See other National News Articles

Title: Velocity's Back And It's Taking Inflation With It

Source:

[None]

URL Source: https://www.zerohedge.com/markets/v ... ck-and-its-taking-inflation-it

Published: Aug 19, 2022

Author: Tyler Durden

Post Date: 2022-08-19 23:40:30 by Horse

Keywords: None

Views: 34

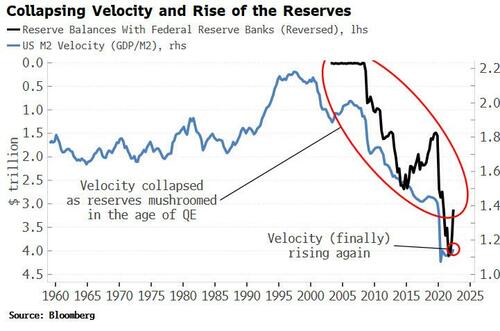

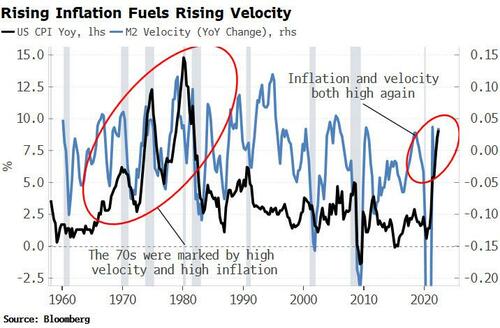

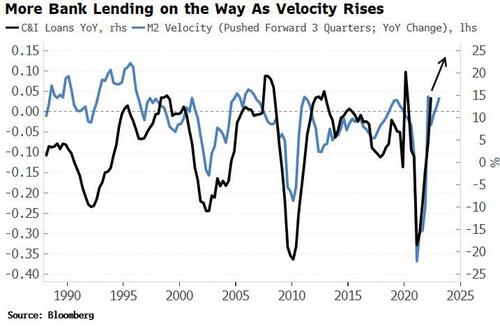

By Simon White, Bloomberg Markets Live analyst and reporter Rising velocity will keep inflation persistently elevated and at risk of becoming unanchored, leaving longer-term yields looking structurally too low. Central bankers should be careful what they wish for. After years of trying to arrest the fall in the velocity of money, it is finally on the rise again. Velocity is little talked about these days, but in the first throes of the financial crisis it was the center of attention. Defined here as the ratio of GDP to M2 money, velocity continued to fall no matter what the Fed threw at it in the fevered months and years after the GFC That’s a major problem when you’re trying to resuscitate demand. Velocity is in essence the average number of times each dollar is spent in the economy, so its inexorable decline meant that, despite the Fed creating trillions of new dollars, total demand was still falling as each dollar was being spent fewer times. The problem was not causal. Demand was collapsing as households and businesses were in the midst of a major retrenchment in the aftermath of the financial crisis. Risk appetite was rock-bottom and the main providers of credit to the economy -- banks -- were pulling back from lending in order to rebuild their balance sheets, or just stay alive. The Fed was running up the down escalator as it created ever more reserves only for them to be hoarded by banks, firms and households. That’s why the Fed was unable to create sustainable inflation despite expanding its balance sheet to unprecedented levels. But the times they are a-changing. Velocity is related to rates, and falling rates through much of the 2010s meant it fell too. But now that rates are rising, there is a greater incentive for savers to decrease money balances and hold higher-yielding assets, which means a higher velocity of money. Velocity today is rising faster than it has done since 2010 and is set to keep advancing. This explains why inflation -- even though it is very likely to fall in the coming months -- will remain persistently elevated above its long-term average and continue to be susceptible to flaring even higher later in the cycle. Elevated inflation is the spark that lights the fire, and velocity is what fuels it. Rising velocity without high inflation is not normally a problem, but when inflation also starts rising it creates more demand for money and thus velocity rises, with a feedback loop developing. We are on the cusp of that today. We can now see how the trillions of dollars of hitherto largely idle reserves at the Fed could rapidly become very inflationary. Prices rise, requiring more money to pay for the rising nominal cost of goods and services. Ultimately this means greater demand for reserves, i.e. the velocity of reserves increases, which soon translates into a rise in the velocity of broader money measures too. More inflation ensues. Wash, rinse, repeat. Even people without much money are experiencing an inflationary-driven increase in demand for it, which is manifesting itself through a rise in bank loans. Rising velocity typically precedes accelerating growth in commercial and industrial loans by about three quarters (C&I loans are a good proxy for loans overall given the stringent lending standards generally attached to them). Demand for C&I loans is also rising, but banks are tightening their standards for such loans. This is unusual as demand for loans normally falls when standards are being tightened, suggesting demand for loans -- to cover inflation-driven rises in costs -- is overwhelming the tighter loan standards. More loans means more money, which banks can conjure out of thin air, meaning yet more inflation potential. QT is an attempt to mitigate the inflationary potential of Fed reserves by curtailing velocity. The reduction in reserves should lead to an even greater fall in demand, meaning velocity should fall. Rate increases, on the other hand, are supposed to work on the demand channel as they can only affect the price of reserves while leaving the volume unchanged. QE was supposed to work in reverse to QT, causing velocity to rise as demand increased more than the increase in money. We know it failed to achieve that aim. If something fails one way, it’s prudent to assume it might not work in the opposite direction either. Rising velocity will keep the inflation embers alive for some time yet. Poster Comment: THIS IS VERY BAD NEWS. The real inflation rate as reported by Shadow Stats is 16.8% not the 8.5% CPI reported by that criminal enterprise masquerading as a government in Washington DC. 1) M x V = P x T. Money x Velocity = Prices x Transactions. Velocity is simply how many times Money changes hands in a year. If Velocity rises, then the overall level of prices and transactions increases. We have printed way too much money in the past. One reason was corruption so Wall Street could steal tens of trillions and not just billions. Another reason was to mask the decline in real wages due to over population caused by massive immigration. A third reason was that in the final stages of a credit based economy with an interest bearing currency that we accumulate mountains of Unpayable Debts.We need massive loans to pay for massive interest rate gouging. So in the final stages before collapse we have to "borrow" $5 trillion into circulation just to get a modest bit of growth. In the chart above we can see that Velocity grew from 1.2 to 1.4. If we substitute 1.4 for 1.2 and insert $21 trillion for M in M X V, then we can see the rate increased by 1/6th or 16.667%. Fortunately, the US M2 Money Supply is declining slightly though Biden did just pass an expensive bill that will force the US Treasury to monetize more debts. The other disturbing fact is that trend line in the growth of velocity. If V were to rise from 1.2 to 1.4 to 1.6, then prices would increase 33%. I once wrote an article in which I explained that America had survived 20% inflation under Paul Volcker. I concluded that we had survived 20% but could not survive 25% annual inflation. I said hyperinflation would begin at 25% and that we would soon thereafter lose our status as an international reserve currency. The late Bob Chapman was asked about my view and he agreed as at 25% the value of a dollar is cut in half every 3 years. So Sergey Gazyev's plan for BRICS and the Global South to combine to end the dollar's reign has now become a certainty to be set in motion. All bank deposits in dollars, pounds, euros and yen will decline to zero value, probably before the November 2024 presidential elections.

Post Comment Private Reply Ignore Thread