See other Business/Finance Articles

Title: Market WrapUp (11-05-07)

Source:

Financial Sense Online

URL Source: http://www.financialsense.com/Market/wrapup.htm

Published: Nov 5, 2007

Author: Rob Kirby

Post Date: 2007-11-05 19:04:15 by Arete

Ping List: *unUsual Suspects* Subscribe to *unUsual Suspects*

Keywords: None

Views: 1970

Comments: 57

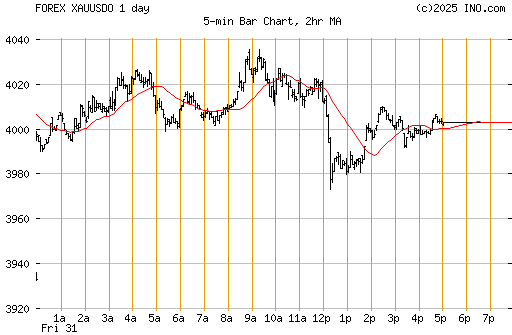

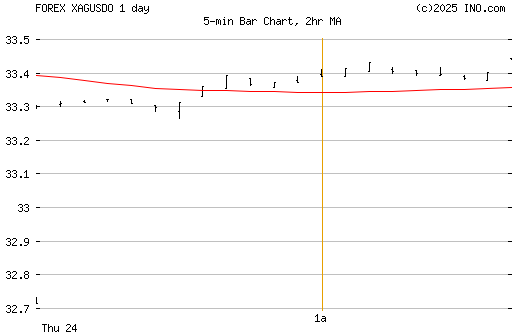

Financial Sense ® Home l Market Monitor l Market WrapUp l Storm Watch l About Us l Contact Us Today's Market WrapUp 11.05.2007 Mon Tue Wed Thu Fri Kirby Archive Musical Chairs at Citibank It’s out with the old and in with the new, or perhaps better stated, the ‘recycled.’ This past weekend Citibank Chairman, Charles Prince resigned. His replacement is none other than Robert Rubin. For those of you who with short memories, Mr. Rubin is a former Chair of Goldman Sachs, former U.S. Treasury Secretary in the Clinton Administration and last but not least – widely credited with the design, implementation and beating-of-the-drum of the heralded U.S. ‘strong dollar policy.’ Since Rubin’s tenure as Treasury Secretary it has become “custom” from that point forward that all who have followed him reiterate this theme – singing the strong dollar mantra. This dogma of the ‘strong dollar policy’ has come to be understood by many market participants as saying one thing while doing something-else completely opposite. A Paradox in Principle In an article written back in 2003 by TheStreet.com’s Aaron Task titled, Strong Dollar Is a Policy in Name Only, Task opines, Other than "I love you" and "You're under arrest," few three-word English phrases have as much significance as "strong dollar policy." Of late, however, singing the tune of the strong dollar policy tends to fly in the face of realities with the U.S. Dollar Index probing new historical lows. As recently as August 2006, current U.S. Treasury Secretary, Hank Paulson reiterated the familiar tune, "I believe that a strong dollar is in our nation's interest and that currency values should be determined in open and competitive markets in response to underlying fundamentals" Despite Mr. Paulson’s proclamation in support of a strong dollar, anecdotal evidence would tend to suggest otherwise: With Robert Rubin now beating the drum over at Citibank – that of Chairman – let’s hope that his assumed intentions of restoring the financial behemoth to financial strength and probity are followed up with a degree of transparency and meaningful change. Today’s Market Overseas equity markets began the week on a sour note with Japan’s Nikkei Index falling 248 points to 16,268. North American markets also stumbled with the DOW losing 51.70 to 13,543.40, the NASDAQ giving up 15.20 to 2,795.18 and the S & P down 7.50 to 1,502.15. NYMEX crude oil futures fell 1.28 to 94.65 per barrel. Interest rates ended a volatile day by rising 2 basis points across the curve with the benchmark 5 yr. bond ending the day at 3.97% and the 10 yr. bond finishing the day at 4.34%. On foreign exchange markets, the U.S. Dollar Index gained .08 to 76.38. The precious metals complex ended the day mixed with COMEX gold futures closing up 1.10 per ounce at 808.60 while COMEX silver futures added .14 to finish at 14.77 per ounce. Meanwhile, the XAU closed down 1.11 at 186.52 and the HUI fell 2.63 to end the day at 436.75. Wishing you all a pleasant evening and happy investing! Rob Kirby Copyright © 2007 All rights reserved. Contact Information Financial Sense ® Home l Market Monitor l Market WrapUp l Storm Watch l About Us l Contact Us

BY ROB KIRBY

Rob Kirby

Kirby Analytics Newsletter

Toronto, Ontario, Canada

Email | Website | WrapUp Archive | Financial Sense Editorial Archive

Copyright © James J. Puplava Financial Sense ® is a Registered Trademark

P. O. Box 503147 San Diego, CA 92150-3147 USA 858.487.3939

(3 images)

Subscribe to *unUsual Suspects*

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

Comments (1-17) not displayed.

