you glance at the chart of tangible and intangible assets below, you'll note that phantom intangible assets are now the overwhelming majority of what's laughably called "assets." You want to trade your shares in XYZ Corporation for a 50-pound bag of rice? How do I know the "value" of shares in XYZ Corporation won't be zero tomorrow? No, thank you. Come back when you have something tangible and tangibly useful (i.e. it will hold its value tomorrow) to trade for the rice. We inhabit a fantasy world in which scarcity has been banished by the gods of globalized markets and phantom assets built on sandcastles of leverage are the most valuable assets on the planet. Global stocks are now worth $115 trillion, woo-hoo. Meanwhile, back in the real world, the vast majority of humanity trades their labor for food and other essentials. The funny thing about human labor is that thanks to population growth, globalization and financialization, the relative value of labor has been in decline for decades. (see chart below) This means that as prices of essentials rise due to scarcities, the quantities of tangibles that labor can buy decline, meaning those trading their labor for essentials can afford fewer essentials. n other words, their prosperity is in a free-fall as scarcities push up prices of essentials. This free-fall of labor's value and thus of prosperity is visible in the RAND chart of income 1975-2018 and in the Federal Reserve database chart of the wealth held by the bottom 50% of American households. The RAND chart of income by the top 1%, top 9% and bottom 90% shows that 25% of the bottom 90%'s income--virtually all from labor--has been transferred to the top 1% (the share of taxable income going to the top 1% rose 2.5-fold) and to a lesser degree, to the top 9%. (Recall that the top 9% mostly rely on earnings from labor, hence their modest increase compared to the top 1%.) The pathetically thin slice of wealth held by the bottom 50% of American households has fallen to near-zero. It's fallen by 2/3 since the recent peak in the mid-1990s, the last "boom" that trickled down to the bottom 90%. The bottom 50% have no reserves to draw upon as prices of tangible essentials rise. They have no wealth to sell, and the value of their labor as measured in purchasing power of essentials is in an accelerating decline. This is a longstanding reality of civilization. As productivity rises, the human population expands up to the carrying capacity of the biosphere. Labor's earnings rise as producers expand production to meet rising demand. Human population and appetites for goodies keep expanding, overshooting sustainable supply while labor expands to the point that it is in oversupply. Wages decline and labor thus loses purchasing power just as prices of essentials soar. Discontent and disorder increase and states and civilizations fall. I've long recommended these books on the fundamental cycle of civilization: The Great Wave: Price Revolutions and the Rhythm of History Ages of Discord This leads us to the last chart of diminishing returns on the phantom fixes of monetary manipulation and bread and circuses free money. The Federal Reserve can create currency out of thin air but it can't conjure up productive land, fresh water, copper ore, oil, or food. The Fed can conjure up phantom "wealth" based on leverage but this relies on a heavily hyped faith in a fantasy world in which all tangible scarcities are magically turned to abundance by central bank money creation and low interest rates, and a splash of technocrat pixie dust: carbon taxes, windmills and drones flitting about. The returns on fantasies and phantom "assets" are also in a free-fall. Monetary and fiscal stimulus is skyrocketing to keep the travesty of a mockery of a sham "prosperity" from collapsing into a putrid sinkhole of failed financial farce. The higher they push phantom "assets" based on exponential increases in leverage, the greater the air gap between essential tangibles and fantasy. * * * Poster Comment: The decline in American wages began when American first had to start importing natural resources from overseas. That would be 1950 though it took a while to gather momentum. Plus Germany and Japan took a while to recover from Allied bombing.

Post Comment Private Reply Ignore Thread