See other World News Articles

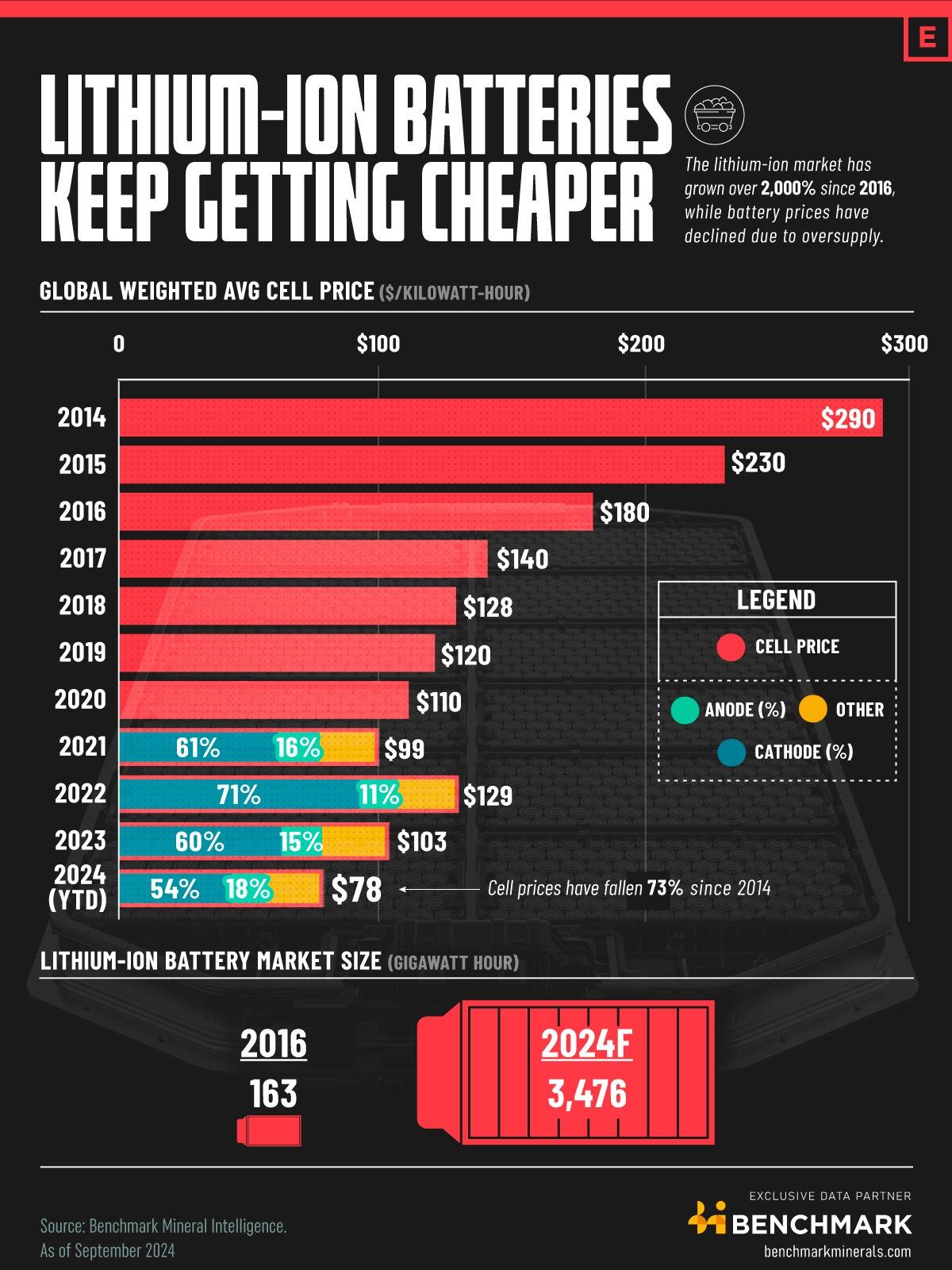

Title: Lithium-Ion Batteries Just Keep Getting Cheaper

Source:

[None]

URL Source: https://www.zerohedge.com/commoditi ... ries-just-keep-getting-cheaper

