See other World News Articles

Title: 3 Reasons Why 2022 Will Be Unforgettable

Source:

[None]

URL Source: https://www.zerohedge.com/economics ... why-2022-will-be-unforgettable

Published: Dec 28, 2021

Author: Tyler Durden

Post Date: 2021-12-28 16:20:54 by Horse

Keywords: None

Views: 47

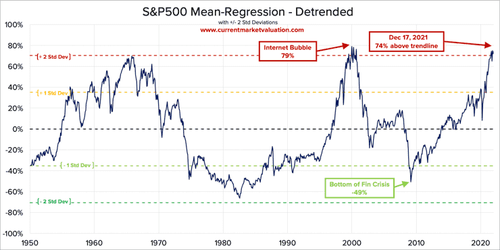

Via Birch Gold Group, After the crazy year we’ve just had, one good question to ponder for a moment is: What does the U.S. economy look like as we head into next year? To answer that, this article will examine three sectors by looking at economic activity (including Wall Street), the inflation situation, and of course physical gold. Here we go… Economists still can’t come to grips with an astronomically overvalued market It’s amazing how long a virus can be blamed for “Economic Woes.” But that’s exactly how economists summed up 2021: U.S. economic activity resurged in 2021 after a year marked by lockdowns and stay-in-place orders, with the rebound fueled by a combination of monetary and fiscal stimulus, as well as firm consumer spending. However, against this backdrop, the second half of this year especially has seen an economy grappling with supply-side constraints and rising price pressures. Lingering virus concerns have compounded with still-elevated demand to push up inflation. When the government hands out free stimulus money, and also places a moratorium on mortgage payments, it would be natural to expect increased consumer demand for products and services as a result. (Along with a little market mania for good measure.) But thinking that these pressures and demand would ease early next year, as those same economists surmised, ended up complicated by Omicron jitters. From the same article: Goldman Sachs: The emergence of the Omicron variant increases the risks and uncertainty for the economy anticipates GDP will grow 3.8% on a full-year basis in 2022, or down from the 4.2% clip it saw previously. Bank of America Economist Michelle Meyer: We think 2022 will be one of rebalancing, albeit only gradually… This should take some of the heat off of inflation but not quickly enough. Wells Fargo: Supply constraints will gradually ease over the course of the next two years. They’re understandably focused on supply issues, the virus (still or maybe again), and an imminent slowdown in 2022. A new report from S&P Global calls the supply chain issues “the largest stumbling block for the U.S. economy.” That same report summarizes its economic outlook for 2022 as “cruising at lower altitudes.” Some of the notable findings include: GDP growth looks to be slow at best through Inflation won’t subside to the Fed’s target rate (2%, in case you’ve forgotten) until late 2023 at best. The potential for a total of six interest rate hikes by 2024. But perhaps the most interesting thing about all of these forecasts is they appear to ignore the signals from Wall Street. Namely, that the stock market is still grossly overvalued. Reversion to the mean, the irresistible “financial law of gravity” threatens to bring the market crashing back down to Earth much like it did when the 1999-2001 dot-com bubble burst. That would be a drop of somewhere between 40-60%. Not a “correction,” not a “bear market” – we’re talking “people jumping out of buildings” bad. Take a look at this chart showing stock valuations now almost as distorted as they were on the eve of the last real crash… Source Of course, two other signals are also pointing at an overvalued market like a neon arrow. The Buffett indicator continues to increase, with its ratio of market value to GDP sitting at 213% (Buffet thinks over 120% is dangerous). The S&P 500 P/E ratio model is also way outside its healthy range. It currently sits at only 90% above its historical average, dangerously close to dot-com crash territory. So to summarize, according to the information so far, the U.S. economy can look forward to slow growth, virus anxiety, and an overvalued market (among other things). Not a good start, and it doesn’t look like inflation worries will be easing in 2022 either… Sticky inflation grips the nation “The U.S. may be stuck with higher inflation in 2022, and potentially beyond” is the headline of a forecast at the London School of Economics. So Powell’s “transitory” inflation idea didn’t really pan out (like we reported it back in June), and now we’re finding out first-hand just how long it can last. In fact, if either of the LSE’s “less comforting” models for PCE (which doesn’t even count those inconvenient food and energy prices) pan out, there won’t be much improvement through all of 2022 (and possibly beyond): We examine two other scenarios which are even less comforting. We assume that the size of monthly price increases falls but does not reduce as quickly or as far, so that it reaches twice the pre-pandemic period average next June. In this case, annual PCE inflation would average 3.2 percent in the final quarter of next year. Finally, if monthly PCE inflation holds at the latest monthly increase (of 0.3 percent) through next year, annual inflation in the fourth quarter of next year would be 3.9 percent. To put this in perspective, as of October 2021, the PCE is 5.0%. An improvement of only 1.1% throughout an entire year won’t amount to much financial relief for already-wary consumers suffering from record inflation now. This is also the number that Powell proudly touts as the Fed’s “target inflation” rate of 2%. The S&P Global report commented on this conundrum: “How sharp a slowdown depends on how big an inflation battle the Fed must fight.” The battle’s already looking like the end of the movie 300, so it’d be smart to prepare for a razor-sharp slowdown. Prepare for the worst, and hope for the best. Which brings us to the last bit of our outlook for 2022, how physical gold will fare. Gold poised for “slow and steady” rally Just as you might expect, the dire outlook presented thus far increases the investor appetite for physical gold. In fact, that’s exactly what this recent update from the World Gold Council reports: The shift to riskier and less liquid assets strengthens the case for an allocation to gold, given its unique combination as a highly liquid diversifier that can reduce portfolio volatility. Popular investments like stocks are starting to get more risky as the market gets more overvalued. Forbes reports that gold’s popularity will rise in 2022 for this reason: People are getting worried about inflation continuing to rise faster. Investing in gold is an age-old, inflation-protection strategy. The bottom line: History offers good support for investing in gold now. And the potential for gold prices to rise in 2022 might even be accompanied by higher oil prices: The United States’ economy is expected to slow down in the first quarter of 2022, causing stock markets to correct and investors to shift their capital out of equity markets and into gold. Financial institutions expect demand to rebound in 2022 and oil prices to return to their rising trend. (As if 58% higher gas prices wasn’t bad enough…) As we presented above, the economic slowdown might last a lot longer than just the first quarter of 2022. If gold’s rally plays out the way we think it will, we’ll see it run much longer than three months. Slow and steady gold wins the race. Since 2000, gold has been on a steady climb in price. That climb could accelerate once again, much like it did from 2009 to late 2011 in the wake of the housing bubble and subsequent market meltdown. The bottom line is… Keep an eye on “alternative investment” opportunities next year But the potential crash of an overvalued market, stubborn inflation, and physical gold would be three good things to focus on as 2022 starts to take shape. We’ll have to wait and see how the year plays out, of course. No one has a crystal ball. All too often, predictions have a way of embarrassing those who made them. Nobody has all the answers. That’s why the most prudent investment strategy is probably not to take sides. If your retirement savings are well-diversified, and you’re taking an appropriate level of risk, and you’re well stocked with inflation-resistant assets, then perhaps the most useful advice comes from author and salesman Zig Ziglar: “Expect the best. Prepare for the worst. Capitalize on what comes.”

Post Comment Private Reply Ignore Thread