See other World News Articles

Title: Silver Looks Sexy

Source:

[None]

URL Source: https://www.zerohedge.com/markets/silver-looks-sexy

Published: Dec 17, 2021

Author: Tyler Durden

Post Date: 2021-12-17 22:10:09 by Horse

Keywords: None

Views: 171

Comments: 1

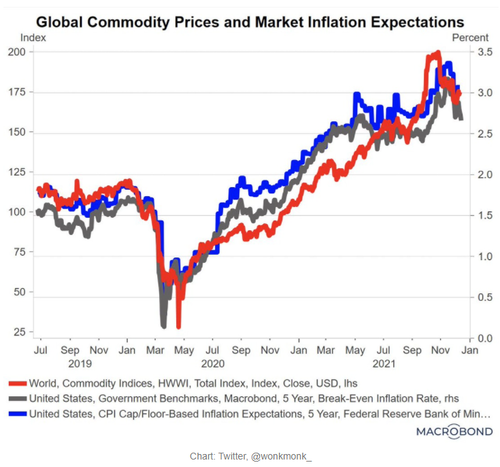

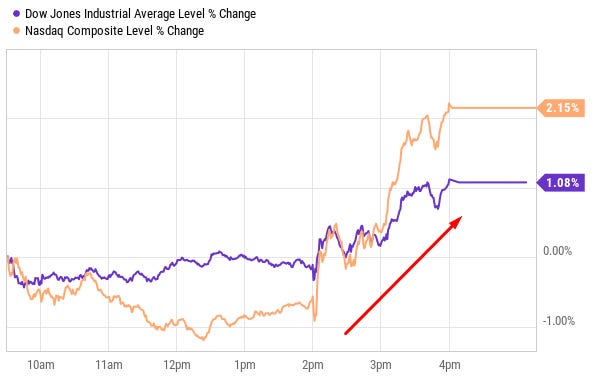

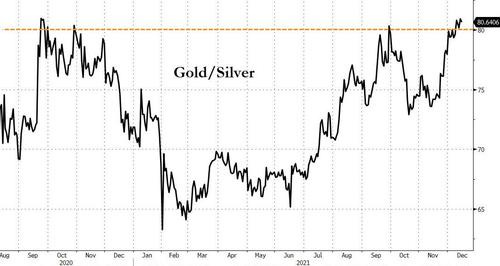

Submitted by QTR's Fringe Finance My readers know that recently, the main commodity I have been harping on has been uranium, which looks like it could be very close to a renaissance. I am still long uranium via numerous names like Cameco (CCJ) and the Global X Uranium ETF (URA). I am also long numerous other commodities and, in addition to owning one or two value stocks I like, I own several names that have exposure to commodities, as I continue to believe they represent an inflation hedge and are entering a “super cycle” that will end in consolidation in both hards and softs at meaningfully higher prices in 2022. But this week, my attention turned back to another commodity I hadn’t looked at in a while: silver. I added some exposure to silver yesterday by purchasing call options on the iShares Silver Trust (SLV) and may add to already existing positions in either the Sprott Physical Silver Trust (PSLV) or any of a host of miners, including Pan American Silver Corp. (PAAS) if the price of silver moves meaningfully lower and/or dislocates from the price of gold further. My reasoning for the purchase was twofold: Monetary policy is a plane that is headed directly into a mountain, as confirmed by Fed chair Powell yesterday. We’ll discuss. The gold/silver ratio, which has traditionally indicated when silver is cheap relative to gold, is back over 80:1, indicating a large dislocation from historical norms. As a quick overture, I’d like to state that, in general, I like the climate for both gold and silver here - both are unloved for reasons I will discuss in moments - but I think silver represents the better opportunity, at least for the time being. It was confirmed yesterday that the Fed is still at least considering speeding up and following through with a taper. Jerome Powell postured on Wednesday that tapering and rate hikes would be well on their way throughout 2022 and into 2023. Surprisingly, Powell’s comments yesterday were seen by the market as dovish despite the accelerated rate with which the Fed announced it would taper. Indexes screamed higher after a quick initial selloff. I believe yesterday’s rally was unjustified and, as I wrote a couple days ago, still believe that the taper will eventually crash the markets if the Fed tries to follow through with it. I also don’t happen to believe that the Fed is going to follow through with their announced plans, however, because the first second the market starts to crash, we can look for an easing of language from them. This, in turn, will send a signal to the precious metals market that the taper isn’t quite as serious as Powell has postured, which will likely send gold into the 2000s next year, in my opinion. Silver, with the gold the silver ratio now out of proportion, would likely have a disproportionately larger move higher if gold were to make such a move heading into the new year. This is part of the reason I wanted to have more exposure to silver than I have had over the last few months, as sentiment around the precious metals has been absolutely terrible. But again, this terrible sentiment has only been a result of the fact that the market believes that the Fed will actually follow through with tapering . I simply don’t believe that this is possible or will be the case. In other words, I’m calling the Fed’s bluff with my increased exposure to silver. The precious metals have been unloved and even bulls like Peter Schiff have admitted recently that they could continue to be unloved until the reality of the Fed’s true plan of action comes to light. We won’t know whether or not we can call the Fed’s bluff until early next year. Until then, precious metal investors may have to endure a little more pain, which I will see as as opportunities to add further. But, with the gold to silver ratio once again over 80:1, it looks like silver may be the precious metal worth considering in this instance. As was pointed out in an excellent writeup by Peter Schiff and Zero Hedge, the gold/silver ratio is now back near historical highs. Chart: Zero Hedge “To put that into perspective, the average in the modern era has been between 40:1 