See other National News Articles

Title: Visualizing The Tax Burden Of Every US State

Source:

[None]

URL Source: https://www.zerohedge.com/personal- ... zing-tax-burden-every-us-state

Published: May 10, 2024

Author: Tyler Durden

Post Date: 2024-05-10 01:01:00 by Horse

Keywords: None

Views: 292

Comments: 1

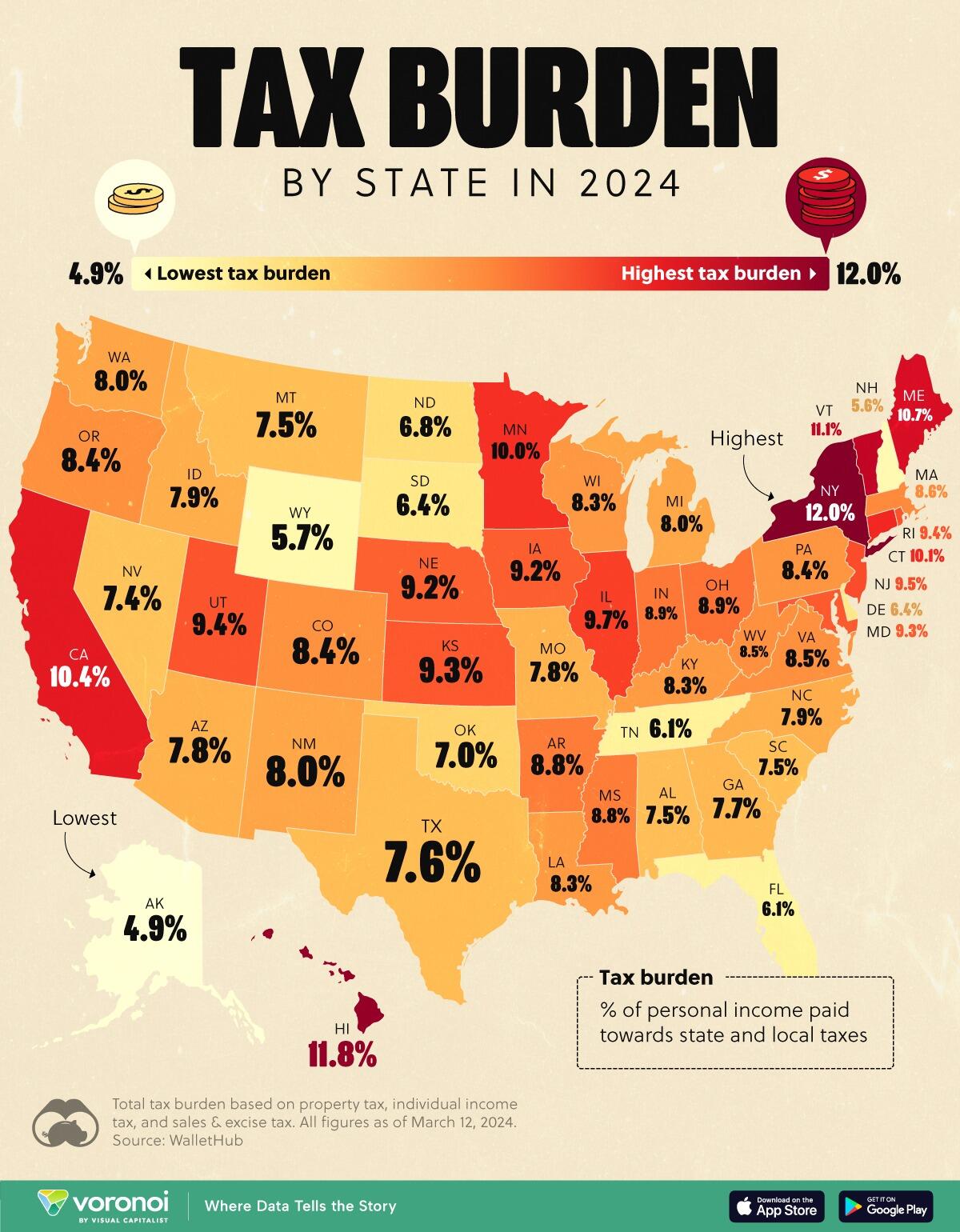

This map graphic visualizes the total tax burden in each U.S. state as of March 2024, based on figures compiled by WalletHub. It’s important to understand that under this methodology, the tax burden measures the percent of an average person’s income that is paid towards state and local taxes. It considers property taxes, income taxes, and sales & excise tax. Poster Comment: Only Wyoming and Alaska have lower tax burdens.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: Horse (#0)

(Edited)

Joe Bannister was an IRS-CID agent. These were the guys that carried guns. One day he asked his supervisor to show him the law that the average American living and working in the 50 states legally owed the federal income tax. His supervisor refused. So, Joe resigned and started to work against them. ;) "When bad men combine, the good must associate; else they will fall, one by one." Edmund Burke

income taxes

Top • Page Up • Full Thread • Page Down • Bottom/Latest