See other National News Articles

Title: How State Income Taxes Have Changed Since 2000

Source:

[None]

URL Source: https://www.zerohedge.com/personal- ... income-taxes-have-changed-2000

Published: Mar 26, 2025

Author: Tyler Durden

Post Date: 2025-03-26 07:40:51 by Horse

Keywords: None

Views: 57

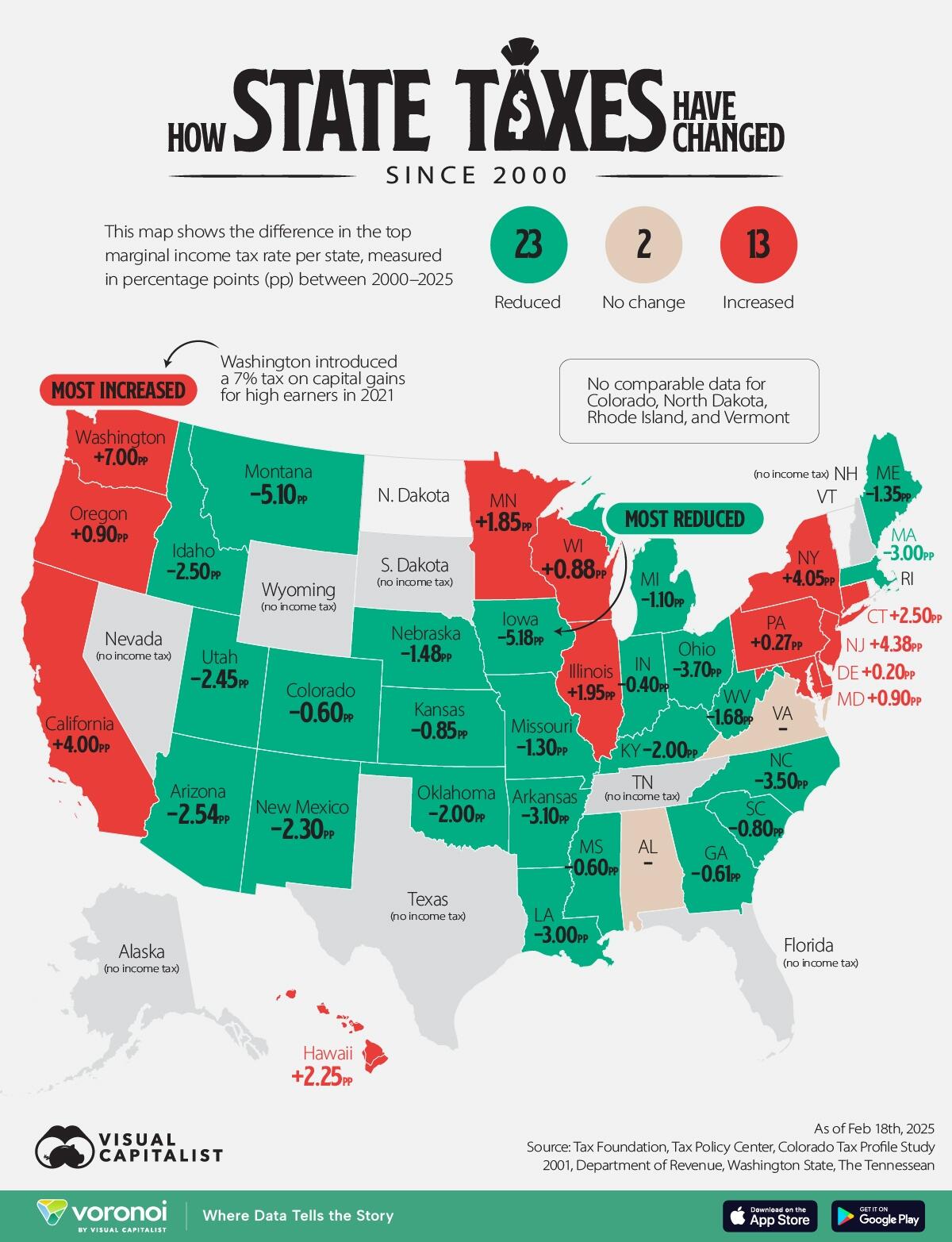

In this graphic, Visual Capitalist's Pallavi Rao compares how the state income taxes have changed between 2000 and 2025. The visualized value is the difference in the top marginal tax rate, measured in percentage points (pp). We also published just the current top rate in 2025, earlier this month for further context. Current and historical data for this map is sourced from the Tax Foundation and Tax Policy Center. Changes are not compared for four states—Rhode Island, Vermont, North Dakota, and Colorado—since their 2000s tax rates were charged as a percentage of federal liabilities owed. As a result, they have been grayed out on the map and are not discussed in this article. States Income Tax Burdens Have Broadly Fallen Since 2000 Led by Iowa (-5.18pp), 23 states reduced their top marginal income tax rate since 2000. Furthermore, two states (Tennessee and New Hampshire) removed income taxes entirely, joining six others that do not tax incomes. Note: Washington’s 7% tax on capital gains has been listed as an income tax by the source. This is discussed further in the next section. Many states have switched to flat tax rates in the past 25 years, with Arizona, Georgia, Idaho, Iowa, Kentucky, Louisiana, Mississippi, North Carolina, and Utah reducing both the rate and multiple brackets to just the one. However, some argue that flat rates are regressive as it imposes a larger burden on low income households than higher incomes ones. Only two states, Alabama and Virginia, have made no changes. So, Who Increased Their Tax Rates? Thirteen states and D.C. increased the top rate, with Washington (+7.0 pp) registering the most increase. However Washington’s 7% flat rate is only applicable for earnings from stocks and bond sales that are above $250,000. There is an argument that a capital gains tax is different from an income tax since it requires both a sale and declared profit to incur the tax. Furthermore, as far back as 1933, a statewide income tax in Washington was ruled unconstitutional. However, to stay consistent with the source’s categories, it has been included as income. New Hampshire’s removal of interest and dividends tax is also counted as eliminating income taxes. If not considering Washington, then New Jersey has seen the highest top rate increase (+4.38pp). Finally, Massachusetts is the only state that switched from flat to marginal rates: putting in a 9% bracket for income above $1.8 million in a year. Poster Comment: The top US Federal Income tax rate for 2025 is 37%.

Post Comment Private Reply Ignore Thread