See other World News Articles

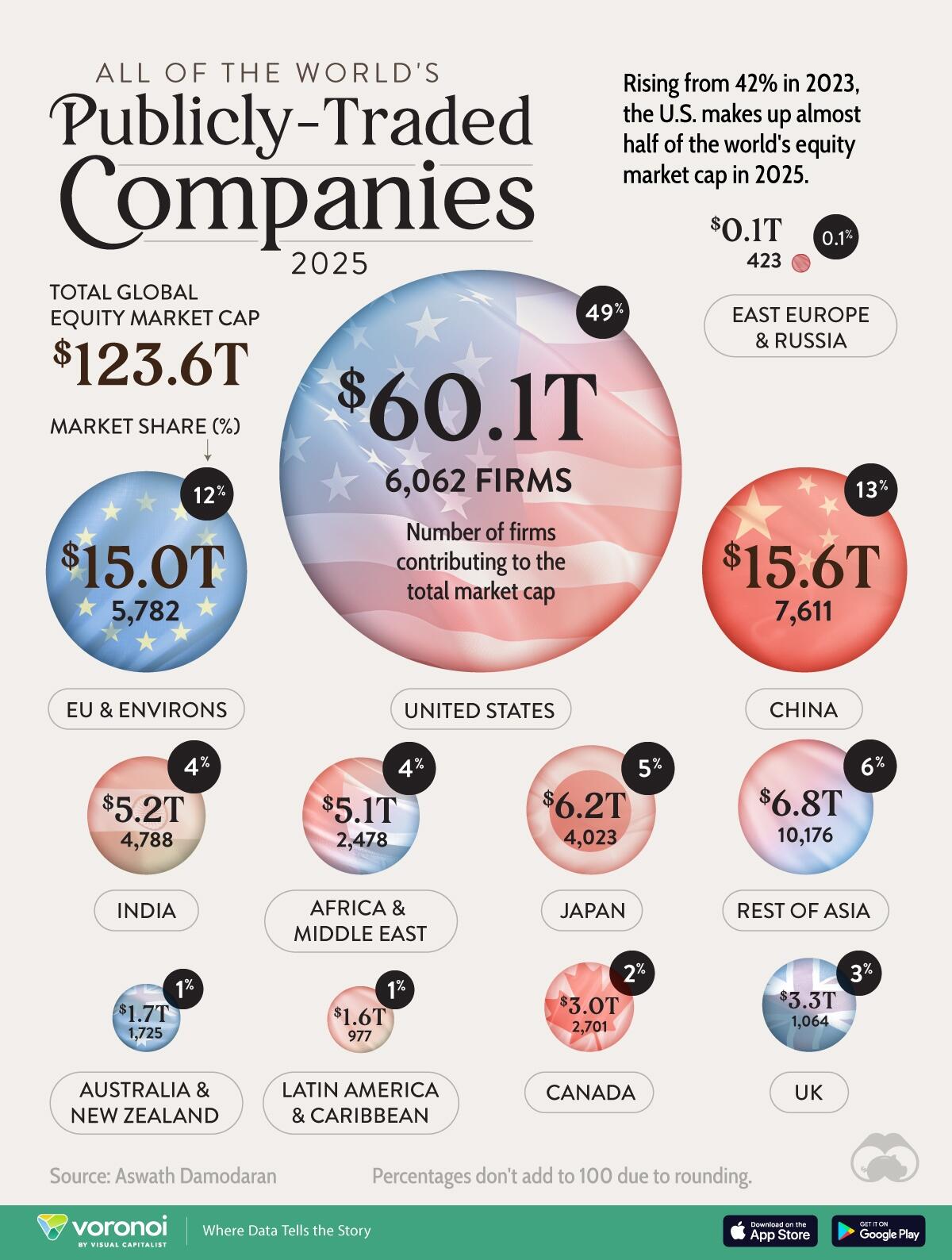

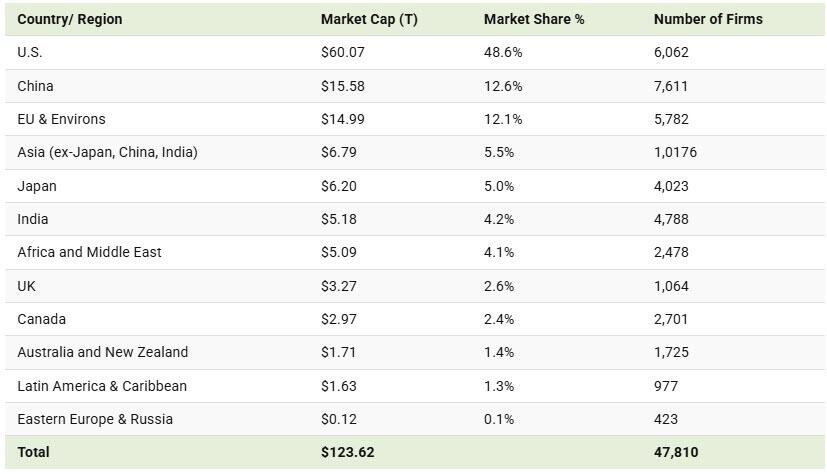

Title: US Still Dominates The $124 Trillion Global Stock Market

Source:

[None]

URL Source: https://www.zerohedge.com/markets/u ... 4-trillion-global-stock-market

Published: Mar 9, 2025

Author: Tyler Durden

Post Date: 2025-03-09 13:01:40 by Horse

Keywords: None

Views: 74

America’s dominance of the global stock market is unrivaled, and its share has only grown in the past two years. The outperformance of the S&P 500 has played a role in America’s leading position, averaging 14.8% compound average returns over the past decade. Global equities, represented by the MSCI ACWI (excluding the U.S.) Index, have returned 7% by comparison. This graphic, via Visual Capitalist's Dorothy Neufeld, shows the world’s publicly-traded companies in 2025, based on data from Aswath Damodaran. At the end of December 2024, the market capitalization of the Magnificent Seven - Apple, Microsoft, Alphabet, Nvidia, Amazon, and Meta Platforms - was over $18.4 trillion, making up almost 30% of the entire U.S. stock market. Last year, these companies fueled more than half of the S&P 500’s returns. This year, it has been the opposite, fueling the downturn as they have lost over $2.5 trillion.. China ranks as the world’s second-largest stock market, valued at $15.6 trillion across 7,061 publicly-traded companies. While Tencent and Alibaba stand as the largest firms by market cap, several financial firms play a dominant role in China’s stock market. With a $5.2 trillion market cap, India’s stock market is now larger than the UK and Latin America combined. In 2024, roughly 20% of households owned shares, rising from just 7% in just five years. Notably, the country’s rapid economic growth and digital transformation have driven shares to rise 80% over the period. By contrast, emerging markets have increased by 6%.

Post Comment Private Reply Ignore Thread