See other National News Articles

Title: Is It 'Monetization' Yet, Dr. Bernanke?

Source:

[None]

URL Source: https://www.zerohedge.com/markets/it-monetization-yet-dr-bernanke

Published: Feb 20, 2022

Author: Tyler Durden

Post Date: 2022-02-20 07:08:05 by Horse

Keywords: None

Views: 31

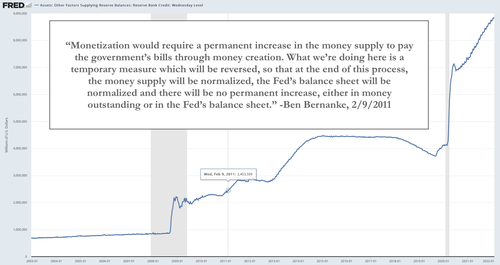

Authored by Jesse Felder via The Felder Report, Eleven years ago, shortly after the onset of QE 2, Ben Bernanke gave us his definition for “monetization” of the debt, telling Congress (hat tip, Grant’s): Monetization would require a permanent increase in the money supply to pay the government’s bills through money creation. What we’re doing here is a temporary measure which will be reversed, so that at the end of this process, the money supply will be normalized, the Fed’s balance sheet will be normalized and there will be no permanent increase, either in money outstanding or in the Fed’s balance sheet. At the time, The Fed’s balance sheet was approaching $2.5 trillion. Today, it stands at nearly $9 trillion, more than triple the figure from a decade ago. And so it only seems fair to ask, ‘Is it monetization yet, Dr. Ben?’

Post Comment Private Reply Ignore Thread