See other National News Articles

Title: Luongo: Tucker, BlackRock, & The SIFI Two-Step

Source:

[None]

URL Source: https://www.zerohedge.com/political ... tucker-blackrock-sifi-two-step

Published: May 1, 2023

Author: Tyler Durden

Post Date: 2023-05-01 20:19:19 by Horse

Keywords: None

Views: 56

Comments: 1

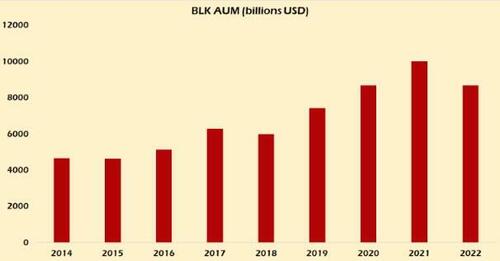

Authored by Tom Luongo via Gold, Goats, 'n Guns blog, The big news last week was Tucker Carlson’s unceremonious firing by Fox News. The reasons for Tucker’s firing are still unclear. And even Tucker’s emergence from his man cave on Tuesday for two minutes did nothing to quell the speculation. What it did do was underscore just how much real power he amassed during his time in the prime time slot anchoring Fox’s entire evening. Tucker Carlson @TuckerCarlson Good evening https://twitter.com/i/status/1651376097349578753 I’m not the first to point out to you just how many views this thing has gotten, dwarfing his Nielsen Ratings. This was a serious needle scratch. Something changed behind the scenes. Within an hour Don Lemon was dumped by CNN. Susan Rice left the Biden Administration that morning. Nate Silver was let go from ABC News. Both Carlson and Lemon had stories planted about them harboring ‘toxic workplace environments’ to set the scene. Nuts and Sluts is a time-tested method of invalidating a public figure. It doesn’t have to be true, it just has to play. Even if only for a day or two *cough* Abby Grossman *cough* There is every theory imaginable about what happened here and all of them have a nugget of truth to them. Dexter White and I recorded a podcast covering what we think is the beginning of the Death of the Time Slot. And while the court politics of this are interesting, they almost feel like discussing 9/11 or the Kennedy assassination at this point. Does it matter who was behind or why Carlson was ousted from Fox? Could we not see this coming the further he went off the reservation? In fact, I was amazed he was still on the air after all this time. I don’t think this is a Tucker-as-Icarus proxy story no matter which way you cut it. It was always about something far bigger than Tucker Carlson. The confluence of major media and political figures leaving their posts, including now the head of the BBC Richard Sharp, over literal ancient conflict of interest issues that looks more like something taken off the shelf for the proverbial rainy day rather than some new, disturbing thing. It never just rains when its time to change the board state. And that’s exactly what this feels like, an attempt to completely change the direction of information flow as we get ready for the next big psy-op… … The remaking of the First Fungal President into the Next Garden Variety Wartime President. Because this is the best chance the DNC has at this point of retaking the presidency with any degree of credibility given their approval ratings. Even if you believe our elections aren’t corrupt (sic) you at least have to admit to yourself that this is a plausibly deniable way to convince yourself of that ‘fact.’ Of course, as I said above, do any of the other whys about these events even matter? Of course not, they are, like Wartime presidents don’t lose, statistics which are simply chum for people to feed their confirmation biases and prevent any coming together of the center of the electorate to say no more. This was Tucker’s real crime if any of us are being honest with ourselves. And, in fact, it is the least interesting part of the whole story. Because the given proximate cause spoon fed to the ‘smart people’ in alternative media is the entire Blackrock angle. Of course, this isn’t true but, again, it doesn’t matter. That said, there is a Blackrock angle to this story but it isn’t what people were led to believe for a couple of days. Blackrock increased their ownership in FOX just before these events. This is symptomatic of Blackrock’s use of proxy to get what they want. Larry Fink, BLK CEO, is notorious for his antics in forcing heads of state and CEO’s to do his bidding while hiding behind the smokescreen of ‘I’m just a guy investing your hard-earned capital on your behalf for the good of humanity.’ Now, this is some prime Grade AA Bullshit. Blackrock is Davos’ main arm-twisting subsidiary in the C-Suites of the S&P 500 as well as the Euro STOXXX 50 (link will need translation from German). He may as well change his first name to Don but there are some ethnic issues with this outside of Queens. As I’ve discussed in previous Private Blog posts for my patrons and interviews Blackrock bet the farm on Obama/Biden getting rid of Jerome Powell. They went all in on their CARES Act power to access the Fed’s Discount window to procure zero-cost seed capital to buy US stocks and, by extension, real estate and everything else. The company’s growth was turbocharged during COVID by this but it was already growing by more than $1 trillion annually before that. Its AUM — Assets Under Management — fell in 2022 because the value of the underlying assets fell as Powell put the interest rate screws to a lot of Blackrock’s ‘investments.’ The headlines have been full of governors like Florida’s Ron DeSantis going on an anti-Blackrock/anti-ESG/anti-Woke tirade which has helped see some outflow from Blackrock’s funds. But that doesn’t do a whole lot in the face of $10 trillion in AUM. A few billion is literally a rounding error. No, the bigger effect came from taking the Fed Funds Rate from 0% to 5% in a year. In the late stages of the ZIRP years we saw really strong moves in the equity markets, especially coming out of COVID as the CARES Act money made its way into the economy. Normie FinTwit is always going on about the Fed subsidizing the ‘wealth effect’ as their main argument for why Powell is just ‘one more meeting away from pivoting’ off his ‘higher rates for longer’ schtick. The ‘wealth effect’ expands not only Blackrock’s AUM but also it’s political pull in the board room. There is both coincidence and causality in my opinion, between things like Woke-a-Cola and genuflecting to every sicko with a gender fetish and the rise in Blackrock’s AUM. So it’s no wonder that the standard FinTwit commentary on the Fed is that QE and ZIRP goose equity prices (which it does) but also that that is what the Fed wants to do all the time! This is the part I disagree with and have been steadfast in my assessment as to why for nearly two years. Powell was trapped by both COVID and the CARES Act to go along with extending this madness for another two years. And in the process handed Don Fink-liosi the keys to the whole rotten candy store to ensure what we’re seeing today — maximal brand destruction that defies market logic — gets ramped up to 11. Buying a huge stake in Fox is just one more brick in the New Media Stonewall for the upcoming war. All they had to do to seal the deal was convince everyone the global economy was still suffering because of COVID and we needed even MOAR SPENDING!! at the zero bound to reflate the economy. Powell was supposed to be deposed and Lael Brainard installed to ensure continuity of policy with them having moved Janet Yellen back into a position of power as Treasury Secretary under “Biden.” That has failed. Brainard is out at the Fed. She’s prepping to replace Yellen in Biden’s 2nd term. Biden/Harris’s soft launch of their re-election campaign, was timed with Carlson’s ouster from Fox and warning shots fired at every major media outlet to toe the line like never before. I note on the chart the 2022 bottom in October. What else bottomed in October 2022? The Euro at $0.956 while the USDX made an important high. But look at that chart. A two-bar reversal in Oct/Nov, followed by a triple-top around $775 which turns into a one-bar reversal in February, when Powell finally turned the corner on convincing the market the Fed Put is dead. Now we’re looking at this as a possible ‘dead cat bounce’ which needs a lot of help here to create a rally. So, if Blackrock is in real trouble here because of falling asset prices, ESG backlash, rising rates, and falling cash flow then that would necessitate a change in the rules to allow it to be bailed out. Remember, last year when the UK pension crisis developed which took out Prime Minister Liz Truss and forced the Bank of England to intervene, the one holding the bag on the failing assets there was none other than Blackrock. They were the ones in trouble who sold these leveraged CLOs — Collateralized Loan Obligations — to the UK state pensions which ran out of money to pay pensioners. Now, is Blackrock, which was built on the same premise as Silicon Valley Bank, using non-balance sheet activity to resist being regulated as a SIFI, is staring at a crisis if yields keep rising? Who is protected by the big inversion of the US yield curve we keep staring at? Who is So, in swoops Yellen to demand Blackrock should be a SIFI once the FUD surrounding it reaches a fever pitch. Who is everyone afraid of now? Blackrock. Why? Because they “own the world.” Why aren’t they regulated like the big banks? Because they sit at the High Table. Who gets screwed if they go tits up? The little guy. Who’s fault will it be if Blackrock went tits up? The Fed. You can hear Elizabeth Warren setting the political stage for this now. We have to protect US workers from the evil Wall St. fat cats. So, we’ll bring them under the auspice of increased government regulation by labeling them as a SIFI. Who sits on the Financial Services Oversight Council who will make this decision? And then we have Jim Rickards’ Ice-9 