See other World News Articles

Title: Forget Everything You Know: Morgan Stanley Reveals The Only Metric That Determines What The Market Will Do Next

Source:

[None]

URL Source: https://www.zerohedge.com/markets/f ... ic-determines-what-market-will

Published: Jun 22, 2021

Author: Tyler Durden

Post Date: 2021-06-22 02:38:58 by Horse

Keywords: None

Views: 49

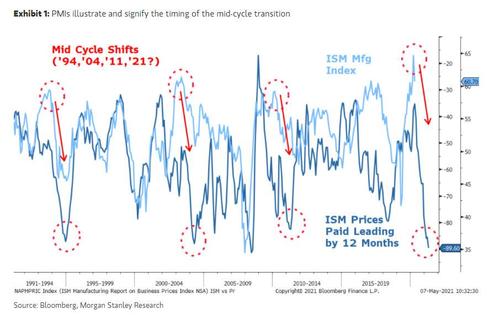

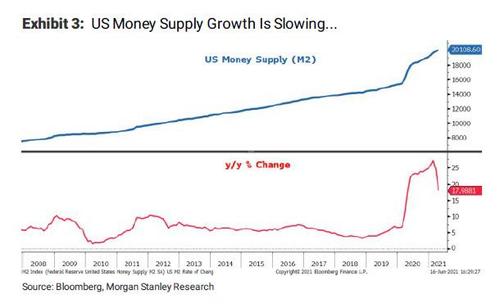

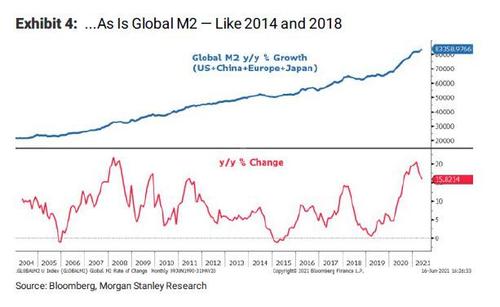

Traders of a certain age may recall that back in 2013, around the time the Fed's "Taper Tantrum" sparked a surge in yields and led to a risk asset selloff, a big (if entirely artificial) debate emerged within financial media, where the Fed muppets and their media puppets would argue that "tapering is not tightening" while anyone with half a brain realized knew that this was total BS. Fast forward to today when Morgan Stanley's Michael Wilson opens up an old wound for clueless Fed apologists, saying in his latest Weekly Warm Up note that "Tapering is Tightening"... but then adds that contrary to the market's shocked reaction to last week's Fed meeting, tightening actually began months ago. Elaborating on this point, Wilson - who several months ago turned into Wall Street's most bearish strategist (again)- writes this morning that while the Fed's pivot to "begin" the tightening discussion caught most by surprise, in reality markets began discounting this inevitable process months ago as price action had indicated. It's exactly this discounting of the coming tightening, that is what Michael Wilson's mid-cycle transition is all about, and as the strategist adds, "fits nicely with our narrative for choppier equity markets and a 10-20% correction for the broader indices this year." Or to paraphrase Lester Burnham, "it's all downhill from here"... and as Wilson predicts, that won't change until M2 growth is done decelerating; or in other words, until the Fed unleashes another liquidity burst into the system "the transition is incomplete." * * * Highlights aside, Wilson then elaborates on each point, noting that while last week's Fed meeting brought more uncertainty to markets one thing is becoming more obvious: "we are on the other side of the mountain with respect to monetary accommodation for this cycle." Furthermore, having repeatedly warned that the US is now mid-cycle.. ... Wilson then takes a victory lap writing that what the Fed is doing is "classic mid cycle transition behavior so investors really shouldn't be too surprised that the Fed would try to begin the long process of tightening." After all, the US economy is booming and expected to grow close to 10 percent this year in nominal terms, a feat last witnessed in 1984. Meanwhile, no matter what one's view is on inflation being transient or not, prices are up significantly and likely higher than what the Fed, or most others were expecting 6 months ago. In other words, the facts and data have changed; therefore, so should Fed policy. Nevertheless, as discussed here extensively, markets reacted as if this was a complete shock with both bonds and stocks trading as if the Fed had hiked rates already (instead of leaving over $2TN in QE still on deck) after the Fed meeting. Starting with bonds, both nominal 10 year yields and breakevens fell significantly. However, breakevens fell more leaving 10 year real rates higher by almost 20 bps Wednesday afternoon. While real rates did settle back a bit on Thursday and Friday, they have formed what appears to be a very solid base from which they are likely to rise as the economy continues to recover and the Fed appropriately pivots. In Wilson's view, "this looks very similar to 2013, the year after Peak Fed. Back then, Peak Fed was QE3 which was announced on September 12, 2012. This time Peak Fed was the announcement of Average Inflation Targeting last summer." That said, there is one notable difference between the taper tantrum and today: in 2013 "tapering" QE was a novel concept to markets and it came more abruptly with Bernanke's surprise mention during his congressional testimony on May 22, 2013. This time, the markets understand what tapering is and see its arrival as inevitable as the economy recovers. Therefore, while the path higher for real rates is unlikely to be as dramatic as witnessed in 2013, it is still likely to be higher from here and that is a change that will affect all risk markets, including equities, in Morgan Stanley's view. Wilson makes one final observation from the chart above, which is how real rates moved substantially before Bernanke's testimony in May 2013, prompting Wilson to notes that "perhaps it wasn't as much of a surprise as believed, at least to markets. We think it's the same situation today." In our view, the data has been so strong, it would be naive not to think the Fed wasn't moving closer