US Macro Surprise data slumped for the 5th straight week, back into negative territory at its weakest weekly close since Nov 2021...

China 'stimulus' (cutting only 5Y prime rates) overnight offered some hope against the relentless tightening of financial conditions by The Fed and that buoyed stocks ahead of the open (and OpEx). But that all ended after the cash open (OpEx) and what had been a relatively calm week of selloffs turned more violent as gamma expired away and stocks puked. Then as the final drips of gamma were wrung out into the close, stocks went literally vertical with The Dow and S&P briefly tagging unchanged...

In the last 8 weeks, following that late-March meltup, The Dow is down 13% and Nasdaq -25%..

But for Monkeypoxx vaccine makers, it has been a big week!!

S&P is down 7 straight weeks, its longest losing-streak since March 2001.

Dow is down 8 straight weeks, its longest losing-streak since May 1923.

The S&P broke below 3855, down 20% from its record highs to its lowest since March 2021, testing below the Fib 38.2% retracement of the post-COVID crash rally level at 3815...

Source: Bloomberg

FANG stocks have fallen for 8 straight weeks, seeing over $ 2 trillion in market cap erased from record highs (over $220 billion this week alone)...

Source: Bloomberg

The last week saw a significant regime shift in the stock-bond relationship...

Source: Bloomberg

VIX rose on the week (most notably after the VIXpiration) but remains decoupled from stocks...

Source: Bloomberg

Still a little more to go before it's "priced in"...

Source: Bloomberg

zerohedge @zerohedge

two hikes in and we are at a bear market, and QT hasn't even started.

"9 or 10 hikes more"

The dollar suffered its first weekly drop in 8 weeks and the biggest weekly drop since the election in Nov 2020...(finding support at the spike lows from FOMC meeting)...

Source: Bloomberg

Meanwhile, the Ruble soared to greater than 4 year highs against the dollar (and 7 year highs against the euro)...

Source: Bloomberg

Bitcoin ended the week lower from last Friday's "close" but has traded in a relatively narrow range since then (albeit trading at the lows of that range now, back below $30k)...

Source: Bloomberg

Gold had a solid week amid the weaker dollar, bouncing off $1800 twice...

Oil prices also rallied once again - as Biden's SPR release actually began - with WTI closing back above $110...

Finally, we wonder which Biden's polls will find more problematic...

Source: Bloomberg

A bear market in stocks...

Source: Bloomberg

Or record high and surging gas prices...

Source: Bloomberg

But, hey, at least we don't get 'mean tweets' anymore, right?

Poster Comment:

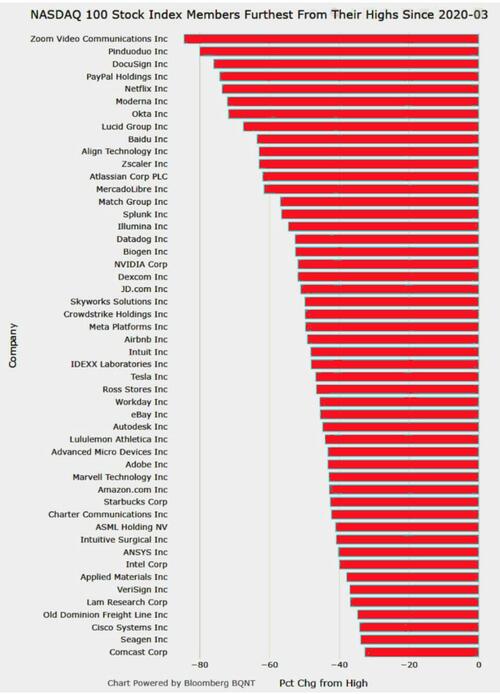

Lots of charts at source. Everything is down. What is OPEX day? OpEx most commonly refers to Options Expiration. For an option contract, expiration is the date on which the contract expires. The option holder must elect to exercise the option or allow it to expire worthless. And here are the biggest loser from their post-COVID highs...