- Dems' Infrastructure Spending Could Lead To Devastating Crash, Druckenmiller Warns

"If I was Darth Vader and I wanted to destroy the US economy, I would do aggressive spending in the middle of an already hot economy."

This isn't the first time billionaire investor Stanley Druckenmiller has warned that US markets are caught up in a "raging mania" fostered by the trillions of dollars in government spending. Druck, an acolyte of George Soros known for his macro investing prowess (even as he complains that contemporary Fed-backstopped markets "make no sense") is a frequent guest on CNBC. But on Friday morning, he made a brief appearance on MSNBC's Morning Show with Stephanie Ruhle, who seemed ill-equipped to respond to Druck's arguments about why the Dems' multi-trillion two-part infrastructure plan will end up hurting America's poorest citizens.

As Druck explains, the "V-shaped" economic recovery has been "the sharpest recovery in history," noting that it took 10 years for the American economy to achieve the same gains following the start of the Great Depression.

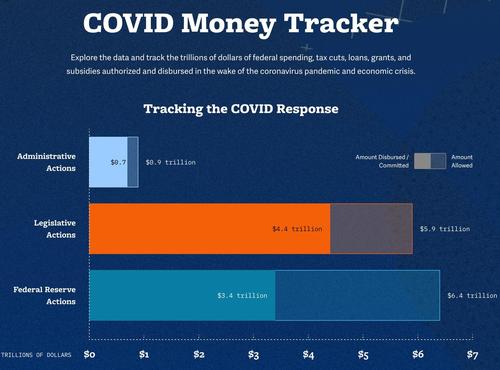

The problem is that the nearly $6 trillion allocated by Congress to combat the economic impact of COVID has been spent after the economy already finished recovering. The accelerating pace of inflation, and inability of certain businesses to hire lower-wage workers, are but byproducts of this.

Moving on, Druck pointed out that the biggest economic crises of the last 100 years have largely been caused by asset bubbles and inflation. "Inflation is a tax the poor can't afford or avoid," Druck added.

Any further stimulus spending is intended to fix a problem that, in Druck's words, "doesn't exist anymore." He added: "If I was Darth Vader and I wanted to destroy the US economy, I would do aggressive spending in the middle of an already hot economy."

"You usually get a bubble out of that, and you get inflation of of that. Frankly, we now have both. This is the biggest bubble I've seen in my career."

And it's not just stocks: Druck pointed to the state of crypto and housing markets.

"What are we going to get out of this? You're going to get a sugar high, the higher inflation, then an economic bust," Druck warned.

When Druck added that he would prefer Dems postpone their infrastructure spending plans (even though he said he supports many of the provisions of the Democratic plan, including improving high-speed infrastructure access in rural areas), Ruhle interjected. Poor people don't care about bitcoin crashing, since they don't own that much bitcoin (or stocks) anyway. But the infrastructure plan will help all Americans, especially those with the fewest resources, Ruhle argued.

"I dont think we need to do anything, we need to take a step back take a breath and see where we are...I think any net spending is a problem. I love a lot of stuff in the infrastructure plan particularly the investments in the digital infrastructure. There's a lot of other stuff I'm okay with."

First of all, Druck argued that the growing retail exposure to equities means a market crash will impact main street even more quickly this time around. And even if they own no financial securities or crypto assets, they will still be impacted by the economic declines, as Druck explains: "It's going to cause a financial crisis, it's going to cause inflation and nothing is going to hurt the poor more than that."