See other National News Articles

Title: Does The Fed Have A Brewing Velocity Problem?

Source:

[None]

URL Source: https://www.zerohedge.com/markets/d ... aving-brewing-velocity-problem

Published: Nov 18, 2021

Author: Tyler Durden

Post Date: 2021-11-18 15:39:40 by Horse

Keywords: None

Views: 43

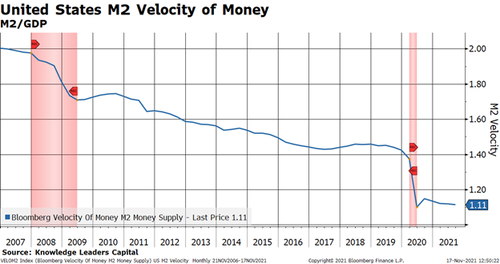

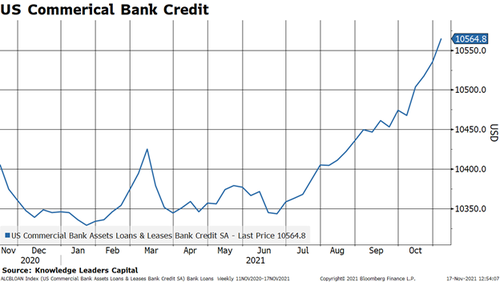

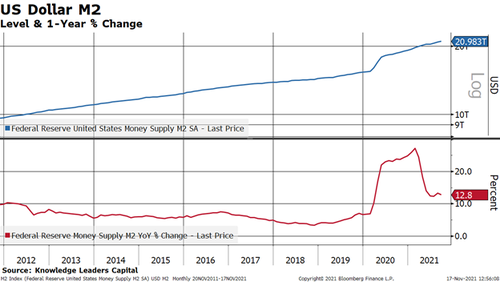

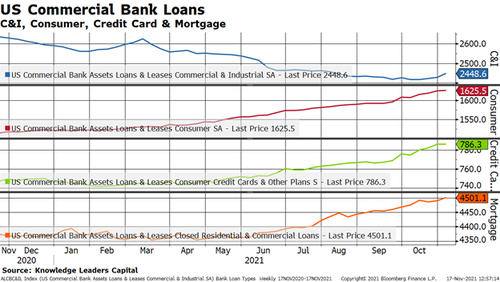

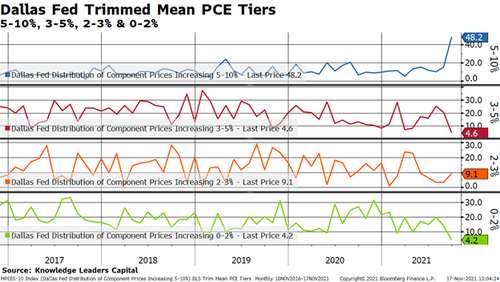

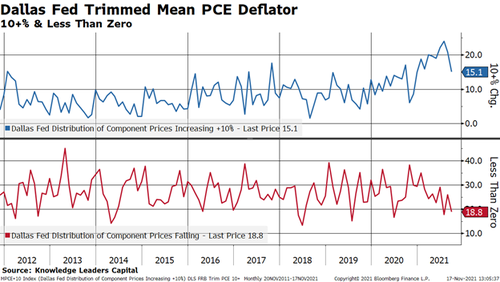

Authored by Steven Vannelli via Knowledge Leaders Capital blog, A basic tautology that economists consider when thinking about monetary policy is the velocity of money. MV=PQ translates into Money*Velocity=Price*Quantity. Of course, price*quantity is nominal GDP while “M” is the money supply (for example, M2) while “V” is velocity, or the number of times the money supply turns over. A prominent feature of the post-Great Financial Crisis period has been the persistent decline in velocity, which is why the Fed has had to pump so much money into the system for so long. Absent an increase in the money supply, the drop in the velocity, all else equal, would have likely been the backdrop for a long recession. But, it appears that the decade of falling velocity may have ended. Bank loans have made a strong turn upward since June. This increase in bank lending is propping up the money supply at an elevated rate, just under 13%. Digging into the details of bank loans, it is clear there is an across-the-board increase in bank lending to the various sectors. Consumer lending, i.e., consumer loans, credit cards and mortgages turned up in June while commercial and industrial loans turned up in recent weeks. All this is occurring as the “transitory” narrative is becoming increasingly comical. The Dallas Federal Reserve produces some interesting data points on the PCE deflator. They break out the percent of categories rising at various rates. Roughly 48% of the PCE is rising at 5-10%, while only 4.2% of components are under 2%. While there are 18.8% of the components that are declining in price, this is almost matched by the 15.1% of items that are rising in price at a rate greater than 10%. So, this means about 63% of the PCE is rising at a rate greater than 5%, or more than double the Fed’s 2% inflation target. Inflation is clearly broadening out. If velocity is on a sustained path higher, in no way shape or form will inflation prove transitory. The Fed has a brewing velocity problem, and hopefully this moves them to curtail QE faster than many expect. Otherwise, it is possible that inflationary pressures become entrenched in the US.

Post Comment Private Reply Ignore Thread