See other ObamaNation Articles

Title: Tesla's Market Cap Drop Is Bigger Than The Legacy Car Industry

Source:

zerohedge

URL Source: https://www.zerohedge.com/markets/t ... rop-bigger-legacy-car-industry

Published: Dec 22, 2022

Author: Tyler Durden

Post Date: 2022-12-22 07:34:10 by Esso

Keywords: None

Views: 33

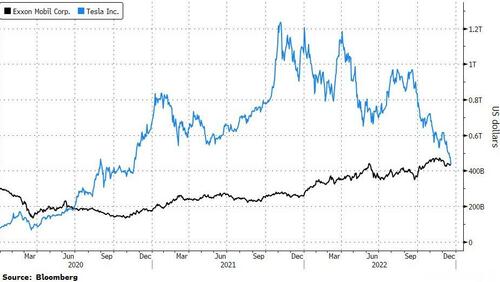

Tesla’s year went from bad to worse on Tuesday, when the company’s battered share price dropped another 8 percent, bringing it down to a new 52-week low. Still the world’s most valuable car maker, Tesla’s market cap now amounts to $435 billion, down 65 percent from its peak on January 3, 2022, when the electric car maker was valued at more than $1.2 trillion. Shockingly, Tesla’s drop in market capitalization, roughly $800 billion from its peak, is bigger than the combined valuation of pretty much any legacy car manufacturer you could think of. As Statista's Felix Richter shows in the following chart, the combined market capitalization of Toyota, Volkswagen, Mercedes-Benz, BMW, GM, Ford, Stellantis (Fiat Chrysler and PSA), Honda, Hyundai, Kia, Nissan and Renault is still more than $100 billion shy of Tesla’s market cap decline. So what caused that extraordinary fall of one of the best-performing stocks of 2020 and 2021? Firstly, Tesla was always valued as a high-growth stock, meaning much of its valuation was based on its future potential. As the economic outlook darkened throughout 2022, so did Tesla’s potential for future growth, especially considering that inflation and high interest rates will eventually affect consumer spending on big- ticket items such as cars. Secondly, Elon Musk’s acquisition of Twitter is clearly playing a role in Tesla’s recent decline. Not only did Musk sell billions worth of Tesla shares this year to finance the deal, but he’s also been tied up in leading the social media platform since the deal was completed at the end of October. His very public approach to overhauling Twitter has left many Tesla shareholders wondering whether he’s still fully focused on his role as Tesla CEO. Musk himself offered a different explanation for Tesla’s decline on Tuesday: “In simple terms: As bank savings account interest rates, which are guaranteed, start to approach stock market returns, which are *not* guaranteed, people will increasingly move their money out of stocks into cash, thus causing stocks to drop,” he tweeted, not explaining why Tesla has underperformed the overall market significantly this year. Finally, we note that for the first time since 2020, Tesla's market cap is below that of Exxon Mobil... “In the first part of the year the divergence was caused by a shift away from growth into value,” said Ivana Delevska, chief investment officer at SPEAR Invest. “Now we have a fundamental problem where consumer preference is not shifting to EVs at the rate that was previously expected.” Poster Comment: EVs are a dead end. Elon needs to sound collision and abandon ship. Let GM and Ford go broke. I'll take XOM any day of the week.

Post Comment Private Reply Ignore Thread