See other Israel/Zionism Articles

Title: Israel Dumps The Dollar For China's Renminbi

Source:

[None]

URL Source: https://www.zerohedge.com/news/2022 ... l-dumps-dollar-chinas-renminbi

Published: Apr 21, 2022

Author: Tyler Durden

Post Date: 2022-04-21 10:20:14 by Horse

Keywords: None

Views: 114

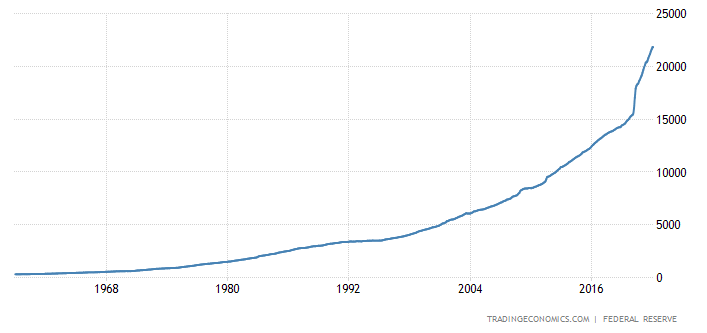

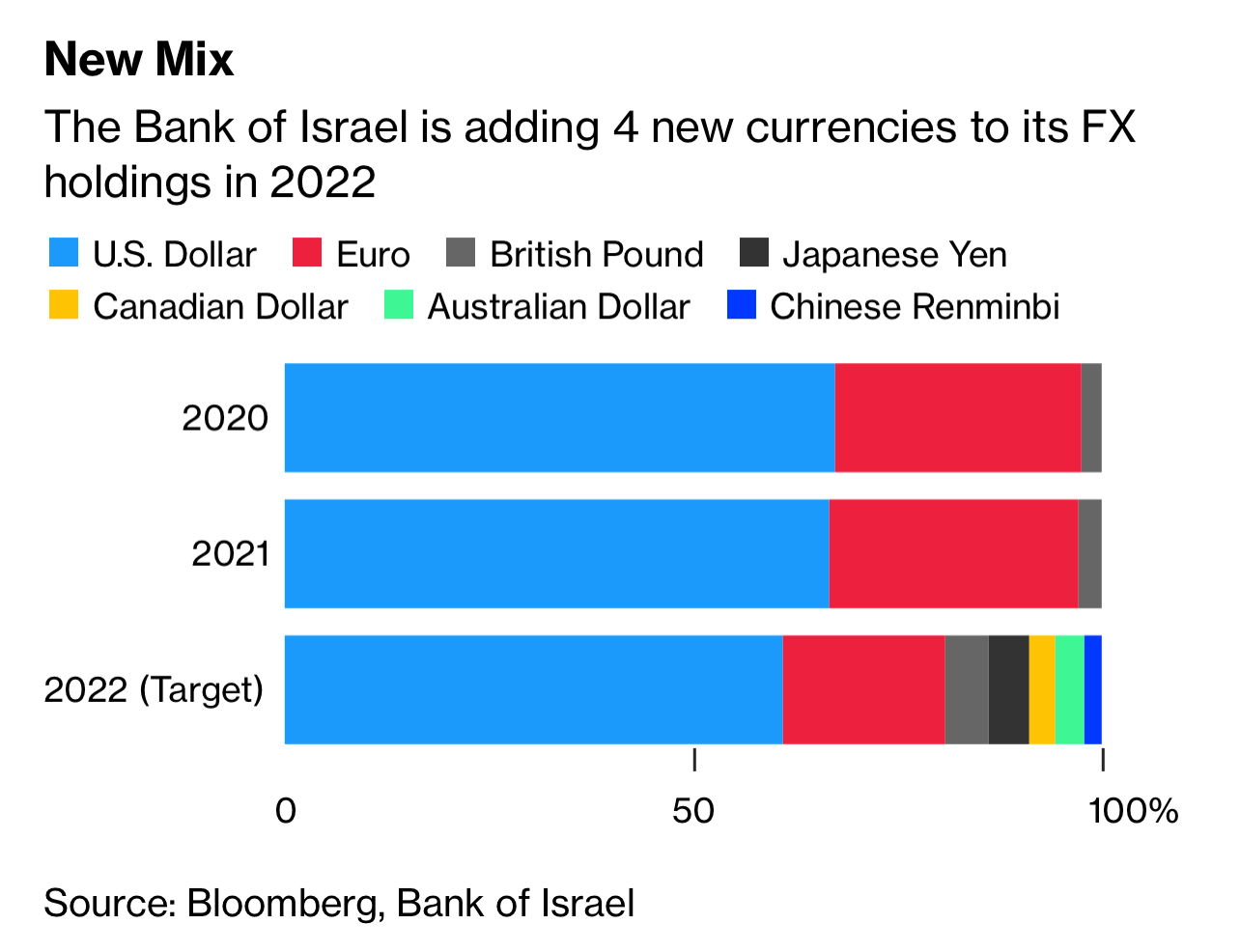

Submitted by QTR's Fringe Finance Over the last 48 hours, China and Russia have taken big steps toward separating themselves from the monetary policy and economies of the west – and nobody has even noticed. Those who have been reading my blog for the last couple of weeks know that I have been predicting that China and Russia would grow far closer economically, creating, in essence, a second global monetary system where the US dollar is no longer the reserve currency. A few weeks ago, I wrote an article proclaiming that Russia would back the ruble with gold as a way to fight back against western economic sanctions. I also made similar predictions about the new digital Chinese currency last summer when I first started Fringe Finance. This shift is happening as a result of the United States and the rest of the western economies foolishly thinking that they’re going to be able to effectively sanction Russia economically, despite the fact that Russia is a massive producer of oil and the country seems prepared to back its currency, the ruble, with this productive capacity. Meanwhile, back at the ranch, we continue to run enormous deficits and have very little productive capacity, and even less to back our currency with. Our destiny seems to be to continue printing money regardless of the negative consequences. We’re nothing more than printing press junkies that won’t cease our inflationary addiction until we inevitably hit rock bottom. If you haven’t read them yet, a couple articles that explain my position on Russia and China creating their own monetary system include: The Dominance Of The U.S. Dollar Is Fading Right Before Our Eyes The Dollar Dethroned: We Have Reached The End Of Monetary Policy As We All Once Knew It The Global Rush To Own Gold Has Only Just Begun Russia Will Backstop The Ruble With Gold There’s been several new developments to this thesis over the last 24 hours. First, it was little noticed yesterday when Bloomberg reported that “Israel’s central bank has made the biggest changes to its allocation of reserves in over a decade, adding the Chinese yuan alongside three other currencies to a stockpile that last year exceeded $200 billion for the first time ever.” The report read: Starting this year, the currency mix will expand from the trio of the U.S. dollar, the euro and the British pound to include the Canadian and Australian dollars as well as the yen and the yuan, which is also known as the renminbi. The additions mark a change in the Bank of Israel’s “whole investment guidelines and philosophy,” Deputy Governor Andrew Abir said in an interview. Following discussions held by the monetary committee last year, the pound and the yen will account for 5% and the currencies of Canada and Australia will have 3.5% each. Under the new approach, the yuan’s proportion is set at 2% for 