See other World News Articles

Title: EU Parliament Votes Against A Proof-Of-Work Ban: What This Means For Crypto

Source:

[None]

URL Source: https://www.zerohedge.com/crypto/bi ... lly-ban-key-digital-currencies

Published: Mar 14, 2022

Author: Tyler Durden

Post Date: 2022-03-14 13:52:53 by Horse

Keywords: None

Views: 116

Comments: 2

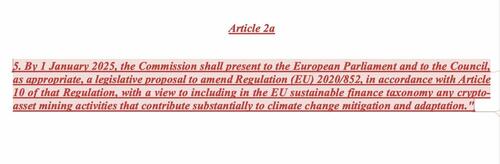

Update: Yesterday, when cryptos suddenly tumbled amid the market's delayed realization that the EU was set to vote on Monday on a new regulatory framework for crypto assets which could accelerate passage of a measure banning "proof of work" mining, which industry executives said could "practically ban key digital currencies including Bitcoin and Ethereum in Europe", we said (see below) that the good news for crypto bulls is that "a small majority of committee members may vote against the measure." If so, we added, "the selloff on Sunday night is merely the latest successful attempt at shaking out the weak holders." That's precisely what happened because moments ago, the EU Parliament voted against a proof-of-work ban. Crypto pundit Patrick Hansen has more details in a tweetstorm: BREAKING: The ECON committee of the EU Parliament just voted against the de-facto POW-ban: 32 against, 24 in favor. Big relief & political success for the bitcoin & crypto community in the EU. Will share a breakdown of the vote and what’s next here in this thread. A majority of MEPs from the EPP, ECR, Renew & ID voted against it, while a minority of MEPs from Greens, Socialists and Democrats (S&D), and European United Left (GUE) mainly voted in favor. Instead, this alternative amendment from Stefan Berger was supported. MiCA regulates financial instruments and financial service providers. It makes way more sense to address any concerns around the sustainability of mining technology separately. Whats next? The MiCA draft will be negotiated in the so-called “trilogues” between the EU Commission/Parliament/Council. After their final agreement (couple of months) the law will enter into force. However, companies will have a 6m transition period to comply with the requirements. Any chances left for the POW-ban? The groups that lost the vote have one last option. They could veto a fast-track procedure of MiCA through the trilogues & bring the discussion to the plenary of the Parliament. They need 1/10 of the votes of the EP to do so, which they have. That would bring the discussion around POW into the high-level policy arena. As we can’t predict how that would play out, it should be prevented. Even if it doesn’t change the vote on POW, it would unnecessarily delay the regulation for at least a couple of months. And even outside of this MiCA regulation, the discussion around POW-regulation is far from over. It will come back in the context of the sustainability taxonomy or in the upcoming data center regulation: So there is loads of work left in the months and years ahead. But today is a big political success for crypto in the EU. Congrats to @DrStefanBerger for this political success and for his support for the crypto community. And thanks and congrats to everyone who contributed to making our concerns and voices heard. The crypto community in the EU has clearly become a political force! Looking forward to keep pushing Europe to embrace crypto. * * * With Bitcoin and ether trading near session highs following the news, a move facilitated by Elon Musk stating overnight that "I still own & won’t sell my Bitcoin, Ethereum or Doge fwiw", those who bought cryptos yesterday are now well in the money. * * * Earlier: Cryptocurrencies stumbled on Sunday evening after trading rangebound for the past two days, following a delayed market realization, and reaction, that on Monday, the European parliamentary committee will vote on a new regulatory framework for crypto assets, which according to Bloomberg could accelerate passage of a measure that industry executives say could "practically ban key digital currencies including Bitcoin and Ethereum in Europe." Crypto-assets issued and/or traded in the EU “shall be subject to minimum environmental sustainability standards and set up and maintain a phased rollout plan to ensure compliance” with those requirements, according to the final draft for the Markets in Crypto Assets (MiCA) law, the EU’s sweeping legislative package for governing digital assets, that was seen by Bloomberg News. The Economic and Monetary Affairs Committee will vote on the bill on Monday, and in an unexpected twist, the draft law contains a late addition that looks to limit the use of cryptocurrencies powered by an energy-intensive computing process known as proof-of-work. Commenting ahead of the vote, Jake Chervinsky, head of policy the Blockchain Association said that "the MiCA situation is worse for crypto than anything in the USA. Tomorrow, the European Parliament votes on "environmental sustainability standards" that look like a pretext for a Bitcoin ban." Jake Chervinsky @jchervinsky The MiCA situation is worse for crypto than anything in the USA. Tomorrow, the European Parliament votes on "environmental sustainability standards" that look like a pretext for a Bitcoin ban. If it passes, it can be undone in the next phase of the EU process, but it's very bad. As Bloomberg points out, the reference to minimum sustainability as well as rollout requirements, appear to be last-minute changes introduced to curb, or ban, the use of digital currencies working on a so-called “proof-of-work” consensus mechanism, for instance Bitcoin and Ethereum (at least until the rollout of Ethereum 2.0 which is proof of stake). An earlier draft didn’t mention a proof-of-work protocol concept, EU parlamentarian and crypto-expert Stefan Berger of Germany’s Christian Democratic Party said in a Tweet early last week. CoinDesk reported yesterday that the provision in question requires all crypto assets to be subject to the EU’s “minimum environmental sustainability standards with respect to their consensus mechanism used for validating transactions, before being issued, offered or admitted to trading in the Union." For cryptocurrencies like bitcoin and ether, that are already being traded in the EU, the rule proposes a phase-out plan to shift their consensus mechanism from proof-of-work to other methods that use less energy, like proof-of-stake. Although there are plans to move ethereum to a proof-of-stake consensus mechanism, i.e., Ethereum 2.0, such an option is not available for bitcoin. Proof of work is one of the main consensus mechanism governing the Bitcoin blockchain. Energy-intensive Bitcoin miners contribute computer power to the network, which secures and processes the blockchain, and are rewarded in Bitcoin for their contribution. A previous version of the law proposed the prohibition of proof-of-work crypto in the EU starting in January 2025. The provision was later dropped following criticism from crypto advocates, before the modified version made it back into the latest draft. Stefan Berger, the EU parliamentarian charged with overseeing the content and progress of the MiCA framework, has been trying to reach a compromise over restricting proof-of-work. Berger also said at the time that he does not feel MiCA is the place for settling technological or energy-related rules because the framework’s goal is to regulate crypto as assets. Once parliament decides on the draft, it will move on to a trilogue, which is a formal round of negotiations between the European commission, council and parliament. “The Greens and Socialists, as you can imagine, are criticizing the proof-of-work concept and criticizing the energy use, saying that bitcoin needs more energy than the Netherlands,” Berger said in an interview with CoinDesk in February, referring to the political parties pushing the energy argument. Furious over whether the new, tougher draft law would be a de-facto ban of Bitcoin, industry executives took their concerns to Twitter on Saturday. “We at Ledger will always defend freedom and self-custody, particularly in our backyard. We are calling on you all to contact your Member of European Parliament and let them know that you oppose a Bitcoin ban in Europe,” Chief Executive Pascal Gaulthier of Ledger, one of the world’s largest crypto wallet providers said on his Twitter account. Pascal Gauthier @_pgauthier We at Ledger will always defend freedom and self-custody, particularly in our backyard. We are calling on you all to contact your Member of European Parliament and let them know that you oppose a Bitcoin ban in Europe: https://europarl.europa.eu/meps/en/home Microstrategy CEO Michael Saylor chimed in that "the only settled method to create digital property is via Proof-of-Work. Non-energy based crypto approaches like Proof-of-Stake must be deemed to be securities until proven otherwise. Banning digital property would be a trillion dollar mistake." Michael Saylor⚡️ @saylor The only settled method to create digital property is via Proof-of-Work. Non-energy based crypto approaches like Proof-of-Stake must be deemed to be securities until proven otherwise. Banning digital property would be a trillion dollar mistake. “Since there is no way #bitcoin can & will implement a rollout plan out of POW, it would affect #BTC as well,” said Patrick Hansen, head of strategy for crypto wallet firm Unstoppable Finance, on Twitter. “Extremely high stakes vote in the EU. That such a proposal made it this far is extraordinarily concerning and unlikely to stand up to practical reality,” said Jeremy Allaire, founder of Circle Pay, on Twitter. The good news for crypto bulls is that according to CoinDesk, which cites people familiar with the matter that although the vote remains a close call, a small majority of committee members may vote against the measure. If so, the selloff on Sunday night is merely the latest successful attempt at shaking out the weak holders.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: Horse (#0)

