By Graham Summers, MBA

The market has rallied aggressively on the belief that a Debt Ceiling deal will be made.

Celebrating a Debt Ceiling deal is like polishing the brass on the Titanic.

The U.S. has $28.8 trillion in debt. Two years ago, it was just $22.7 trillion.

The Trump administration spent like socialists, running $1 trillion deficits even when the U.S. economy was GROWING.

That deficit then ballooned up to $3 trillion when the pandemic hit. And now, the Biden administration is now looking to outdo even President Trump’s spending spree.

By practically all measures, the U.S. economy is in recovery as it reopens. And yet, the Biden administration is looking to run AT LEAST a $3 trillion deficit this year… an amount that could potentially rise to $5 trillion or even $6 trillion if President Biden manages to get his infrastructure deal and other stimulus programs passed.

Meanwhile, inflation has ignited.

The “inflation is transitory” argument has been thoroughly debunked to the degree that even clueless Fed officials are admitting it. The official inflation measure (the Consumer Price Index or CPI) claims inflation is 5.3%.

See also Japan faces its own power crisis via its enormous energy imports

However, the CPI has been tweaked aggressively to understate inflation over the last 30 years. If we were to measure CPI today the same way it was measured in 1970, REAL inflation is at 14%.

Yes, 14%.

And the bond market knows this.

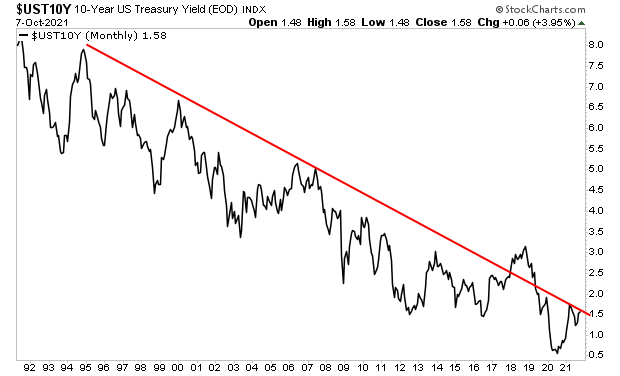

Even the Fed’s $960 BILLION QE program, which is designed to SUPPRESS bond yields is failing. Bonds know inflation is roaring which is why yields are once again rising rapidly.

When they break that downward trendline, the U.S. will be just weeks away from a crisis.

The last time the line broke in 2018, it was because the Fed was raising rates at a pace of FOUR per year while also shrinking its balance sheet buy $500 billion.

This time around, the Fed has rates at ZERO and is running $120 billion in QE per month (a record). Even if the Fed tapers QE by $15 billion soon, it will still be running over $100 billion or $1.2+ TRILLION in QE per year. See also Panic At Sea: 500,000 Containers Stuck At US Ports As Supply Chain Crisis Goes From Bad To Worse

In simple terms, this time around, when bond yields begin to break out, it will be when the Fed is already pumping its brains out.

And that’s when the End Game begins for the U.S.’s debt situation.

The ONLY way the U.S. can continue to service its mountain of debt is if interest rates remain low. So, if interest rates are rising when the Fed is already engaged in EMERGENCY levels of intervention, it’s GAME. SET. MATCH.

When will this happen?

Put another way, when does the next crash hit?

To figure this out, I rely on certain key signals that flash before every market crash.