See other World News Articles

Title: Wall Street's 'Commodity Trading' Risk Soars, Confirms 'Volatility Trap' Doom-Loop Under Way

Source:

[None]

URL Source: https://www.zerohedge.com/commoditi ... irms-volatility-trap-doom-loop

Published: Apr 20, 2022

Author: Tyler Durden

Post Date: 2022-04-20 17:06:35 by Horse

Keywords: None

Views: 150

Comments: 1

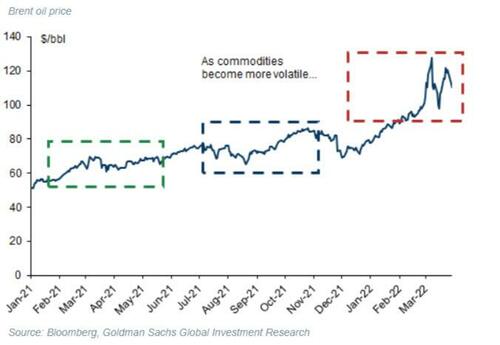

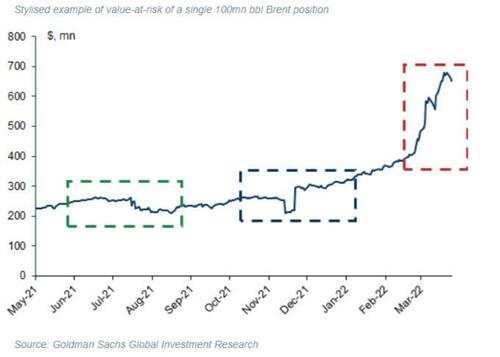

Two weeks ago, reflecting on the consequences of the West's response to Russia's invasion of Ukraine, Goldman's Jeff Currie warned that commodities are entering a volatility trap. In the report, he highlighted two self-sustaining factors - physical and financial - that are likely to last years rather than weeks, prompting higher prices and higher volatility. In the period since his report, bank earnings have hit and have confirmed the potential vicious doom-loop of the 'financial' factor that will lead commodity prices higher. Specifically, Curries explained that volatility is both curbing liquidity and restricting access to the very credit required to maintain orderly financial and physical trading of commodities. In addition, it is also exacerbating the medium- to long-term capital shortages that have built up after an era of low returns and ample supply, reinforced by political and investor ESG concerns. This can be visualized in the following vicious doom-loop of volatility creating more illiquidity and lowering capital, leading to more volatility and so on... As oil becomes more volatile... ...the range of possible outcomes becomes wider, with a greater potential for loss... ...that shifting distribution drives up the Vale-at-Risk (VaR)... ...which drives down the hedgeable amount of commodities, for any given amount of risk capital... And a lack of risk capital lowers market participation, driving down liquidity and exacerbating volatility, and further discouraging potential lenders and investors, reinforcing lower participation and higher volatility. And so with all that background, we switch our attention to the recent bank earnings which gives us insight into the last two steps of the vicious cycle... Specifically, commodities trading exposures have been going up on Wall Street, following Russia’s invasion of Ukraine, leaving banking firms vulnerable to large swings in asset values. As Bryan Jung reports, Goldman Sachs and JPMorgan have both reported a rise in commodities trading risk measures, according to their first-quarter earnings disclosures, with GSG reporting its highest uptick in a decade. Goldman’s average daily Value at Risk (VaR) in commodities hit a total of $49 million in Q1 2022, up from $32 million in Q4 2021, well above the $33 million average VaR it had in equities trading and the $25 million in currency trading. JPMorgan Chase reported its average daily VaR in commodities at $15 million in Q1 2022, up from $12 million the previous quarter and surpassing its $12 million in equities and $4 million for foreign exchange. Additionally, Citigroup, which does not report VaR alongside its earnings, disclosed in its latest report that its VaR in commodities was up year-on-year every quarter in 2021, with a peak of $48 million at the end of last year’s second quarter. Exactly as Goldman's Currie forecast, which will lead to a reduction risk capital, lowering market participation, driving down liquidity and exacerbating volatility, and further discouraging potential lenders and investors, reinforcing lower participation and higher volatility. Furthermore, macro hedge funds and other financial traders are holding back - just as we would expect on higher risk capital requirements. Their net-long positions for Brent and WTI are the lowest since Nov. 2020. They’ve cut their exposure this year despite Russia’s invasion of Ukraine. The long-short ratio for crude of 4.5 is way below the five-year average of 6.3. This volatility trap is a direct consequence of the "Revenge of the Old Economy". As commodity producers under-invest in new supply, commodity inventories deplete, raising volatility as the market loses its balancing buffer between small supply and demand shocks. This volatility in turn keeps commodity producer assets unattractive - it raises the uncertainty surrounding the investment's true value, lowering its appeal to investors. Capital continues to stay away from the sector, keeping new supply capacity - and hence inventories - low. And as we saw in the 1970s, such a volatility trap can create persistently higher commodity inflation and a supply constrained market. In the 1970s, the markets turned to long-term fixed price contracts and built large conglomerates to deepen the balance sheets required to deal with these funding stresses. In the 2000s (pre GFC) they used financial markets, and a higher degree of bank leverage, to share the risks. Neither avenue is fully available in today’s regulatory environment. But, it's different this time. Given there is unlikely to be a widespread lift of sanctions on Russia, regardless of the outcome of the war, as has historically been the case with such regulatory impositions, Goldman expects this new, more volatile pricing regime to persist for the foreseeable future. All of which reinforces Goldman's forecast for $125/bbl Brent crude in 2H22 and reinforces Poszar's warnings that you can print money but not print oil, iron, or wheat, or VLCCs or other ships to guarantee delivery of the critical commodities. Thus, as Poszar concludes rather ominously, commodity reserves will be an essential part of Bretton Woods III, and historically wars are won by those who have more food and energy supplies. And as Goldman's price forecast suggests, the current 'lull' in the stagflationary storm (as oil prices slide to post-invasion lows) is perhaps just the eye of a very much larger and longer storm. However, while many have been predicting the birth of a new monetary system in the past decade, it is the nuances of Zoltan's vision of the monetary future that is especially troubling: as he puts it "we are witnessing the birth of Bretton Woods III - a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West."

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: Horse (#0)

However, while many have been predicting the birth of a new monetary system in the past decade, it is the nuances of Zoltan's vision of the monetary future that is especially troubling: as he puts it "we are witnessing the birth of Bretton Woods III - a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West." If Bidette had not cancelled the Keystone XL pipeline, we just might be on the verge of energy independence. Plus, all the lost jobs including ending the border wall construction. And if China releases its 40% gold backed Yuan the Dollar will crumble to dust since it is only backed by promises to pay. If Bill Clinton had not caused to be borrowed all the money in the Social Security Trust Fund leaving IOUs in there, we would not be risking the total collapse of the Social Security System. Now because of this all Social Security payments must be budgeted. :-/ "When bad men combine, the good must associate; else they will fall, one by one." Edmund Burke

As oil becomes more volatile...

Top • Page Up • Full Thread • Page Down • Bottom/Latest