The author is mistaken. Ethereum used to be a proof-of-work coin, but it has changed as part of its "2.0" upgrade and is now a "proof-of-stake" coin that is no longer minable. Bitcoin is mined, as are a number of other coins, but Ethereum is not. But there is a misconception about crypto mining requiring enormous amounts of energy. The truth is that a single laptop has enough CPU power to mine bitcoin every 10 minutes and facilitate all bitcoin transactions globally, which isn't hard at only 7 transactions per second. The only reason why so much energy is directed to mining is because of market competition. Bitcoin is valuable so the mining rewards are lucrative. The Bitcoin protocol adjusts the "difficulty factor" of mining about every two weeks, and the more competition there is, the higher the difficulty factor is to ensure new coins are mined about every 10 minutes, and less competition means a lower difficulty factor. So crypto mining energy consumption is directly tied to mining competition only. The Bitcoin network itself doesn't need all that power to operate. I wonder if miners could even form a mining guild of sorts that would allow miners to take turns mining so they don't waste power competing against one another.

Reading further, the author does make clear that Ethereum "2.0" is Proof-of-Stake. The USD price of BTC has been very stable for the past 4 days, 38.7k - 39.2k, including this alleged Sunday "sell-off" which the BTC price has already recovered from. As for banning cyrpto in Europe, they could ban mining in Europe, but that won't damage bitcoin. Transacting from Europe would be a very private affair one does while setting at their computer or on a park bench tapping on their cell phone. If the mining is done in Vietnam, then the transaction goes through in Europe with no one the wiser.

which could accelerate passage of a measure banning "proof of work" mining, which industry executives said could "practically ban key digital currencies including Bitcoin and Ethereum in Europe"

#2. To: Horse (#0)

Top • Page Up • Full Thread • Page Down • Bottom/Latest