.

.

.

#18. To: All (#17)

Today's Gold -

Local gas n go is charging $2.89 for regular. Costco only marginally lower at $2.87.

Hi Ho -

We're running 20 cents above you up here. Looks like the Oilgizer Bunny is off & running again today too. I wonder when somebody is going to blame this rise on the holiday driving season?

Oil will come down when the dollar goes up.

In smoke? The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

Here it's $3.09 - $3.19 for the past week.

I still have faith that the central planners will manage to save Christmas shopping season with lower gasoline prices. They still have a couple of weeks to engineer a major energy market top before pulling the rug out from under the oil market. I will be shocked, to put it mildly, if it doesn't happen this year. It would be like Santa died.

I filled up at $2.79 Sunday morning. It has since gone up a dime.

I see that chicky-poo is ready for the cost of natural gas & heating oil this winter.

The weatherman says that it is going to be in the 30's the next 3 nights. That's cold for this early in the season.

Inflation 1923-24: A German woman feeding a stove with currency notes, which burn longer than the amount of firewood they can buy.

The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

I'm thinkin' that if it doesn't happen by Thanksgiving, it ain't gonna happen.

Well, we've been getting these background stories about an "early" shopping season so maybe we don't get the traditional black Friday kickoff with all the staged Wal-Mart media reports showing out of control crowds bursting through their doors at opening.

The plan here is to dump as much cash as possible before it melts away. Spent about a grand on equipment in the last month. Met with my roofer last week when he flew back into town on a break. We'll probably be putting a new roof on my house as soon as he gets finished up with the job he's on in Alabama. Probably get my wife the flat-panel TeeVee she's been wanting this year too, if they have some deals. Figure I better use it or lose it.

Took a few minutes after the open put the HUI is now above VooDoo target of 443.

Both gold and silver have registered intraday indications that they are already on their next FIBO growth cycle. The broad gauge is now showing a triple in both. That's the 0 to 100% growth cycle.

NEW YORK (Reuters) - IndyMac Bancorp Inc (IMB.N: Quote, Profile, Research), one of the largest independent U.S. mortgage lenders, on Tuesday posted a quarterly loss more than five times larger than it had projected, hurt by mounting delinquencies and a collapse in investor demand to buy its home loans. The third-quarter net loss totaled $202.7 million, or $2.77 per share. It was IndyMac's first quarterly loss since the fourth quarter of 1998. Profit a year earlier was $86.2 million, or $1.19 per share.

IndyMac shares are up almost 10% on the bad news. Go figure.

Good afternoon Mr. da Wit. Wow, you Richard have the metals smokin' today. Partly on the basis of your TA, I added some Ag at the Asian opening price on Sunday. We're looking good. A tip of the hat to you.

Best price I saw in the Pittsburgh vicinity today was the 2.999 ( trying to hide $3 ). How'd you like those Steelers throwback uniforms, Richard ?

Thanks. Just noticed that my FIBOmeter on gold didn't show up so here it is.

How long have you been posting the WrapUp now? I seem to recall getting involved about 5 years ago (on TOS.)

#19. To: All (#18)

#20. To: All (#18)

#21. To: Arete (#19)

(Edited)

Mike Flaherty: Yeah, it's been there a long time. I wish I knew which corner.

#22. To: Esso (#21)

#23. To: Arete (#22)

Oil will come down when the dollar goes up.

#24. To: Arete (#19)

#25. To: angle, Esso (#24)

#26. To: angle (#24)

Here it's $3.09 - $3.19 for the past week.

#27. To: DeaconBenjamin (#23)

Mike Flaherty: Yeah, it's been there a long time. I wish I knew which corner.

#28. To: Esso (#27)

#29. To: Esso (#27)

#30. To: Arete (#25)

I still have faith that the central planners will manage to save Christmas shopping season with lower gasoline prices. They still have a couple of weeks to engineer a major energy market top before pulling the rug out from under the oil market. I will be shocked, to put it mildly, if it doesn't happen this year. It would be like Santa died.