Published: Sep 30, 2024

Author: Tyler Durden

Post Date: 2024-09-30 04:36:48 by Horse

Keywords: None

Views: 573

Comments: 3

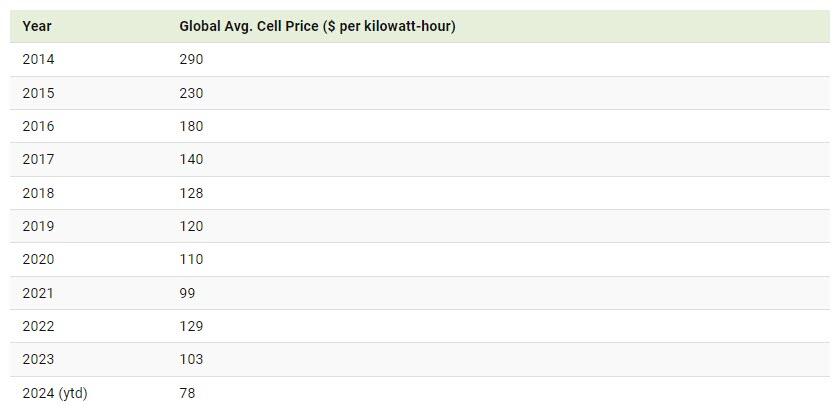

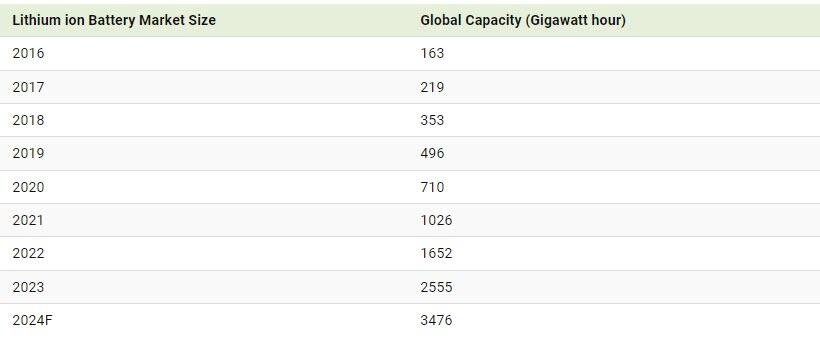

Battery metal prices have struggled as a surge in new production overwhelmed demand, coinciding with a slowdown in electric vehicle adoption. As Visual Capitalist's Bruno Venditti details below, Lithium prices, for example, have plummeted nearly 90% since the late 2022 peak, leading to mine closures and impacting the price of lithium-ion batteries used in EVs. More than Half of the Battery Price Comes from the Cathode Lithium-ion batteries operate by collecting current and directing it into the battery during the charging process. Typically, a graphite anode attracts lithium ions and retains them as a charge. During discharge, the cathode draws the stored lithium ions and channels them to another current collector. The circuit functions effectively because the anode and cathode do not come into direct contact and are suspended in a medium that facilitates the easy flow of ions. Currently, 54% of the cell price comes from the cathode, 18% from the anode, and 28% from other components. In the coming months, prices are expected to drop further due to oversupply from China. Despite declining prices however, battery demand is projected to increase ninefold by 2040, with the battery industry’s total capital expenditure expected to nearly triple, rising from $567 billion in 2030 to $1.6 trillion in 2040.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: All (#0)

Nearly One Million Forcibly Displaced In Lebanon After Week Of War Tens of thousands of displaced Syrians living in Lebanon have crossed back into Syria. The Truth of 911 Shall Set You Free From The Lie

Swedish Foreign Minister Says Country Must Speak Openly Of The Downsides Of Mass Immigration ...in the case of immigrants from the Middle East and Africa, "we are dealing with lower education and a completely different cultural background" The Truth of 911 Shall Set You Free From The Lie

So does fentanyl. https://www.zerohedge.com/geopolitical/nearly-one-million-forcibly-displaced-lebanon-after-week-war

#2. To: All (#1)

https://www.zerohedge.com/geopolitical/swedish-foreign-minister-says-country-must-speak-openly-downsides-mass-immigration

#3. To: Horse (#0)

Lithium-Ion Batteries Just Keep Getting Cheaper

TRUE TERROR will arrive at these people’s door, and they will cry, scream, and beg for mercy…

but it will fall upon the deaf ears of the Men who just wanted to be left alone.”

Top • Page Up • Full Thread • Page Down • Bottom/Latest