See other Business/Finance Articles

Title: Market WrapUp (11-05-07)

Source:

Financial Sense Online

URL Source: http://www.financialsense.com/Market/wrapup.htm

Published: Nov 5, 2007

Author: Rob Kirby

Post Date: 2007-11-05 19:04:15 by Arete

Ping List: *unUsual Suspects* Subscribe to *unUsual Suspects*

Keywords: None

Views: 1644

Comments: 57

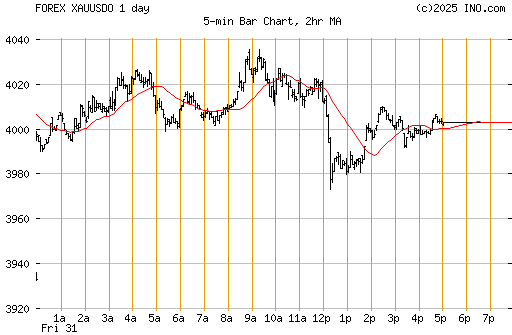

Financial Sense ® Home l Market Monitor l Market WrapUp l Storm Watch l About Us l Contact Us Today's Market WrapUp 11.05.2007 Mon Tue Wed Thu Fri Kirby Archive Musical Chairs at Citibank It’s out with the old and in with the new, or perhaps better stated, the ‘recycled.’ This past weekend Citibank Chairman, Charles Prince resigned. His replacement is none other than Robert Rubin. For those of you who with short memories, Mr. Rubin is a former Chair of Goldman Sachs, former U.S. Treasury Secretary in the Clinton Administration and last but not least – widely credited with the design, implementation and beating-of-the-drum of the heralded U.S. ‘strong dollar policy.’ Since Rubin’s tenure as Treasury Secretary it has become “custom” from that point forward that all who have followed him reiterate this theme – singing the strong dollar mantra. This dogma of the ‘strong dollar policy’ has come to be understood by many market participants as saying one thing while doing something-else completely opposite. A Paradox in Principle In an article written back in 2003 by TheStreet.com’s Aaron Task titled, Strong Dollar Is a Policy in Name Only, Task opines, Other than "I love you" and "You're under arrest," few three-word English phrases have as much significance as "strong dollar policy." Of late, however, singing the tune of the strong dollar policy tends to fly in the face of realities with the U.S. Dollar Index probing new historical lows. As recently as August 2006, current U.S. Treasury Secretary, Hank Paulson reiterated the familiar tune, "I believe that a strong dollar is in our nation's interest and that currency values should be determined in open and competitive markets in response to underlying fundamentals" Despite Mr. Paulson’s proclamation in support of a strong dollar, anecdotal evidence would tend to suggest otherwise: With Robert Rubin now beating the drum over at Citibank – that of Chairman – let’s hope that his assumed intentions of restoring the financial behemoth to financial strength and probity are followed up with a degree of transparency and meaningful change. Today’s Market Overseas equity markets began the week on a sour note with Japan’s Nikkei Index falling 248 points to 16,268. North American markets also stumbled with the DOW losing 51.70 to 13,543.40, the NASDAQ giving up 15.20 to 2,795.18 and the S & P down 7.50 to 1,502.15. NYMEX crude oil futures fell 1.28 to 94.65 per barrel. Interest rates ended a volatile day by rising 2 basis points across the curve with the benchmark 5 yr. bond ending the day at 3.97% and the 10 yr. bond finishing the day at 4.34%. On foreign exchange markets, the U.S. Dollar Index gained .08 to 76.38. The precious metals complex ended the day mixed with COMEX gold futures closing up 1.10 per ounce at 808.60 while COMEX silver futures added .14 to finish at 14.77 per ounce. Meanwhile, the XAU closed down 1.11 at 186.52 and the HUI fell 2.63 to end the day at 436.75. Wishing you all a pleasant evening and happy investing! Rob Kirby Copyright © 2007 All rights reserved. Contact Information Financial Sense ® Home l Market Monitor l Market WrapUp l Storm Watch l About Us l Contact Us

BY ROB KIRBY

Rob Kirby

Kirby Analytics Newsletter

Toronto, Ontario, Canada

Email | Website | WrapUp Archive | Financial Sense Editorial Archive

Copyright © James J. Puplava Financial Sense ® is a Registered Trademark

P. O. Box 503147 San Diego, CA 92150-3147 USA 858.487.3939

(3 images)

Subscribe to *unUsual Suspects*

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

Begin Trace Mode for Comment # 49.

