See other National News Articles

Title: Merry Christmas... Here's The Average Credit Card Debt In Every US State

Source:

[None]

URL Source: https://www.zerohedge.com/personal- ... redit-card-debt-every-us-state

Published: Dec 25, 2024

Author: Tyler Durden

Post Date: 2024-12-25 20:31:32 by Horse

Keywords: None

Views: 168

Comments: 1

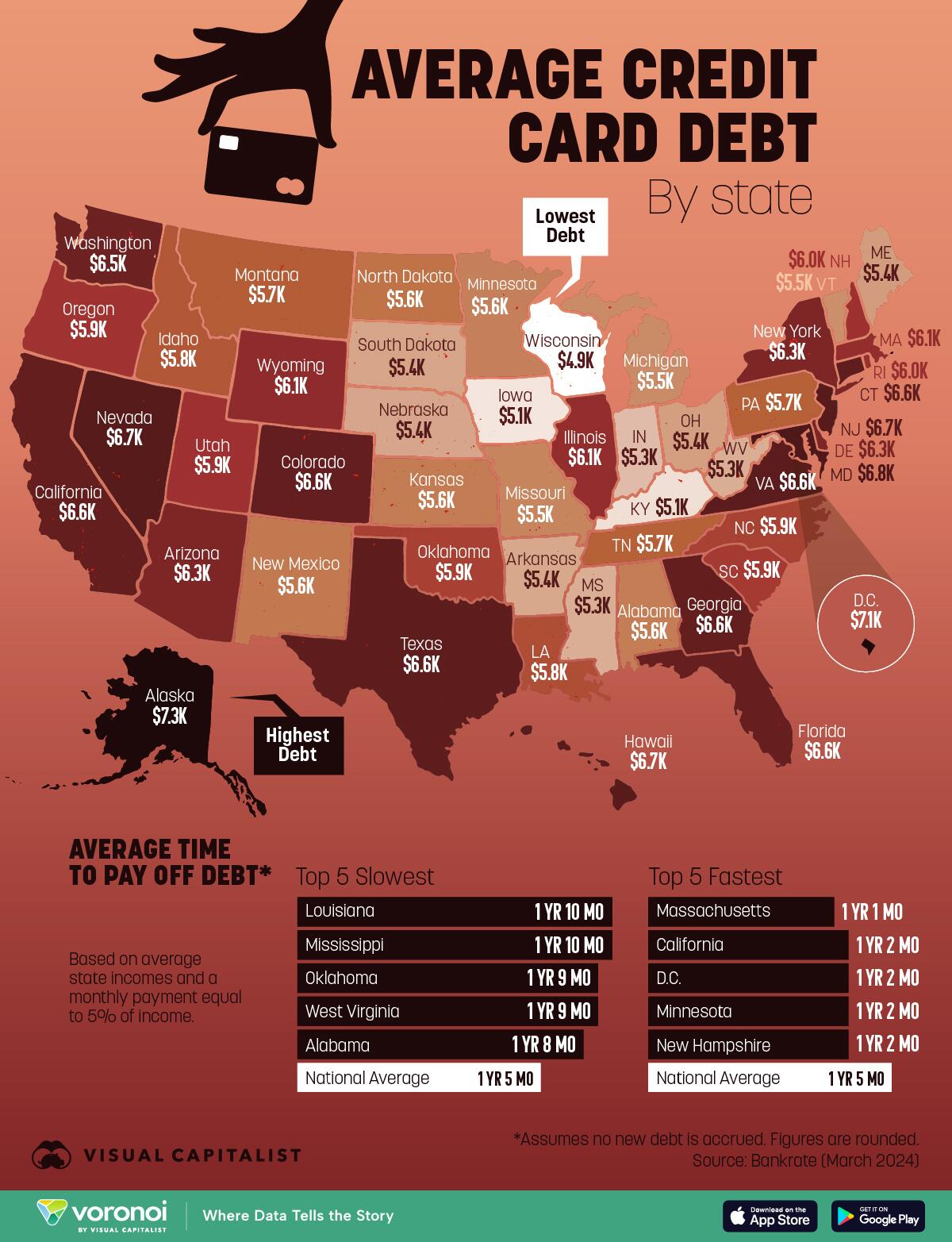

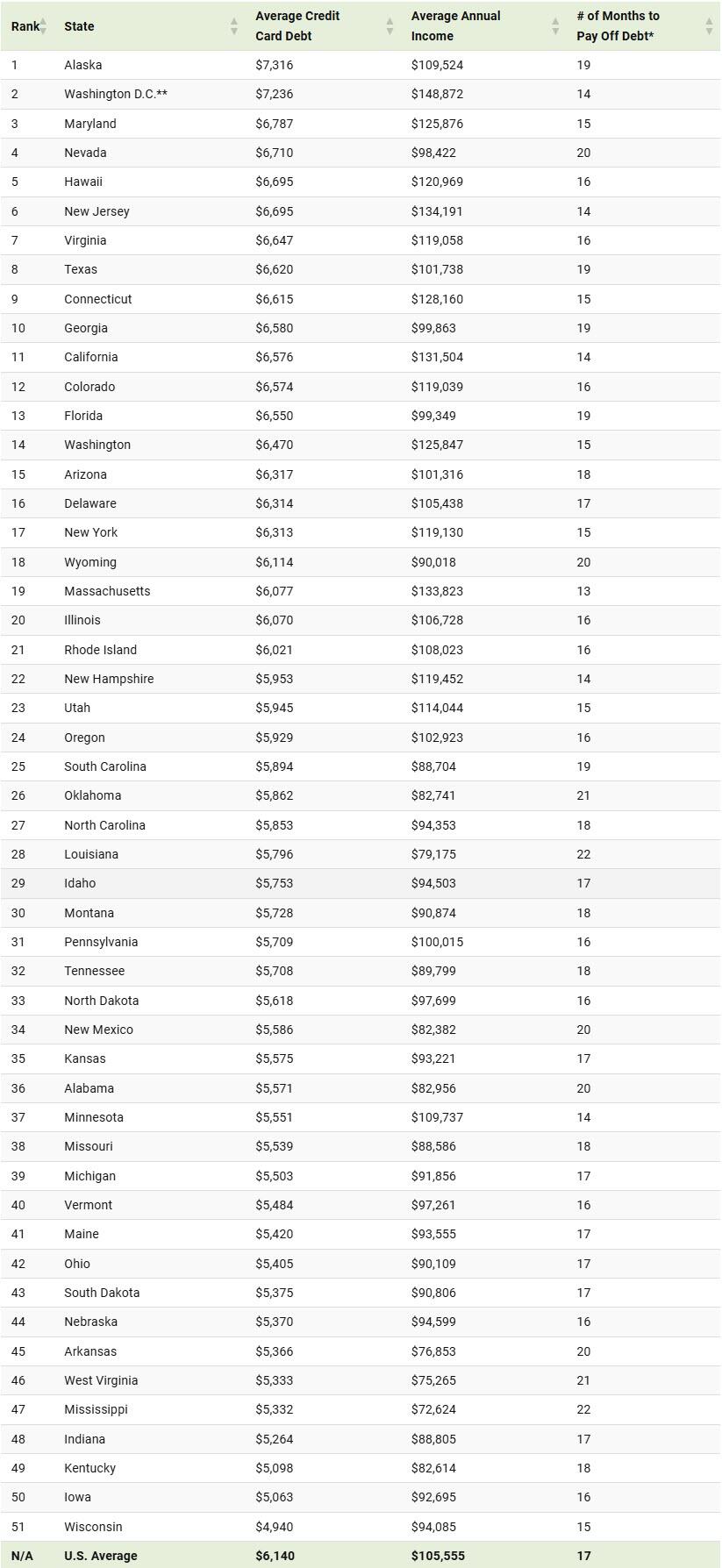

This map, via Visual Capitalist's Pallavi Rao, visualizes the average credit card debt held by households in each U.S. state and ranks the states where residents pay off the debt the fastest and slowest. Data is sourced from Bankrate (2024) who also used average monthly household income to calculate how long it takes to pay off balances. ℹ️ Assumptions made for this analysis: 5% of monthly household income is used for card payments. Also, no new debt is accrued in this time period. How Long it Takes to Pay off Credit Card Balances in Each State Households in Alaska and Washington D.C. are carrying more than $7,000 in credit card debt, the highest across the country. However, with average annual household incomes of $109,000 and $149,000, residents in both states can pay off their debt in about 14–20 months. *Assuming no new debt is accrued. **Federal district. Richer state households—Connecticut, California, Washington—have higher costs of living and are carrying higher credit card balances. But they also manage to pay them off quickly with their larger incomes. On the other hand, households in poorer states have below-average debt but it take closer to two years for them to pay it off. This highlights the unequal debt burden across America. While the people living on the coasts have higher costs, they’re compensated by their incomes. However the South’s lower costs are not as evenly compensated. And of course, compound interest is not a game played in favor of the borrower. Carrying the debt for longer periods of time accrues additional interest. Bankrate’s analysis points out that when making only minimum payments, it would take more than 17 years to pay it off the national average debt: $6,140. In case that seems like a ludicrous amount of time, here’s a good reminder that most credit card interest compounds daily and not monthly. Cross reference this map with Credit Card Delinquency Rates by State to see the effects of debt burden.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: All (#0)

Chief Nerd @TheChiefNerd Colbert cuts off Claire Danes before she spills the tea about the intelligence community “allying itself” with the legacy media during Trump’s first term Watch until the end… https://x.com/i/status/1871600142203412849 The Truth of 911 Shall Set You Free From The Lie

Top • Page Up • Full Thread • Page Down • Bottom/Latest