See other World News Articles

Title: Oil Is "Out Of OPEC's Hands" And "Going Higher"

Source:

[None]

URL Source: https://www.zerohedge.com/markets/o ... t-opecs-hands-and-going-higher

Published: Jan 21, 2022

Author: Tyler Durden

Post Date: 2022-01-21 18:17:43 by Horse

Keywords: None

Views: 51

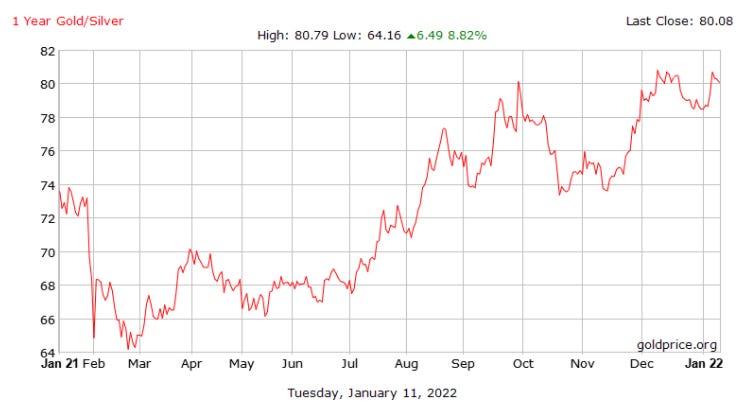

This is Part 1 of an interview with Harris Kupperman, founder of Praetorian Capital, a hedge fund focused on using macro trends to guide stock selection. Mr. Kupperman is also the chief adventurer at Adventures in Capitalism, a website that details his investments and travels. Part 2 of this interview is here. (Subscribers only.) Harris is one of my favorite Twitter follows and I find his opinions - especially on macro and commodities - to be extremely resourceful. I’m certain my readers will find the same. I was excited to get the chance to ask him about anything I wanted, which I did last week. Q: Hi Harris, thanks for agreeing to chat. Let’s jump right into commodities: OPEC said this week they don't want oil to hit $100 / barrel. Is there a situation where you think OPEC is no longer in the drivers' seat in helping determine oil prices? Honestly, it’s out of their hands. Governments around the world are stimulating demand. They’re going crazy. They’re printing money and subsidizing users. At the same time, they’re making it amazingly painful for producers to produce oil. They’re withholding permits and blocking pipelines. They’re already talking about excess profits taxes and carbon taxes are next. Why would anyone increase production under these circumstances? Hence, non-OPEC production isn’t going up much. So, OPEC is left to make up the balance. They can talk about raising production by 400k/d, but they’re already almost out of spare capacity. They aren’t even hitting their own internal targets. It’s increasingly out of their hands at this point. Oil is going higher. I recently spoke with Andy Schectman about his thoughts on silver and gold. I was wondering what your outlook on precious metals, including thoughts on less discussed metals like palladium and platinum, was? If they’re going to print insane amounts of money, then gold is a good way to preserve purchasing power and it will likely go higher over time. The same goes for platinum. It all comes down to the fact that as a commodity, these should trade around the marginal cost of production, which will likely increase with inflation. As oil goes higher, it will drive production costs higher (mining is really just a big earth-moving operation). This should be bullish for metals, but a lot less bullish for miners as their margins get squeezed. Any thoughts on the gold/silver ratio back toward 80:1 right now? I really have no opinion on the ratio between the two. It is just a ratio, but not particularly indicative of anything. Silver around $23 is not particularly cheap compared to production costs. Remember, it’s flare gas. It’s super easy to recover more silver from the tailing stream. At current prices, they’ll recover more. I can't help but think an upcoming taper would be a vanilla directional negative for equity markets, as I have written. Will the Fed have the balls to taper the way they are telegraphing? What will markets do as a result? The Fed is a very political organization, despite protestations that they are not. When everyone wanted higher asset prices, the government cheered the Fed to lower interest rates and flood the world with liquidity. Now that inflation is roaring, politicians are complaining about inflation and demanding that the Fed “do something.” What can the Fed do about the price of tomatoes or heating oil? They don’t control these things. Government obstruction has made prices go crazy. All the Fed can do is raise rates or QT and soak up liquidity. I assume they’ll do a bit of both, and it won’t matter to the price of oil because politicians won’t allow producers to produce more. As oil goes higher, the Fed will have far more pressure to act, and they’ll eventually panic, overshoot and crash the equity markets. Oil going parabolic will kill everything else. Peter Schiff thinks next year will be inflationary. Jim Rickards has argued the opposite. Will the next year be deflationary or inflationary? Why or why not? A bit of both. Inflationary assets will go screaming because supply will be artificially constricted by government stupidity, while risk assets will collapse as the Fed tries to control the price of tomatoes by raising rates and soaking up liquidity. What's your 1 year, 5 year and 10 year outlook on uranium? I know you are a bull like me, but how much patience is going to be necessary? One day they’ll have finished soaking up the aboveground uranium stockpile and the price will go crazy. I don’t know when, but if they produce less than they consume, it’s inevitable. Then, a few years later, mothballed mines will be restarted, and the price will collapse. This is the history of commodities. They overshoot in both directions. I just think that uranium will overshoot far more dramatically than most commodities as there is a limited supply of it and a nuclear facility without access to uranium is a multi-billion-dollar paperweight. Unlike many other commodities, higher prices will not curtail demand. As a result, these utilities will panic and pay up to acquire uranium once the price gets going and that will send the price to some crazy level. In terms of timing, I have no idea when, but if Sprott keeps buying a few million pounds a month, that’s bound to accelerate it. I think the supply gets soaked up in 2022 and this theme gets a lot more traction soon.

Post Comment Private Reply Ignore Thread