See other National News Articles

Title: Here Is The Heatmap From Today's Blowout CPI Report

Source:

[None]

URL Source: https://www.zerohedge.com/markets/h ... tmap-todays-blowout-cpi-report

Published: Feb 10, 2022

Author: Tyler Durden

Post Date: 2022-02-10 19:32:20 by Horse

Keywords: None

Views: 73

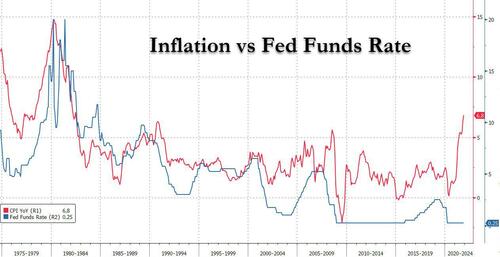

Today's CPI print was a stunner: despite JPM hearing "whispers" that inflation would miss expectations, not only did that not happen with CPI now coming in higher than Wall Street estimates 9 of the past 11 months, but CPI came in at the hottest level since 1982 when the Fed Funds rate was 11.50%. And with the market's head still spinning from today's post CPI moves, let's take a look at what exactly the BLS reported: Headline CPI and core CPI popped 0.6% (0.65%/0.58% unrounded) mom in January, kicking off the new year with a positive inflation surprise. This boosted the yoy rates to 7.5% from 7.04% for headline and 6.0% from 5.5% for core — both the highest since 1982 as noted above. Within headline, food prices accelerated to a 0.9% clip from 0.5% in December, while energy prices also came in at 0.9%, keeping steady from the previous month. There was broad-based strength across goods and services. First on goods, household furnishings & supplies surged 1.6% mom, apparel spiked 1.1% mom, used cars jumped 1.5% mom, recreation commodities climbed 1.0% mom, medical goods rose 0.9% mom, other goods increased 0.8% mom, alcohol was up 0.4% mom, and education/comm. increased 0.3%. The only soft component was new cars, which was flat. The widespread pressure across goods likely reflects ongoing supply chain constraints which have not yet shown signs of material improvement. In services, rents stayed hot, with OER up 0.42% mom and rent of primary residence accelerating to a 0.54% clip—the strongest monthly increase since October 1992. Tight labor markets and strengthening wage growth are likely underpinning the rent trajectory, which could continue to heat up in coming months. Medical care services accelerated to a 0.6% mom clip, doubling from December. Hospital services spiked 0.5% mom as the surge in Omicron cases may have boosted payments, health insurance spiked 2.7% mom, and professional services grew 0.2% as physicians seemed to be unaffected by the 0.75% Medicare cut this month. Omicron seemed to have a mixed impact on travel prices. On one hand, lodging plunged 3.9% mom and car/truck rental slid 7% mom. On the other hand, airline fares jumped 2.3% mom. Broader transportation services rose 1.0% as motor vehicle insurance also gained 0.9% mom. Recreation (+0.8%), other personal (+0.7%), and water/sewer/trash (+0.9%) all gained impressively as well. Education/comm services edged up 0.1% mom while household operations was unreported for a second consecutive month. A visual summary of the data looks like this, first on a M/M basis.. ... and then the YoY CPI print. Incidentally for those wondering what the Fed's change in the CPI basket as part of its biennial update looks like, here is the answer: According to Bank of America, "for the Fed this report provides another wake-up call. Inflation is here and it continues to make its presence known everywhere." It's why the bank remains comfortable with its hawkish call for the Fed to hike seven times this year, beginning at the next FOMC meeting in March. The surprisingly strong report drove the nominal Treasury curve flatter, with the front-end up 10bps. The market now assigns around 50% odds of a 50bps rate hike in March, a 20PPT increase in market-implied probability on the print. Inflation breakevens rose sharply in shorter dated tenors (2y +12bps), while longer-tenor breakevens were little changed. Real rates led the more modest move higher in 5y-30y tenors. Needless to say, today’s print endorses the Fed to move more quickly, and the market will likely encourage the Fed to hike 50bps at the next meeting. However, more importantly, the market is now also starting to price in the rate cuts that will follow the current hiking cycle which will end in a recession, as they always do. It's why after tumbling after the CPI print, risk assets have stormed higher and are now trading near session highs on expectations of the QE/ZIRP that will follow the coming recession. Poster Comment: Lots of charts at source. Problem is that people are still waiting for items they need on back order. That will not let prices go down. Plus food and fuel are going up.

Post Comment Private Reply Ignore Thread