See other National News Articles

Title: Money-Supply Growth Turns Negative For First Time In 33 Years

Source:

[None]

URL Source: https://www.zerohedge.com/markets/m ... s-negative-first-time-33-years

Published: Jan 3, 2023

Author: Tyler Durden

Post Date: 2023-01-03 19:44:15 by Horse

Keywords: None

Views: 36

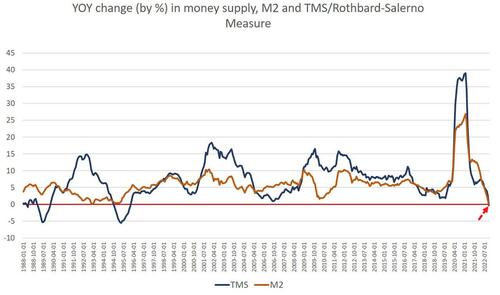

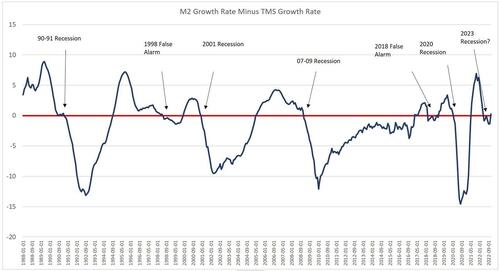

Authored by Ryan McMaken via The Mises Institute, Money supply growth fell again in November, and this time it turned negative for the first time in 33 years. November's drop continues a steep downward trend from the unprecedented highs experienced during much of the past two years. During the thirteen months between April 2020 and April 2021, money supply growth in the United States often climbed above 35 percent year over year, well above even the "high" levels experienced from 2009 to 2013. Since then, the money supply growth has slowed quickly, and we're now seeing the first time the money supply has actually contracted since the 1980s. The last time the year-over-year change in the money supply slipped into negative territory was in February of 1989. At that time, negative growth continued for 12 months, finally turning positive again in February of 1990. During November 2022, year-over-year (YOY) growth in the money supply was at -0.28 percent. That's down from October's rate of 2.59 percent, and down from November 2021's rate of 6.66 percent. The money supply metric used here—the "true" or Rothbard-Salerno money supply measure (TMS)—is the metric developed by Murray Rothbard and Joseph Salerno, and is designed to provide a better measure of money supply fluctuations than M2. The Mises Institute now offers regular updates on this metric and its growth. This measure of the money supply differs from M2 in that it includes Treasury deposits at the Fed (and excludes short-time deposits and retail money funds). In recent months, M2 growth rates have followed a similar course to TMS growth rates. In November 2022, the M2 growth rate was -0.03 percent. That's down from October's growth rate of 1.25 percent. November's rate was also well down from November 2021's rate of 12.40 percent. Money supply growth can often be a helpful measure of economic activity, and an indicator of coming recessions. During periods of economic boom, money supply tends to grow quickly as commercial banks make more loans. Recessions, on the other hand, tend to be preceded by slowing rates of money supply growth. However, money supply growth tends to begin growing again before the onset of recession. Another indicator of recession appears in the form of the gap between M2 and TMS. The TMS growth rate typically climbs and becomes larger than the M2 growth rate in the early months of a recession. This occurred in the early months of the 2001 and the 2007–09 recession. A similar pattern appeared before the 2020 recession. Notably, this has happened again beginning in May this year as the M2 growth rate fell below the TMS growth rate for the first time since 2020. Put another way, when the difference between M2 and TMS moves from a positive number to a negative number, that's a fairly reliable indicator the economy has entered into recession. We can see this in this graph: In the two "false alarms" over the past 30 years, the M2-TMS gap reverted to positive territory fairly quickly. However, when this gap firmly enters negative territory, that is an indicator that the economy is already in recession. The gap has now been negative for 6 of the past 7 months. Moreover, in both September and October, the gap was greater than -1. There is only one case—1998—in more than 30 years during which the gap was greater than -1 and the US not in recession. Interestingly, this indicator also appears to follow the pattern of yield curve inversion. For example, the 2s/10s yield inversion went negative in all the same periods where the M2-TMS gap pointed to a recession. Moreover, the 2s/10s inversion also fell into negative territory in 1998. This is not surprising because trends in money supply growth have long appeared to be connected to the shape of the yield curve. As Bob Murphy notes in his book Understanding Money Mechanics, a sustained decline in TMS growth often reflects spikes in short-term yields, which can fuel a flattening or inverting yield curve. It's not especially a mystery as to why short-term interest rates are headed up fast, and why the money supply is decelerating. Since January of 2022, the Fed has raised the target federal funds rate from .25 percent up to 4.0 percent. This means fewer injections of Fed money into the market through open market operations. Moreover, although it has done very little to sizably reduce the size of its portfolio, the Fed has nonetheless stopped adding to its portfolio through Quantitative Easing, and allowed a small amount (about $358 billion out of $8.9 trillion) to roll off. It should be emphasized that it is not necessary for money-supply growth to turn negative in order to trigger recession, defaults, and other economic disruptions. With decades marked by the Greenspan put, financial represssion, and other forms of easy money, the Federal Reserve has inflated a number of bubbles and zombie enterprises that now rely on nearly constant infusions of new money to stay afloat. For many of these bubble industries, all that is necessary is a slowing in money-supply growth, brought on by rising interest rates or a confidence crisis. Thus, a growth rate in money supply turning negative is not in itself an especially meaningful metric. But the drop into negative territory does help illustrate just how far and how rapidly money-supply growth has fallen in recent months. That is generally a red flag for economic growth and employment. It also serves as just one more indicator that the so-called "soft landing" promised by the Federal Reserve is unlikely to ever be a reality. Poster Comment: Not a good sign. But the worst sign is Saudi Arabia selling oil for yuan.

Post Comment Private Reply Ignore Thread