See other National News Articles

Title: Janet Yellen Suggests Much Lower For Much Longer

Source:

[None]

URL Source: https://www.zerohedge.com/economics ... uggests-much-lower-much-longer

Published: Oct 11, 2023

Author: Tyler Durden

Post Date: 2023-10-11 13:12:44 by Horse

Keywords: None

Views: 43

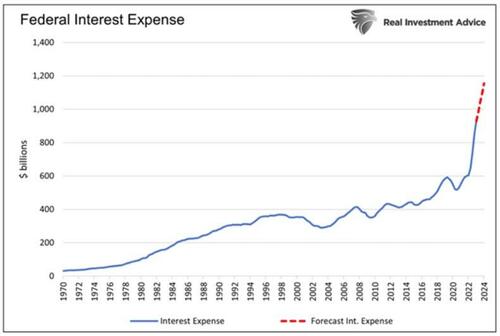

On October 5, 2023, Treasury Secretary Janet Yellen made a very telling statement about the future course of interest rates. YELLEN SAYS DEBT SERVICE COSTS WILL BE 1% OF GDP FOR THE NEXT DECADE. – Reuters Her statement implies that the economy will be strong and the government will run budget surpluses, or interest rates will be near zero for the next ten years. Instead of guessing what she is pondering, we do some math and arrive at the only possible answer. The Government Can’t Afford Today’s Interest Rates Before walking through various scenarios to figure out what Yellen may be implying, it’s helpful to provide background on what drives her mindset. In our article The Government Can’t Afford Higher For Longer, Much Longer, we shared the following graph and commentary: Total federal interest expenses should rise by approximately $226 billion over the next twelve months to over $1.15 trillion. For context, from the second quarter of 2010 to the end of 2021, when interest rates were near zero, the interest expense rose by $240 billion in aggregate. More stunningly, the interest expense has increased more in the last three years than in the fifty years prior. The graph above is just the tip of the fiscal iceberg. Every month, lower-interest-rate debt matures and will be replaced with higher-cost debt.

Post Comment Private Reply Ignore Thread