See other National News Articles

Title: These Are The States Most And Least Dependent On The Federal Government

Source:

[None]

URL Source: https://www.zerohedge.com/markets/t ... t-dependent-federal-government

Published: Mar 12, 2025

Author: Tyler Durden

Post Date: 2025-03-12 22:32:08 by Horse

Keywords: None

Views: 217

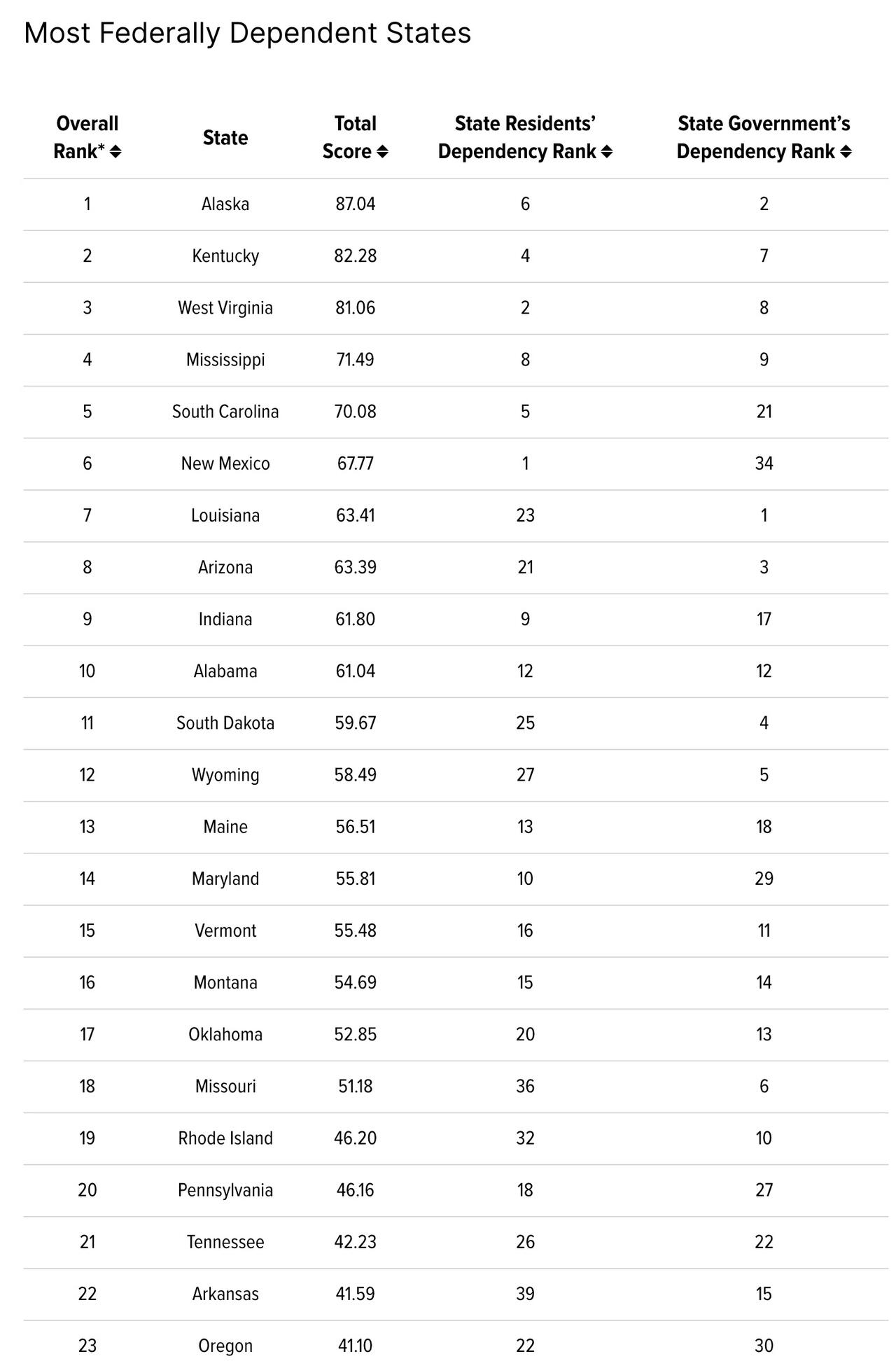

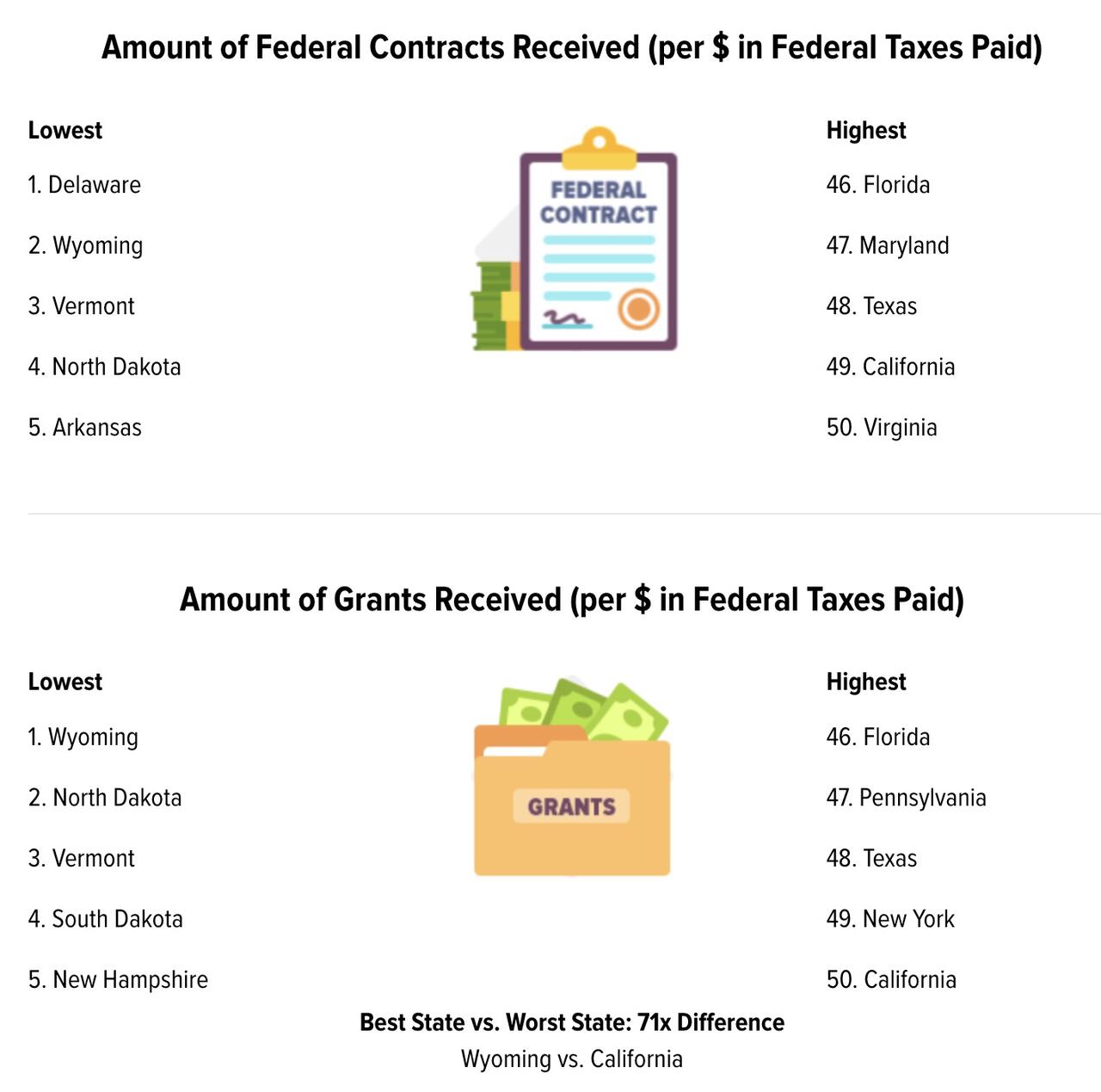

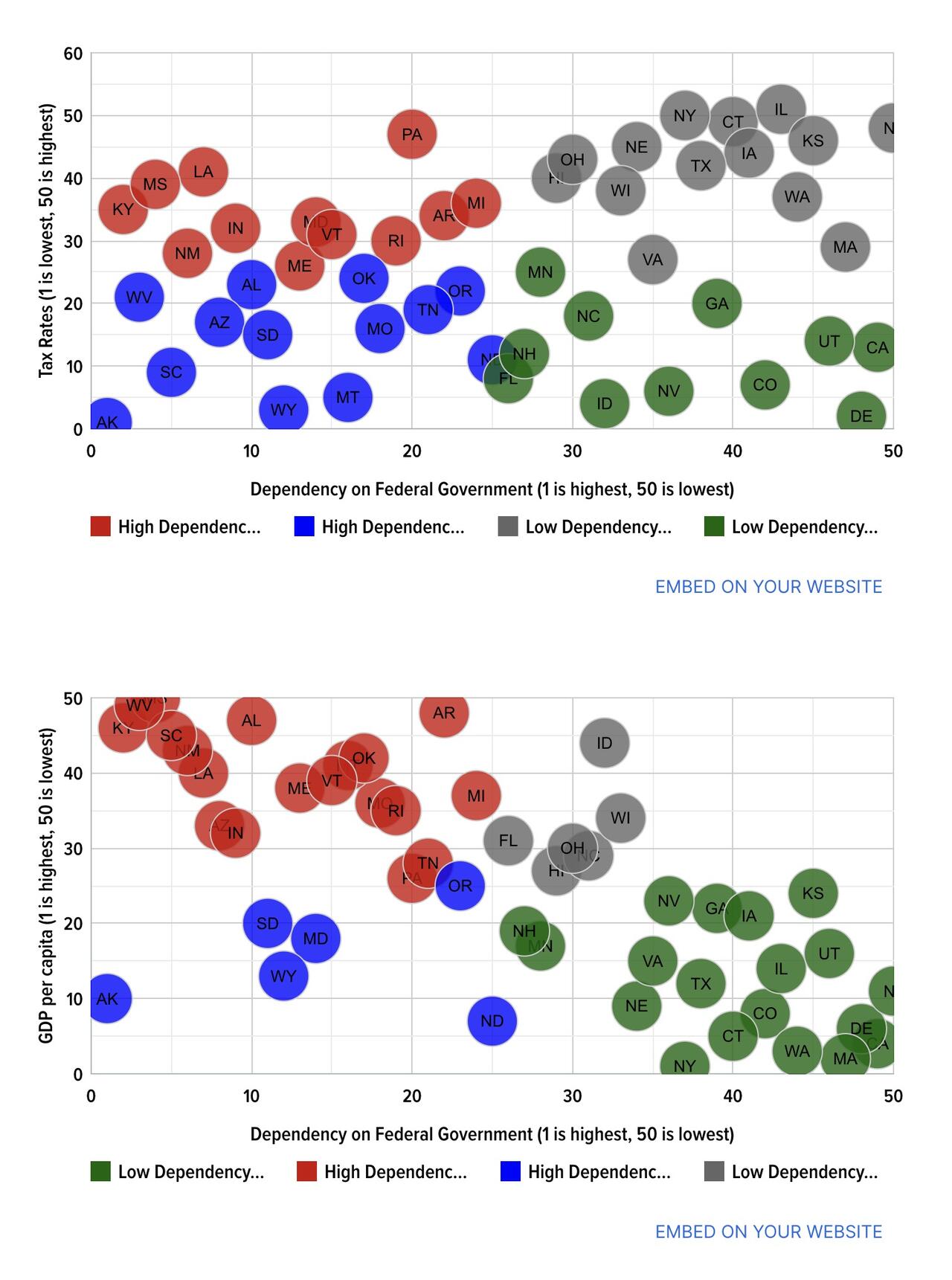

A new study highlights how much states rely on federal aid compared to what they contribute in taxes. The study evaluates three key metrics: return on federal taxes, federal funding as a share of state revenue, and the percentage of federal jobs in each state. Most dependent states include Alaska, Kentucky, and West Virginia, while New Jersey, California, and Delaware are the least reliant, according to a new WalletHub study. The report found