2022, according to the Israeli central bank’s annual report published at the end of last month. To accommodate the changes, the euro’s share will fall to 20% -- the lowest in at least a decade -- from just over 30%, while the dollar will account for 61%, down from 66.5%. The pound’s weighting, by contrast, will almost double to 5%, returning to a level last seen in 2011. The “dramatic” rise in Israel’s foreign-exchange reserves led the central bank to lengthen its investment horizon, Abir said. “We look at the need to earn a return on the reserves that will cover the costs of liability.” In other words, Israel is reducing its exposure to the dollar and to the Euro to add exposure to the Renminbi. And so perhaps isn’t just little old me here chipping away at my blog daily that has noticed that China and Russia could be on the verge of effecting meaningful change to the global monetary landscape. It sure seems like Israel is catching on. I expect other countries to follow suit. Then, another prediction of mine started to come to fruition this morning when it was announced that China was considering buying some of Shell’s Russian LNG assets. Bloomberg reported: China’s key state-run energy companies are in talks with Shell Plc to buy its stake in a major Russian gas export project, according to people with knowledge of the matter. Cnooc, CNPC and Sinopec Group are in joint discussions with Shell over the company’s 27.5% holding in the Sakhalin-2 liquefied natural gas venture after the European firm said it would exit Russian operations following the Ukraine invasion I had previously argued on my podcast and on my blog that even though the west was going to be ignoring Russian investments, there would definitely be a strategic buyer who would come in and scoop up what can only be described as long-term strategic energy assets from Russia. Many people smarter than I am, including macro analyst Luke Groman, predicted that China would be the strategic buyer for such transactions. I agreed. Now, it looks like that is exactly what’s happening. These purchases will only serve to knit China and Russia’s economies even closer together. Liquefied natural gas (LNG) | Shell Global If the picture hasn’t come into focus, it soon will - even for most people that aren’t paying attention yet. China and Russia continue on a cooperative path together: doing business together, backing their currencies with tangible commodities and, as I wrote just days ago, we’re in the process of watching the dollar become dethroned as the global reserve currency. We just don’t notice it yet. The next prediction I have, that hasn’t yet taken place, is that China will back its digital currency with gold. I’ve predicted this since August of 2021, long before the current macro picture has emerged. Now, my convictions are even stronger. When the rest of the world catches on to what is playing out here, there’s going to be a mad dash for gold, in my opinion. I still prefer gold over any fiat currency and, as I wrote weeks ago, consider miners to be one of the market’s truly undervalued sectors. Thank you for reading QTR’s Fringe Finance . This post is public so feel free to share it: Share

Post Comment Private Reply Ignore Thread