See other World News Articles

Title: A "Global Inflationary Depression" Is Very Possible

Source:

[None]

URL Source: https://www.zerohedge.com/economics ... onary-depression-very-possible

Published: Aug 12, 2023

Author: Tyler Durden

Post Date: 2023-08-12 21:34:47 by Horse

Keywords: None

Views: 32

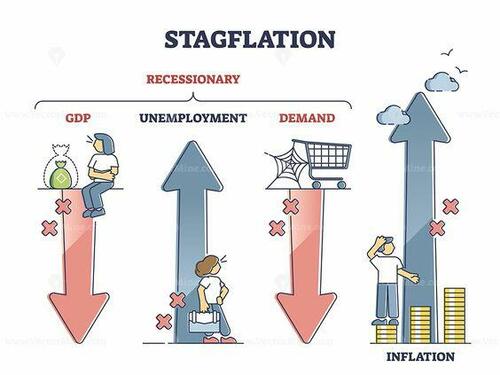

Authored by Bruce Wilds via the Advancing Time blog, Roughly two and a half years ago it was predicted here on AdvancingTime that we might soon be witness to the first global inflationary depression. Many of us predicted inflation rolling in but underestimated the size of stimulus that would be put in the pipeline. This has only postponed the collapse of the financial system and economy. Still, many investors are basing their investments on more intervention from central banks and governments to pull another rabbit out of their hats. Global inflationary depression is not a mix of words we normally see placed together. To those finding this notion unacceptable, we could reframe this as a stagflation era of reversion. Moving us towards the depression part of this scenario is the fact many economic watchers are predicting outright deflation pointing to a huge slowing of the economy. Currently, the biggest source of demand comes from governments. Demand from working people and private sector growth is on the wane. If you remove all the money being spent on Covid-19 vaccinations, tests, and a slew of inefficient spending that has created little long-term benefits to the economy the GDP would fall like a stone. We seldom have depressions but instead tend to roll through mild recessions, however, what we face today may be far more severe. In the past, times of falling economic activity have generally been deflationary as defaults rise but this time if inflation does not abate the result may be very different. Part of this is rooted in the fact that in the past many events tended to be regional rather than global. Today, economies have become more interconnected the resulting codependency presents an increased possibility of problems spreading across the world. The money flowing from the central banks and governments has created the so-called "pent-up demand" we have been hearing about and the constant predictions of solid GDP growth. In truth, capacity utilization and productivity are down even while trillions of new dollars pour into the system. This is the logic behind saying a depression may be in the wings. The methods governments use to use to determine GDP have also become so skewed that they lack real value. Paying someone to dig a hole and then fill it back in adds to the GDP but does nothing to increase productivity. Government spending can increase the GDP while at the same time reducing productivity. Recently several articles have appeared indicating the big boost China experienced post-Covid-19 has come to an end. China's economy was the first to recover from the Covid-19 collapse due to trillions of credit pumped into the economy at home as well as Americans rushing out to buy imported goods using stimulus money. With China again showing signs of economic weakness, the story that it takes more and more stimulus to create the same kick each time we play this game is playing out. Growing concern over the debasement of the fiat currencies issued by nations and central banks is adding to expectations inflation is waiting in the wings. Policies such as we see today would have been impossible when money was tied to gold. As investors shift into assets that do well during times of inflation, it is possible they will set in motion a self-feeding loop or cycle. When fiat money that has quietly sat in paper promises begins to be exchanged for tangible assets and inflation hedges it has the potential to reverse the long-falling velocity of money. Money sitting in the hands of wealthy people that sat in one place for years may start to move. This dovetails with the fact that inflation brings with it higher interest rates that impact most sectors of the economy. This tends to put a spotlight on the difference between liquidity and solvency. As interest rates rise construction tends to grind to a halt. Higher interest rates also result in people having a difficult time paying for or financing big-ticket items such as automobiles. In short, it puts a great deal of stress on most parts of the economy including government deficits which have exploded since the 2008 financial crisis. Two often-overlooked factors support the idea we are headed down a path of inflation even if the economy drastically slows. The first is many laws have been set in place to raise the minimum wage. The recent agreement workers made with UPS screams wage inflation. The second is the fact that so many Americans work for the government. These are mostly full time and workers seldom get laid off without pay. Figures from the National Debt Clock show just under 150 million workers are in the workforce and nearly 24 million of them are employed by the government. That is almost one in six. The government's oversized role in today's economy which is much larger than it was during the Great Depression has put a net under the ability of prices to fall. Across the world, sophisticated lenders, but not the general public, understand the history of how governments’ monetary policies destroy the purchasing power of currencies. To avoid the issue of currency debasement risk, regardless of the yield we have seen the power of being the world's reserve currency on display in loan documents. The BIS reports this is up from 40% a decade ago. One reason the dollar will most likely fare better than the euro or yen when fiat currencies come under assault is the huge percentage of the world’s $30 trillion-plus in cross-border loans are priced in US dollars. Inflation is a form of thief that moves wealth from the people and into governments' coffers. While many investors are focused on yield curves, bitcoin, and surging market valuations, the foundation of central bankers' argument that QE is possible without inflation may be crumbling. We are now seeing that large sectors of the economy are broken. Inflation expectations are continuing to grow and the law of diminishing returns is raging havoc with the efforts of central banks to control the economy. Expect more investors to move into assets that do well in an inflationary environment while the masses wither in pain. This all folds into the story of how for decades the monetary illusion created by central banks collaborating with governments has delayed an inevitable crisis by not dealing with reality. This means when the forces pent-up over the years finally break free events will most likely occur faster with far deeper ramifications than many people expect. When imbalances are ignored, bad things occur. When things finally blow up in the faces of those creating and promoting MMT we can expect to hear them claim it was not their fault and it was because of a general misunderstanding of the role of money and credit in the economy. Such a shift will have profound consequences for inflation-sensitive assets around the world. The one thing we can count on is that when things crumble, we will hear the old, "we should have done more" or the "it would have been far worse" lines flow forth. Those in charge often find great comfort in spouting such nonsense. We have been lulled into complacency and have given central banks too much credit for being able to control the economy and stop financial crises. The first global inflationary depression may not start today or tomorrow but it is coming and when it arrives most people will have never seen it coming. Poster Comment: Ed Dowd explained that we do not have a lot of unemployed. We have a lot of people sick and injured from the Covid shots. This has caused supply chain problems.

Post Comment Private Reply Ignore Thread