that Red States (average rank: 21.48) depend more on federal funding than Blue States (32.05). Additionally, states with lower per-capita GDP tend to receive more federal support. Notably, Illinois ranks among the least dependent but has the nation's highest tax rates, while Alaska, the most dependent state, has the lowest taxes. WalletHub writes that Alaska ranks as the most federally dependent state, with over 50% of its revenue coming from federal funding. The state's harsh weather, large landmass, and small population contribute to its reliance on federal dollars for infrastructure, disaster relief, and resource management. Despite this, only 1.8% of Kentucky’s workforce is employed by the federal government, placing it in the middle of the pack for federal employment. Similarly, West Virginia ranks third, receiving $2.72 in federal funding per $1 paid in taxes. The state derives over 45% of its revenue from federal aid, and 3.7% of its workforce is employed by the federal government, highlighting its strong economic dependence on federal support. A broader analysis of federal dependency shows a strong correlation between low GDP per capita and high reliance on federal funds. Many Red States rank among the most dependent, with an average dependency rank of 21.48, compared to 32.05 for Blue States. Additionally, states with low tax rates, such as Alaska and West Virginia, often receive significant federal support, while high-tax states like New Jersey and Illinois rank among the least dependent. This dynamic reflects ongoing debates about federal resource distribution, tax policies, and economic sustainability across the U.S. Poster Comment: southern states have low cost of living and qualify their residents for more food stamps.

Post Comment Private Reply Ignore Thread