See other National News Articles

Title: The Fed-Enabled Apartment Bubble Is Unraveling

Source:

[None]

URL Source: https://www.zerohedge.com/news/2023 ... ed-apartment-bubble-unraveling

Published: Dec 16, 2023

Author: Tyler Durden

Post Date: 2023-12-16 13:41:58 by Horse

Keywords: None

Views: 50

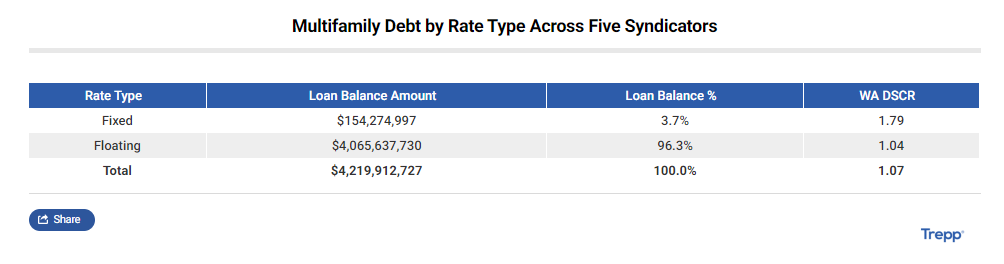

By Artis Shepherd, Mises Institute, Submitted by QTR's Fringe Finance The apartment investment industry has experienced severe malinvestment over the last several years, resulting in a massive bubble that has only recently begun to deflate with rising interest rates. A tidal wave of easy money—enabled by the Federal Reserve and four consecutive United States administrations, from George W. Bush to Joe Biden—drastically lowered the barriers to entry. As a result, even those with no investment acumen have raised and used other people’s money for complex, high-risk projects like buying, developing, and managing apartment buildings. Bridge loans, a natural outgrowth of enormous amounts of liquidity searching for yield in an environment with a zero-interest rate policy, have facilitated this process. The results should not be surprising, and to some they aren’t. Syndication and Bridge Loans Scrutinizing Fed-driven malinvestment in the apartment industry involves highlighting two separate but closely related phenomena—syndication and bridge loans. Syndication involves the pooling of capital from various sources to execute an investment. However, during the recent apartment bubble, this practice degenerated significantly. Syndicators often showed a lack of experience in the industry, raised money anonymously online, heavily relied on marketing and technology, and demonstrated limited risk awareness. As opportunists in the world of easy money and widespread malinvestment, these syndicators took advantage of a nominally wealthy but unsophisticated investor pool to acquire properties that these syndicators intended to quickly flip, riding a wave of speculative asset inflation and earning substantial fees with each closed acquisition, refinance, or sale. However, syndication, as described earlier, would not have been possible without the ubiquity of bridge loans. During the peak of the apartment bubble, which took place roughly from mid-2020 to early 2022, syndicators emerged as the primary users of bridge loans: short-term, floating-rate, high-leverage loans with essentially no lending criteria that were used to fund roughly 90 percent of the apartment acquisition activity during the period. Syndicators rushed in to outbid for apartment properties and, with virtually no credit standards to meet, borrowed as much as they could using bridge loans. Ostensibly, the sole investment rationale at play was the “bigger fool” strategy, a bet that loose monetary policy would never go away, thus fueling continued asset inflation and allowing the syndicators to flip these properties to even bigger fools. While they lasted, the bubble conditions and bridge loans enabled these aggressively rent-seeking but otherwise dim-witted syndicators to earn significant fees for themselves and build up massive assets under management. Research published by Trepp, a leading provider of loan analytics for commercial real estate, has revealed insightful findings. Trepp analyzed the portfolios of five syndicators—Tides Equities, GVA Real Estate Group, Nitya Capital, ZMR Capital, and Rise48 Equity—and the results are both enlightening and utterly predictable. The Chickens Come Home to Roost Across the five syndicators mentioned, Trepp provided several noteworthy data tables. The table below shows the proportion of each type of debt employed by these syndicators in their apartment acquisitions. Figure 1: Multifamily debt by rate type across five syndicators Source: Emily Yue, “Multifamily Syndicators Come Under Scrutiny—Everything to Know About Exposure to CRE CLOs and Floating-Rate Debt,” Trepp, July 20, 2023. The table’s third column shows that 96.3 percent of these loans were taken on a floating-rate basis. These syndicators were either ignorant of the risks associated with increasing interest rates or simply assumed that rates would stay at all-time lows for the foreseeable future. However, interest rates did not stay at...(READ THIS FULL ARTICLE, FREE, HERE).

Post Comment Private Reply Ignore Thread