scenario. (Link to tweet with video). In short, Blackrock as a SIFI becomes a protectorate of the Treasury department and it circumvents a bankruptcy. Since Blackrock is just a pile of AUM on top of a relatively small balance sheet it can be carved up pretty easily. Its book of business can be bought by the rest of Wall St. licking their lips at the thought of all those asset management and consulting fees that generate the lion’s share of the company’s cash flow. So now, does Blackrock want to be regulated as a SIFI after having built itself into the monster it is by evading that designation? You can see the game here, Janet Yellen can force Jerome Powell to bail them out when their balance sheet implodes for real, holding the holes in the pension funds hostage as blackmail. Why would they do that? Why would Fink do this? Well, if you want to nationalize the US pension system and end the old US dollar system then you do that during a major crisis. How did they tie Powell’s hands during COVID? The CARES Act. How will they tie Powell’s hands during the European Sovereign Debt Crisis? Making Blackrock a SIFI before it happens. What would you expect to happen between now and then? Snuffing out any major selloff in US Treasuries by managing credit spreads between US and European debt. This relieves the pressure on Blackrock’s balance sheet and that of others. Now let’s talk about the blowout in US Credit Default Swap Rates as well as the massive plunge in the 1-month T-Bill rate last week creating an historic 1 month/2 month spread of over 160 basis points. Yellen has been ramping up the rhetoric about the US defaulting once the Treasury General Account is empty. “Biden” and Davos are serious about trying to stop any kind of spending cuts, because they want to balloon the US deficit to the moon to save the EU. Blackrock is more heavily exposed to Europe than the US pension systems, but still heavily exposed to both. What did Lagarde at the ECB put in place last July? The TPI – Transmission Protection Instrument — designed to protect credit spreads within the EU, nominally, but also internationally. What’s been happening during this major rally in the euro to $1.10 and Powell convinced the markets he’s serious about not pivoting? A collapse of US/European credit spreads indicating preferential capital movement into the US and out of Europe. In short, I think Blackrock’s deteriorating balance sheet as well as Yellen’s intention to stiff US bondholders to save pensioners is setting us up for the biggest Lucy with the Football moment in history. It is the biggest threat to Powell’s “higher for longer” rate policy and the future of the US. And it comes down to playing hard ball over the debt ceiling without significant spending cuts. If that happens then Yellen is winning and Powell is checkmated. If McCarthy and the GOP hold the line then the US banking interests will tear Blackrock apart and take their business in bankruptcy. Making Blackrock a SIFI short-circuits this completely and puts the onus directly on the taxpayer, per Rickards’ analysis. I can easily see Blackrock sacrificed on the alter of the Great Reset once it’s control over corporate interests has been turned over to the Treasury and the ECB. In fact, it is the best play for them to nationalize all the assets they have. $9 trillion in AUM is a lot of win for the commies. And Fink, as I said, already has his seat at The High Table. Which is why Tucker Carlson’s firing is important but really the side show in all of this. * * * Poster Comment: That explains a lot.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

Begin Trace Mode for Comment # 1.

#1. To: Horse (#0)

The original link has been disappeared but it is Continued At This Link: http://rense.com/general27/gad.htm The Rotchilds imploded the economy to create the "Great Depression" (Milton Friedman) and buy American Industries for pennies on the dollar and they are creating this one to conquer the rest. Read Congressman Louis T. McFadden's commentary from the 1930's - before they whacked him. www.sweetliber http://ty.org/issues/hoax/mcfadden.htm

There are no replies to Comment # 1. End Trace Mode for Comment # 1.

Top • Page Up • Full Thread • Page Down • Bottom/Latest Rep McFadden's Speech On the Federal Reserve Corporation http://home.hiwaay.net/~becraft/mcfadden.html 7-20-2 Quotations from several speeches made on the Floor of the House of Representatives by the Honorable Louis T. McFadden of Pennsylvania. Mr. McFadden, due to his having served as Chairman of the Banking and Currency Committee for more than 10 years, was the best posted man on these matters in America and was in a position to speak with authority of the vast ramifications of this gigantic private credit monopoly. ..."

Replies to Comment # 1.