See other World News Articles

Title: China's $7 Trillion "Hidden Debt" Is Back In Focus

Source:

[None]

URL Source: https://www.zerohedge.com/economics ... rillion-hidden-debt-back-focus

Published: Jan 12, 2023

Author: Tyler Durden

Post Date: 2023-01-12 19:31:44 by Horse

Keywords: None

Views: 40

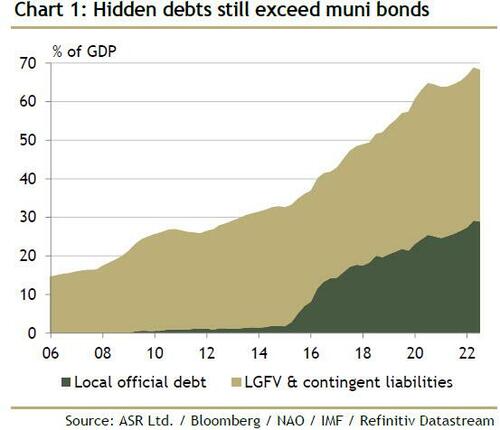

By Ye Xie, Bloomberg Markets Live reporter and analyst While optimism toward China has been growing amid the economic reopening, the recent loan restructuring of a local government financing vehicle shined a light on this $7 trillion in “hidden” debt. While this group of borrowers has never defaulted, markets are starting to get worried, shunning some weaker borrowers. With Beijing pivoting on key policies, a cyclical recovery appears to be underway. But structural issues – such as the heavy debt load of local governments — haven’t gone away. On Dec. 30, Zunyi Road & Bridge Construction Group from Guizhou province, one of the poorest regions, extended its bank loans for two decades. It pledged to honor payments on its bonds.The restructuring caused a splash among market participants. Local government financing vehicles, or LGFVs, are mostly tasked with building infrastructure projects. They allow local authorities to raise money without having the debt appear on the government’s balance sheet. This “hidden” debts and contingent liabilities have risen to 47 trillion yuan ($7 trillion and 39% of GDP) in September, up from 20 trillion yuan at the end of 2016, according to Adam Wolfe, an economist at Absolute Strategy Research. So far, these risky state borrowers – with the perception of an implicit guarantee from local governments — have avoided default in public bond markets. But slumping land sales and massive Covid-induced expenditures weaken local governments’ finances and raise questions about their ability to pay, as shown by Zhunyi’s restructuring. Investors have already showed some concerns about the sector, shunning weaker LGFV and muni bonds. Exhibit 2: Guizhou has been squeezed out of muni market, with its share of issuances falling. Exhibit 3: The spread differential between AA-rated and AAA-rated five-year LGFV bonds has widened to the highest since 2018. The spread widening, in part, reflects offloading by wealth-management products to meet redemptions,but also signals “the tail risk concerns on weaker LGFVs,” according to Goldman Sachs analysts Kenneth Ho and Chakki Ting. The Zunyi restructuring “reinforces our view that an element of caution is warranted for China LGFVs, as we believe further credit differentiation is likely amongst LGFVs, exacerbated by uneven fiscal stress in local governments,” they wrote. LGFV bonds — known as “chengtou zhai” or “city investment debt” – are enormous, accounting for about a third of total issuance. The stress there could easily spread to the rest of the credit market. Moreover, their inability to borrow may reduce local governments’ spending. Losses at LGFVs could also increase non-performing loans at banks that lend to them. Few expect a full-blown crisis. As Bloomberg economist David Qu noted, many LGFVs have diversified away from real estate and government-related businesses, and the ones that still rely on local governments financially would probably get official aid in some form in a crunch. Still, this hidden debt remains what’s known as a “grey rhino” — a high-risk threat that is often ignored until it’s too late. In the words of Wolfe, Guizhou’s debt restructuring is just “a tip of the iceberg.” Poster Comment: China's financial system is piss poor at best. And they never in 2,000 years survived a Grand Solar Minimum.

Post Comment Private Reply Ignore Thread