See other National News Articles

Title: Here's What's In Biden's 'Reckless' $7.3 Trillion Budget, And Here's How He'll 'Pay' For It

Source:

[None]

URL Source: https://www.zerohedge.com/political ... dget-and-heres-how-hell-pay-it

Published: Mar 11, 2024

Author: Tyler Durden

Post Date: 2024-03-11 21:23:53 by Horse

Keywords: None

Views: 170

Comments: 2

The Biden administration has released a proposed budget that would boost federal spending to $7.3 trillion next fiscal year. To pay for it, they plan to raise taxes on the wealthy and large corporations. And while there's virtually no chance of it passing given the current makeup of Congress (WSJ calls it 'largely symbolic'), it will give Biden a steady supply of talking points to read off teleprompters across the land during his re-election campaign. According to the White House, the 2025 budget would cut the deficit by $3 trillion over the next decade, and raise taxes by a net of $4.9 trillion - a boost of roughly 7% in collections without any policy changes, the Wall Street Journal reports. Other features of the proposed budget include: A boost in defense spending to $895 billion, up from $886 billion. Congressional approval for roughly $1.6 trillion in discretionary spending - slightly lower than the current year's budget. This will be offset by $1.6 trillion in spending caps which were agreed to last year by House Republicans and the Biden administration, according to the Congressional Budget Office. Medicare taxes and drug pricing are also included, with tax increases on people earning more than $400,000 per year (which we all know is total bullshit). The plan will also significantly expand the number of drugs subject to government price negotiation, to 50 per year, up from 20, and it would extend a $2,000 cap on out-of-pocket prescription drugs under Medicare. Immigration and international aid: The Department of Homeland Security would receive an additional $8.7 billion under the proposal - much of which would plug a budget hole created by the 'unexpected' surge in migrants last year. $2.9 billion of it would fund longer term investments, including hiring more Border Patrol agents and asylum officers. Ukraine: Of course, the budget proposal also reiterates Biden's supplemental request for $60 billion in emergency aid for his favorite country. Other items of note: the budget calls for shoring up Social Security but does not specify a plan. It also calls for extending Trump-era tax cuts for most households after they expire in 2025, but does not detail how they should be paid for. It also calls on restoring the expanded child tax credit on a temporary basis. Under his plan, families making less than $200,000 a year would be guaranteed subsidized child care, with the lowest income families paying nothing. The president proposed building or preserving more than two million housing units, and a series of tax credits to ease the high cost of purchasing a home. He calls for spending $12 billion to come up with strategies to reduce the cost of college, while expanding Pell Grants and offering tuition-free community college. And he again outlined a federal paid family and medical leave program. -WSJ According to White House spox Olivia Dalton, the budget "invests in all of America to make sure everyone has a fair shot, we leave no one behind," adding that congressional Republicans "have made their values clear in the meantime; they have repeatedly fought to slash critical programs that the American people rely on." House Republican leaders, meanwhile, said in a statement that "the price tag of President Biden’s proposed budget is yet another glaring reminder of this administration’s insatiable appetite for reckless spending and the Democrats’ disregard for fiscal responsibility." The budget proposal comes less than eight months before Election Day and amid polls that show Trump with a narrow lead over Biden. As he shifts his focus to the general election, the president is expected to increasingly seek to draw a contrast with his presumed opponent, casting Trump as out of touch with voters’ priorities and a danger to democracy. Trump, in turn, has railed against the president, targeting his spending on issues such as clean energy. -WSJ According to Shalanda Young, director of the Office of Management and Budget, Americans are "going to have a robust tax debate at the end of 2025."

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: All (#0)

3 corporations own 19,000 metro Atlanta homes. What does that mean for the housing market? The Truth of 911 Shall Set You Free From The Lie

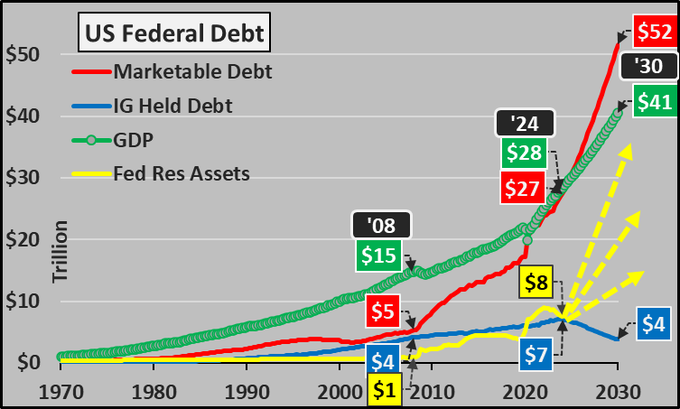

Biden unveils massive new budget with $6 trillion in tax increases, $36,000 in tax hikes per family; National Debt would grow by $1.8 trillion in one year. Biden’s fiscal blueprint envisions a future where the U.S. debt soars to a jaw-dropping $45 trillion within a decade. The proposed tax increases of $5.5 trillion, targeting the wealthy and corporations, are intended to fund a range of initiatives, including federal benefit programs, affordable housing, and student debt cancellation. However, the budget’s fiscal responsibility is being hotly debated. Critics, including fiscal hawks and Republicans, swiftly condemned the proposal as a path to “reckless spending.” The Committee for a Responsible Federal Budget underscored projections by the Office of Management and Budget (OMB), indicating that the national debt could surge to an alarming 105.6% of Gross Domestic Product (GDP) by 2034. This projection far exceeds the current debt-to-GDP ratio of 97%. Adding to the financial strain, the budget proposes almost $36,000 in tax hikes per family, with $4.9 trillion in new taxes and over $2 trillion in additional spending earmarked for the “woke agenda.” As the debate over Biden’s budget unfolds, one thing remains certain: the potential consequences of such ambitious fiscal policies could have a profound impact on the nation’s economic future. With looming questions about tax hikes, increased spending, and the trajectory of U.S. debt, Americans are left to grapple with the uncertain financial landscape that lies ahead. CH @Econimica best guestimate of what's coming by end of decade...likely sooner!?! The Truth of 911 Shall Set You Free From The Lie

https://citizenwatchreport.com/3-corporations-own-19000-metro-atlanta-homes-what-does-that-mean-for-the-housing-market/

#2. To: All (#1)

https://citizenwatchreport.com/biden-unveils-massive-new-budget-with-6-trillion-in-tax-increases-36000-in-tax-hikes-per-family-national-debt-would-grow-by-1-8-trillion-in-one-year/#google_vignette

Top • Page Up • Full Thread • Page Down • Bottom/Latest