See other World News Articles

Title: For students of financial history, the frequent issuance of Convertible Bonds is a major red flag.

Source:

[None]

URL Source: https://citizenwatchreport.com/for- ... rket-value-is-largely-fuggazi/

Published: Dec 3, 2024

Author: Horse

Post Date: 2024-12-03 07:53:21 by Horse

Keywords: None

Views: 186

Comments: 1

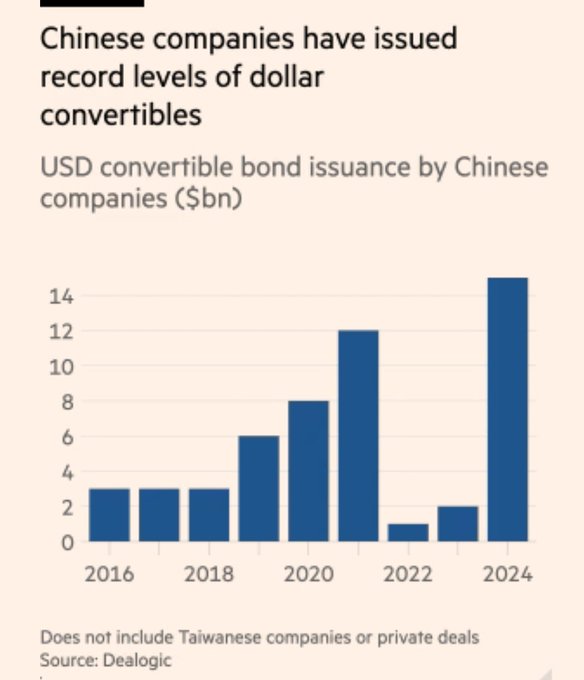

Crypto’s inflated market value is largely fuggazi. Serial Convertible Bond Issuers SunEdison* Chesapeake Energy Molycorp* Lehman* iStar Financial* Calpine* Fannie Freddie* Enron* Tyco* Adelphia* Six Flags* eToys* Avaya* Worldcom* Tesla * went bankrupt H/T: @Convertbond Tether is injecting billions of dollars into crypto, printed out of thin air, fueling a final bull run before DOJ lawsuits and stablecoin regulations take effect next year. Let’s be honest—none of this growth is driven by genuine demand from ETFs or institutions. It’s 80% Tether, followed by 20% FOMO. In this all-encompassing crypto bubble, even the most outrageous shit coins are seeing massive surges. History teaches us that peaks are often followed by brutal crashes and multi-year bear markets. Buying now at all-time highs means trading on emotion—and more than likely, facing significant losses. Don’t forget this. Feeling tempted to FOMO? You need to step away from the charts, find a new hobby, and wait it out. Patience always beats emotion in the long run. While every other crypto page is urging you to take out loans and go all in, I genuinely care about my followers and offer a contrarian yet realistic approach. The market is almost entirely fuggazi, and while bull markets often make people forget that, you need to remember: the true market value isn’t even worth 5% of its current valuation.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: All (#0)

US transfers $1.9B Bitcoin, likely preparing assets for auction or liquidation. The Truth of 911 Shall Set You Free From The Lie

https://citizenwatchreport.com/us-transfers-1-9b-bitcoin-likely-preparing-assets-for-auction-or-liquidation/

Top • Page Up • Full Thread • Page Down • Bottom/Latest