See other World News Articles

Title: WE ARE ABOUT TO FALL OFF A CLIFF

Source:

[None]

URL Source: https://citizenwatchreport.com/we-are-about-to-fall-off-a-cliff/

Published: Dec 26, 2024

Author: Horse

Post Date: 2024-12-26 23:50:12 by Horse

Keywords: None

Views: 322

Comments: 1

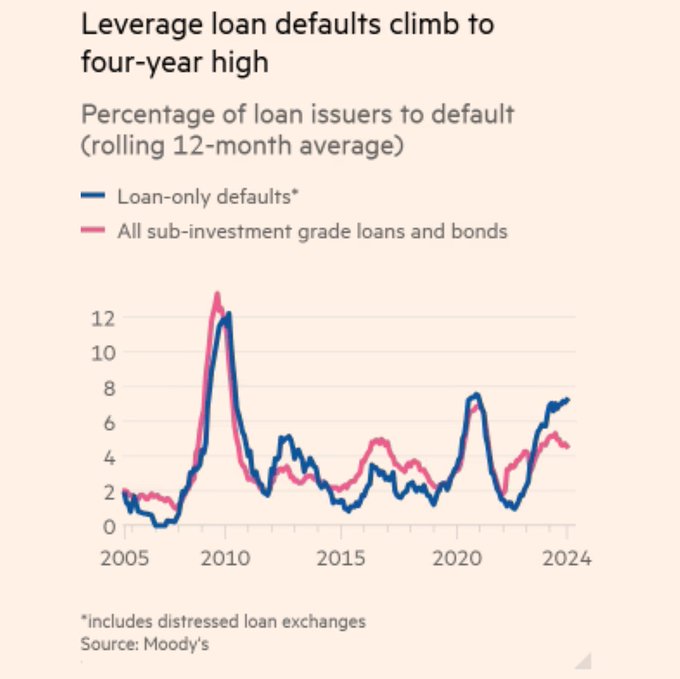

Mohamed A. El-Erian @elerianm Per the @FT : “US companies are defaulting on junk loans at the fastest rate in four years, as they struggle to refinance a wave of cheap borrowing that followed the Covid pandemic.” This is not about weak demand. Rather, it’s the consequence of excessive borrowing by companies, and risk taking by creditors, during what many thought at the time would be “QE infinity” with artificially low interest rates for as long as it mattered. Bravos Research @bravosresearch History tells us something important: Surges in money market fund assets, like today, have only occurred 3 times before: - 2001 dot-com crash - 2008 financial crisis - 2020 pandemic When cash hoarding hits these levels, trouble often follows https://twitter.com/i/status/1871917530228691455 Cash hoarding at these levels isn’t a coincidence—it’s a signal. History shows that when fear spikes, opportunities often follow. Stay alert; the best plays are made when others hesitate. QE Infinity @StealthQE4 This is dark and deep but it’s my biggest concern heading into 2025. We have $7 trillion of debt that needs to be refinanced in 2025 alone and rates are now considerably higher. I don’t know how this gets done. https://x.com/i/status/1871971880225452176

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: All (#0)

Russia declares federal emergency over Black Sea oil spill cleanup struggle. Russia has just declared a federal-level emergency in the face of a massive oil spill along the Black Sea coast. This move, led by Russia’s Emergency Situations Minister, Alexander Kurenkov, is a critical step to unleash federal funds to combat this environmental catastrophe. The spill is a nightmare for both nature and local communities, and the situation demanded swift action. The Truth of 911 Shall Set You Free From The Lie

https://citizenwatchreport.com/russia-declares-federal-emergency-over-black-sea-oil-spill-cleanup-struggle/

Top • Page Up • Full Thread • Page Down • Bottom/Latest