and 50:1,” they write. “In simple terms, historically, silver is extremely underpriced compared to gold. At some point, you should expect that gap to close.” I concur. Their writeup also does an excellent job offering detailed historical perspectives on the ratio, and is free to read here. I’ll just note that in the months following the ratio hitting going over 80 back on September 22, 2021, silver rallied for about 5 straight months afterward. Additionally, bulls like Andy Schectman continue to believe that demand for silver is eventually going to completely overwhelm supply. In an interview with Schectman a couple months ago, he told me: More silver is being consumed than is being mined each year. Last year, approximately 850 million ounces were mined globally, with a demand of over one billion ounces. The industrial demand for silver is surging in an increasingly digital world, with new applications every day in green energy and battery powered vehicles. At the same time annual global mine supply is declining and industrial demand is increasing, a global renaissance in monetary demand is upon us. This is happening while a handful of large Wall Street bullion banks have manipulated the price of monetary metals for decades, allowing some of the biggest money in the world to accumulate massive amounts of physical gold and silver at subsidized prices. The physical demand filters down from the top. Over 300 million ounces of silver were removed from the Comex market in 2020 by some of the most sophisticated and well healed investors in the world. Settlements on the Comex are usually mostly in dollars. The Comex was not set up to be a source of physical delivery. This is no small development. In years past, this amount would represent roughly a decade’s worth of silver deliveries. In addition, Comex deliveries in 2021 are now on pace to better the 2020’s delivery numbers. When all of this is added to record global retail physical demand in coins and bars - physical demand at some point and probably sooner rather than later, will completely overwhelm supply. Silver remains just one piece of the puzzle for me, as I work like most traders to try and distort reason and behavioral incentives enough to barely understand our FUBAR markets as they exist today. As I wrote about at length a couple days ago, I believe the Fed has cornered itself and has no choice but to raise rates and that a taper is simply "bad news" with no upside, despite the market's rally this week. Days ago, I also asserted that the market was moving more on Powell's posturing than on fears of the Omicron variant of Covid. On a recent podcast, I expounded on my thinking. I also supported my thesis that Cathie Wood's ARKK remains dangerous territory, as the only string it is holding on by is Tesla - and some weird shit is starting to happen with Elon Musk (stock sales, cryptic Tweets about quitting, etc.) This week, I also released two names that, despite the market crash, I would look at as potential buyout candidates. Poster Comment: This is from a paid service.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: Horse (#0)

(Edited)

The high gold/silver ratio is meaningless when there is very little demand for silver. The biggest demand for silver are silver stackers who buy silver thinking that silver is under-priced. When they finally realize that there is far more silver mined than the pitiful real demand based on actual usage, silver will go to under $10 per ounce. It doesn't matter if silver mines become unprofitable and close because most silver is obtained as a byproduct from mining other metals such a copper and those mines will not close. And, since their profit comes from mining other metals, they will continue to dump silver even if is $2 and ounce. 70 years ago most middle and upper classes owned silverware. That was billions of ounces that very few people care to own and is therefore sold as junk silver. Hundreds of millions of ounces of silver was used up in photography. Now there is almost none. Billions ounces of silver was used in a coins as actual money in the USA, Canada, the Philippines, and many if not most other countries. Now there is none. Even solar panels use less silver and at least one solar panel manufacturer has replaced silver with copper. The only remaining uses are only a small fraction of yearly silver production obtained from mining other metals. Even silver usage in jewelry is far less than in the past.

Top • Page Up • Full Thread • Page Down • Bottom/Latest