See other National News Articles

Title: Shocking Consumer Credit Numbers: Credit Card Debt Soars With Savings Long Gone

Source:

[None]

URL Source: https://www.zerohedge.com/markets/s ... ng-gone-credit-card-debt-soars

Published: Apr 7, 2022

Author: Tyler Durden

Post Date: 2022-04-07 16:41:48 by Horse

Keywords: None

Views: 239

Comments: 2

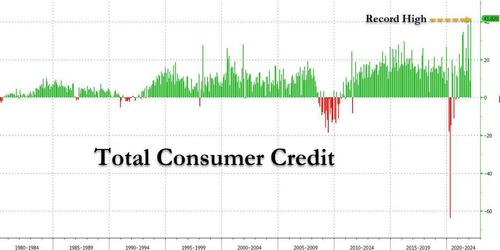

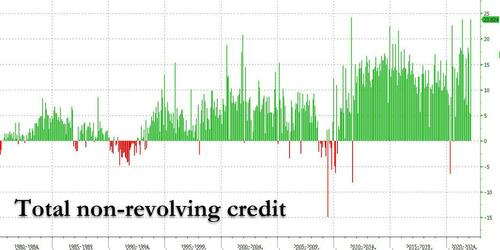

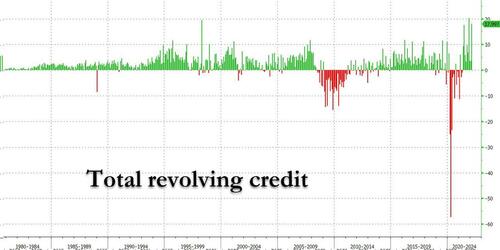

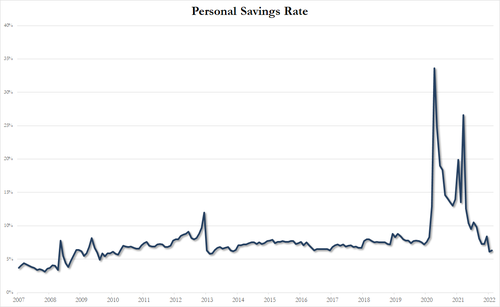

While it is traditionally viewed as a B-grade indicator, the February consumer credit report from the Federal Reserve was an absolute stunner and confirmed what we have been saying for month: any excess savings accumulated by the US middle class are long gone, and in their place Americans have unleashed a credit-card fueled spending spree. Here are the shocking numbers: in November, consumer credit exploded by a whopping $41.8 billion, more than double the expected $18.1 billion print, nearly five times more than the upward revised $8.9 billion January number (revised from $6.8 billion), and the highest on record! And while non-revolving credit (student and car loans) surged by a near record 23.8 billion, the third highest on record... .. the real stunner was revolving, or credit card debt, which soared nearly six-fold February to $18 billion from $3.1 billion in January, the second highest print on record, just in time for those credit card APR to starting moving higher, first slowly and then fast. While this unprecedented rush to buy everything on credit at a time when there were no notable Hallmark holidays should not come as much of a surprise, after all we have repeatedly shown that for the middle class any "excess savings" are now gone, long gone... ... the fact is that most economists - such as those at Goldman Sachs - had previously anticipated that continued spending of savings by consumers (who they fail to realize are now tapped out) is what will keep the US economy levitating in 2022. Unfortunately, as today's consumer credit numbers clearly demonstrate, any savings that US middle class households may have stored away courtesy of stimmies, are now gone. The implications are profound: any model that projected that US spending will be fueled by "savings" can now be trashed. And since this is most of them, the consequences are dire as they confirm - once again - that the Fed is tapering, QTing and hiking right into a recession, which according to Deutsche Bank will begin in late 2023 and which according to Morgan Stanley can start in as little as 5 months. Today's data suggests that Morgan Stanley is right... Poster Comment: Recession starts later this year just in time for November 2022 elections.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: Horse (#0)

We've been in recession since the day that Brandon was installed.

“ On some great and glorious day the plain folks of the land will reach their heart's desire at last, and the White House will be adorned by a downright moron. ” ~ H. L. Mencken

Imagine doing TV soundbites on wages after factoring out Shadow Stats' 15% inflation rate. People would get pissed.

The Truth of 911 Shall Set You Free From The Lie

#2. To: Lod (#1)

Top • Page Up • Full Thread • Page Down • Bottom/Latest