See other National News Articles

Title: America's Insolvency Is Mandatory

Source:

[None]

URL Source: https://www.zerohedge.com/economics/americas-insolvency-mandatory

Published: Dec 3, 2022

Author: Tyler Durden

Post Date: 2022-12-03 15:25:19 by Horse

Keywords: None

Views: 22

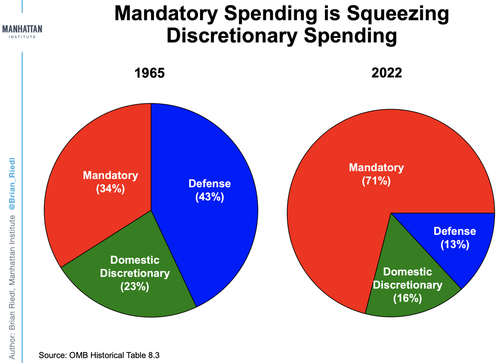

Authored by Brian McGlinchey via Stark Realities In October, the U.S. national debt reached $31 trillion, and the government is projected to wade another trillion dollars into the red in the 2023 fiscal year. The longer-term picture is even gloomier, with the deficit expected to double to $2 trillion by 2030. Indeed, the longer the horizon, the worse things get. At 98% of Gross Domestic Product, the current national debt is the highest it’s been since just after World War II. On its current course, the debt will soar to 185% of the country’s entire economic output by 2052. What’s particularly troubling is that the government’s 2022 $1.3 trillion-dollar deficit came at a time of near-record tax intake. At 19.8% of GDP, Uncle Sam’s 2022 tax haul was close to the all-time high of 20.5% set in 1944. Washington doesn’t have a revenue problem — it has a spending problem. What few people realize, however, is the extent to which the U.S. government’s disastrous trajectory is on autopilot, thanks to the fact that an ever-larger proportion of federal spending happens without Congressional action. To understand why, it’s important to first understand that there are two main categories of government spending: Discretionary spending, which requires a vote by Congress as part of the annual appropriations process. Mandatory spending, which is dictated by previously-enacted laws and thus happens without an annual vote in Congress. Social Security, Medicare and Medicaid comprise a big majority of mandatory spending. Here’s where things have taken an ominous turn. In 1965, mandatory spending accounted for 34% of all federal spending. Today, that share has more than doubled, with mandatory spending representing 71% of federal outlays. With overall spending higher too, mandatory spending is much larger slice of a larger pie. As much as it’s right to spotlight wasteful discretionary spending — like a $2.4 million National Science Foundation grant to promote dinosaur enthusiasm or $11.3 million to tell Vietnamese people to stop burning trash — the truth is that the annual budgeting process offers federal legislators a shrinking opportunity to make meaningful fiscal course corrections. While mandatory spending can be adjusted by passing new laws, there’s a big problem with that: Meaningfully changing the trajectory of mandatory spending requires meaningful adjustments to Social Security and Medicare. The mere idea arouses indignation among those who’ve been paying taxes into those programs for all their working lives. That’s understandable, since the government fosters the myth that Americans have Social Security and Medicare “accounts.” However, the truth is that these programs increasingly operate not as savings accounts or insurance plans, but rather as schemes that redistribute money from current workers to retirees. Social Security already dishes out far more in benefits than it takes in via payroll taxes, and Medicare crosses into an annual deficit this fiscal year. While former Democratic Speaker Tip O’Neill rightly called Social Security the “third rail” of American politics, some Republicans have recently dared to propose touching both it and Medicare. The Republican Study Committee — a group of House reps — in June of this year floated a budget that suggested: Gradually raising Medicare’s eligibility age to 67 and Social Security’s to 70, and then indexing both to life expectancy Withholding payments from those who retire early and earn more than a certain amount Reducing Social Security payroll taxes and redirecting them to private alternatives Phasing in means-testing for Medicare Sen. Ron Johnson (R-WI) has proposed moving Social Security and Medicare from the mandatory spending category to the discretionary one, so that Congress is compelled to actively monitor and manage the programs — rather than contentedly looking the other way as their mandatory nature digs them deeper into a hole. As the GOP went out on a political limb, Democrats naturally grabbed their saws. Henry Connelly, a spokesman for Speaker Nancy Pelosi, said “House Republicans are openly threatening to cause an economic catastrophe in order to realize their obsession with slashing Medicare and Social Security.” The “catastrophe” comment refers to the notion that Republicans may make reform of the programs a condition for raising the federal debt ceiling yet again. Republicans’ aspirations to reform Social Security and Medicare gave Democrats powerful midterm-election ammunition — with Democrats and allies pushing attack ads portraying the GOP as ruthlessly bent on shrinking the programs, apparently just for the sake of doing so. President Biden pushed the theme hard down the campaign stretch: “They’re coming after your Social Security and Medicare in a big way,” he warned in stump speeches with congressional candidates. Without action, however, time is coming for Social Security and Medicare in a big way. Social Security’s trust fund is projected to run out around around 2035. Absent congressional intervention, that will trigger a 20% cut for everyone receiving benefits when the well runs dry. Medicare’s trust fund is projected to vanish in just six years, with less clarity on how shrinking resources will be apportioned. As close as those two grim milestones are, to politicians of both parties whose principal aim is re-election, they’re critically still more than one election cycle away. Given that, don’t expect any fruitful action on Social Security or Medicare anytime soon. You can, however, expect that anyone who attempts to tailor the programs to economic reality will be accused of cruel intentions— by disingenuous politicians who portray their own irresponsible inaction as the height of benevolence. Stark Realities undermines official narratives, demolishes conventional wisdom and exposes fundamental myths across the political spectrum. Read more and subscribe at starkrealities.substack.com Stark Realities with Brian McGlinchey: Invigoratingly unorthodox perspectives for intellectually honest readers

Post Comment Private Reply Ignore Thread