See other World News Articles

Title: 2022 Could Be "Even Crazier" Than 2021 For Supply Chains

Source:

[None]

URL Source: https://www.zerohedge.com/news/2022 ... ven-crazier-2021-supply-chains

Published: Feb 4, 2022

Author: Tyler Durden

Post Date: 2022-02-04 11:36:47 by Horse

Keywords: None

Views: 47

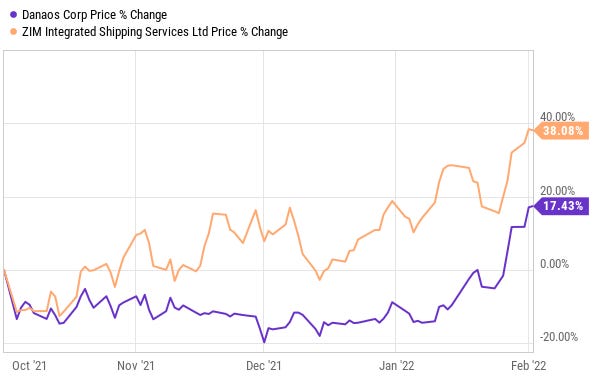

Submitted by QTR's Fringe Finance This is part 1 of an exclusive Fringe Finance interview with shipping analyst (and friend of mine) J Mintzmyer, where we discuss the state of the supply chain in the country, the developments with Canadian truckers, logistics, the effects of Covid and what shipping names he likes for 2022. J is a renowned maritime shipping analyst and investor who directs the Value Investor's Edge ("VIE") research platform on Seeking Alpha. You can follow him on Twitter @mintzmyer. J is a frequent speaker at industry conferences, is regularly quoted in trade journals, and hosts a popular podcast featuring shipping industry executives. J has earned a BS in Economics from the Air Force Academy, an MA in Public Policy from the University of Maryland, and is a PhD Candidate at Harvard University, where he researches global trade flows and security policy. Q: J, last time we talked was in Fall 2021. How has the supply chain changed since then? Where are the bottlenecks, if any, now? Despite all the nonsense across the mainstream media about the supply chain "normalizing" or "recovering," by and large we are in a very similar situation as last fall. This period of time (January-April) is typically the weakest part of the year since we are post-Holidays in the US and Europe and China also slows production around the Lunar New Year, so we would otherwise expect freight rates to crash and congestion to ease. Instead, we are seeing freight rates hold up firm (actually rates are higher than November-levels right now, which is wild!), and throughput numbers out of LA and Long Beach have been very low even as the ship backlog keeps piling up. If these ports fail to clear the backlog and congestion by June/July, then Fall 2022 could be even crazier than last year, I'm watching this closely. Both DAC and ZIM, which you pointed out last fall, are up significantly since you first pointed them out. Are you staying with these names? It's a timely question! I have made life-changing returns from both Danaos Corp (DAC) and Zim Integrated Shipping (ZIM) and I still have long exposure; however, I have trimmed DAC substantially around the $90-$95 mark and I have trimmed a lot of ZIM in the mid/upper-$60s. My personal 'fair value estimate' is $120 for DAC and $77.50 for ZIM, but I often take profits on rallies. A common mistake I see from traders and investors is an 'all-or-nothing' approach (i.e. "when should I sell it all?"). I prefer to layer in and layer out. During the December slump in ZIM I was loading the wagons. I was also loading the wagons in DAC in very-early January in the low- to mid-$70s. At this exact time (February 2, 2022), I personally prefer both Poster Comment: The remainder is a paid interview. Canadian truckers are being joined by European, American and Australian truckers. That cannot solve supply chain problems even if it means the end of mandates.

Post Comment Private Reply Ignore Thread