to tapering over the past several months. In fact, the idea that the Fed hasn't been thinking and/or talking about it seems absurd. Surely the market understands this, making the events of the past week not so much of a surprise. It's all part of the mid cycle transition that has been ongoing for months and fits with the choppier price action and unstable market leadership we have been witnessing. The underperformance of early cycle stocks is another classic signal the market "gets it." Nevertheless, in talking with clients the past few days, this view is still out of consensus. Most haven't been ready for tighter monetary policy, nor did they think it's something they needed to worry about, until now. Wrapping up the Fed "surprise" part of his note, Wilson writes that contrary to the FOMC shock, monetary tightening actually began months ago if one is looking at the right metric, which to the top Morgan Stanley equity strategist - who emerges as yet another closet Austrian - is money supply growth: In a world where all of the major developed market central banks are stuck at the zero bound, or lower, the primary metric that determines if monetary policy is getting more or less accommodative is Money Supply Growth. Realizing that to most Keynesian this will be a controversial statement to say the least, Wilson digs in and says that "it's absolutely the case and financial markets seem to agree." He explains: When money supply is accelerating, the more speculative / riskier assets tend to outperform and when it's decelerating these assets have more trouble. As noted here several times over the past few months, the Fed's balance sheet (M1) growth peaked in mid February and that coincided with a top in many of the most expensive/speculative stocks in the equity market just like the acceleration in the Fed's balance sheet in the prior 12 months contributed to their spectacular performance. Interestingly, the recently flattening out of the growth in M1 has coincided with more stability in these stocks, although they remain well below prior highs (Exhibit 2). And visually: ,img src="https://assets.zerohedge.com/s3fs-public/styles/inline_image_mobile/public/inline-images/riskier%20assets.jpg?itok=ubewL48B"> But wait there's more, and also an explanation why the Fed has made it virtually impossible to track the weekly change in M2 (the aggregate is now updated only monthly). Taking Wilson's argument a step further, M2 growth might be even more important to monitor than M1 because that's the net liquidity available to the economy and markets. On that front, the deceleration also began at the end of February but has not yet flattened out and appears to have much further to fall to a more "normal" level of annual growth — i.e., 7-8% More ominously, this also suggests liquidity is likely to tighten further from here whether the Fed's begins tapering later this year or next. Finally, when we look at M2 data on a global basis, we get the same picture. Wilson concludes that even ahead of last week's "shock" FOMC, the market had already started to de-rate lower into a mid-cycle transition as Fed balance sheet growth has materially slowed. Meanwhile, M2 is slowing just as rapidly and has further to fall, especially when the Fed begins to taper later this year or early next. Finally, global money supply growth is also slowing from elevated levels and every major region is contributing. This to Wilson "looks reminiscent of 2014 and 2018 when markets went through a rolling correction of risky assets" and he thinks 2021 will prove to be similar in that regard with the highest beta regions falling first (Kospi, China, Japan) and ending with the most defensive (US). Putting it all together, the MS strategist writes that "tapering is tightening but the tightening process began with the rate of change in money supply growth. The good news is that the market already knows it. The bad news is that a majority of investors seem to be just catching on with the Fed's "surprise" announcement this past week. This means asset prices are far from done correcting as witnessed with the more cyclical, reflationary assets taking their turn the past few weeks." And while we completely agree with Wilson's newly discovered Austrian view of markets - funny how on a long enough timeline everyone turns Austrian - the real question is what will catalyze the next M2 boosting cycle, how high will it push stocks, and will the Fed be forced to come out and start buying equities this time after having nationalized the bond market back in 2020. We expect that the answer will be revealed after the next 20% drop at which point all of the Fed's hawkishness will evaporate, and Powell (or his replacement Kashkari) will shift to an uber dovish mode as they prepare to unleash the final and biggest asset bubble of all...

Post Comment Private Reply Ignore Thread