#1. To: All (#0)

Market WrapUp is Delivered! Other news, views and commentary - U.S. Economy: Services Growth Unexpectedly Quickens PetroChina's Value Tops $1 Trillion, Surpassing Exxon Google Plans Mobile-Phone Operating System to Expand Beyond Web Bond Risk Jumps to Highest Since August on Citigroup Writedowns Weill's Profit Machine Breaks Down on Citi Writedowns PIMCO: Fed "can't afford" to let housing crack Fed's Mishkin: Fed must be ready to take back cuts COTs Still Bullish Silver & Some Gold Stock... But Not All INTUITIVE TRADING: FACT OR FICTION? Part 1 THE WEEK AHEAD IN THE FINANCIAL MARKETS THE ELLIOTT WAVE GOLD DEBATE IS OVER STOCK MARKET UPDATE: US Stocks Long-term Uptrend Remains Healthy BIG BANG THEORY by Peter Navarro IS THERE DANGER IN THIS GOLD RUN? THE GOLD PRICE AND WAR IN THE MID EAST GOLD IS A WIN Win Proposition by Captain Hook

"Presently, the trend of Treasury yields is constructive, but that trend is in the context of very overbought conditions in bonds, born of increasing concerns about mortgage delinquencies and securitized debt. Meanwhile, stock valuations are quite high even without normalizing for profit margins. Normalizing for profit margins, the current P/E on the S&P 500 would be well above 20. To get an idea of where valuations are adjusting for the level of profit margins, it's notable that the price/revenue multiple on the S&P 500 is currently about 50% higher than it was before the 1973-74 and 1987 plunges. While it's not a grand assumption to expect profit margins to normalize, we need not make that assumption to conclude that stocks are richly valued here. Even if current profit margins are sustained indefinitely, stocks would still be priced to deliver unsatisfactory long-term returns."

"Look at last Wednesday's report on third-quarter gross domestic product. Our government would have us believe that inflation was running at only 0.8%, which allowed the growth of real GDP to be 3.9%. If the government had calculated the annualized rate of inflation to be 3.9% (probably a low estimate), then real GDP growth would have been zero. One number cannot be incorrect without the other number being incorrect." "So while the government and the Fed pretend the U.S. doesn't have inflation problems, countries around the world are acknowledging their own and trying to deal with them. Of course, we have the weakest currency, so whatever problems the rest of the world has, we have in spades, though we've jiggered the statistics to mask that."

"Speaking of the inevitable result, Bloomberg reports that a mortgage fund managed by Cheyne Capital Management Ltd. Has just announced that it will fail to pay the interest immediately due on the commercial paper it issued to buy mortgages. Here’s the problem: If it tried to pay the interest, it would have to sell assets to raise the money. If it were to sell assets in an illiquid market, they would fall in value, making the collateral in the fund worth less. I’ll bet this company can’t wait for that call from the managers of the new super fund, that is, if it owns any top-rated mortgages." "Can you see how exquisite the conundrum is for the "investors" who lent money to this firm? If they ask for their rightful interest, their principal will fall. If they don’t ask for interest, they have no income. If they can’t sell the assets, in truth they have no principal." "The emperor has no clothes, but so far the stock market floats merrily unconcerned in a haze of unprecedented optimism. Someday that optimism will melt as fast as it did in the mortgage market."

The Candian dollar keeps chugging along. Today the CAD is buying 1.071 US dollars. Jim Rogers finally gets around to mentioning investing in Canada -

On its way to ICU -

Today's Gold -

Local gas n go is charging $2.89 for regular. Costco only marginally lower at $2.87.

Here it's $3.09 - $3.19 for the past week.

Currently sitting at about 2.9 silver dimes now, or 2 mercs, a war nickel and 4 copper pennies :-)

1942-1945 Nickel ** silver value $0.8574 increase 1714.92%

Yup, take the nickel from 1942 (partial year) to 1945 (oddly enough they turn up a lot more frequently than old regular ones because regular nickels read close to pull tabs, though I dig a shitload of those as sliders so as to not miss them, and gold). 0.8754 (current metal value)/0.05 (face) = 17.1492 (multiple of increase) X 100 for the percent. Of course, the increase is essentially since 1964 as ostensibly the circulation value and silver value was close or at parity then, but either way a 39.88% annualized average rate of return is nothing to sneeze at :-)

There are no replies to Comment # 49. End Trace Mode for Comment # 49.

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#2. To: All (#1)

#3. To: All (#2)

#4. To: All (#3)

#5. To: All (#4)

#17. To: All (#5)

#18. To: All (#17)

#19. To: All (#18)

#24. To: Arete (#19)

#44. To: angle (#24)

Here it's $3.09 - $3.19 for the past week.

#45. To: Axenolith (#44)

Does this make sense?

1916-1945 Mercury Dime value $1.1024 increase 1102.44%

1946-1964 Roosevelt Dime value $1.1024 increase 1102.44%

1932-1964 Quarter value $2.7561 increase 1102.44%

1916-1947 Half Dollar value $5.5122 increase 1102.44%

1948-1963 Half Dollar value $5.5122 increase 1102.44%

1964 Kennedy Half Dollar value $5.5122 increase 1102.44%

1965-1970 Half Dollar (40% silver) value $2.2538 increase 450.77%

1878-1921 Morgan Dollar value $11.7873 increase 1178.73%

1921-1935 Peace Dollar value $11.7873 increase 1178.73%

#49. To: DeaconBenjamin (#45)

Replies to Comment # 49.