Mike Flaherty: Yeah, it's been there a long time. I wish I knew which corner.

#31. To: Esso (#30)

#32. To: Arete (#31)

Mike Flaherty: Yeah, it's been there a long time. I wish I knew which corner.

#33. To: Arete (#31)

BINGO !

#34. To: All (#33)

Next FIBO leg up.

#35. To: All (#31)

#36. To: All (#35)

#37. To: imawit (#10)

#38. To: Arete (#19)

Gasoline

#39. To: Dukie (#37)

We're looking good. A tip of the hat to you.

#40. To: Arete (#1)

| Government Warning: The Attorney General has determined that Federal Regulation may be hazardous to your health |

#41. To: All (#32)

Filled up the work truck today. 67 gal@$3.089 - $207. From the looks of the NYMEX, gas will go up 12 to 22 cents here in FTW tomorrow. Passenger car diesel is at $3.599. Wow. Don't know where tax exempt diesel is.

Mike Flaherty: Yeah, it's been there a long time. I wish I knew which corner.

#42. To: sourcery (#40)

I honestly don't know myself but 5 years seems like a pretty good guess.

How long have you been posting the WrapUp now? I seem to recall getting involved about 5 years ago (on TOS.)

#43. To: imawit (#15)

How about freakin' Hecla today!?!? Up 14%. ILDS.PK, a holder of an adjacent property they contract mine is pretty interesting too. Appears Hecla needs to do some system upgrading because their Lucky Friday equipment is old as crap and losing a hell of a lot of material...

You know how this all ends right? It ends with all of us screaming and thrusting bayonettes and bullets into each others guts while fat elites from both "parties" sit back behind their walled compounds and governmment complexes and count the money and wealth they skimmed off us before we begin to "cull" ourselves...

#44. To: angle (#24)

Currently sitting at about 2.9 silver dimes now, or 2 mercs, a war nickel and 4 copper pennies :-)

Here it's $3.09 - $3.19 for the past week.

You know how this all ends right? It ends with all of us screaming and thrusting bayonettes and bullets into each others guts while fat elites from both "parties" sit back behind their walled compounds and governmment complexes and count the money and wealth they skimmed off us before we begin to "cull" ourselves...

#45. To: Axenolith (#44)

1942-1945 Nickel ** silver value $0.8574 increase 1714.92%Does this make sense?

1916-1945 Mercury Dime value $1.1024 increase 1102.44%

1946-1964 Roosevelt Dime value $1.1024 increase 1102.44%

1932-1964 Quarter value $2.7561 increase 1102.44%

1916-1947 Half Dollar value $5.5122 increase 1102.44%

1948-1963 Half Dollar value $5.5122 increase 1102.44%

1964 Kennedy Half Dollar value $5.5122 increase 1102.44%

1965-1970 Half Dollar (40% silver) value $2.2538 increase 450.77%

1878-1921 Morgan Dollar value $11.7873 increase 1178.73%

1921-1935 Peace Dollar value $11.7873 increase 1178.73%

The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

#46. To: All (#45)

American Gold Eagle http://www.coinsite.com/

1/2 Oz. bid $407.30 ask $433.30

1/4 Oz. bid $202.65 ask $219.65

1/10 Oz. bid $81.44 ask $89.06

Silver American Eagle Bid $16.08 ask $17.08

Silver Maple Leaf Bid $15.37 ask$17.11

90% Silver Bags bid $10,585.44 ask $10,821.69

The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

#47. To: Arete (#42)

How about some sort of party/celebration commemorating 5 years of The Wrap Up?

| Government Warning: The Attorney General has determined that Federal Regulation may be hazardous to your health |

#48. To: sourcery (#47)

I'll second the motion. The Wrap must hold some sort of record .... longest running migratory financial thread ( on at least 3 sites ). A tribute to Richard's posting dedication. I should drop a note to Jim Puplava to inform him of all the free publicity that FSO has garnered.

5 years of The Wrap Up?

#49. To: DeaconBenjamin (#45)

Yup, take the nickel from 1942 (partial year) to 1945 (oddly enough they turn up a lot more frequently than old regular ones because regular nickels read close to pull tabs, though I dig a shitload of those as sliders so as to not miss them, and gold). 0.8754 (current metal value)/0.05 (face) = 17.1492 (multiple of increase) X 100 for the percent. Of course, the increase is essentially since 1964 as ostensibly the circulation value and silver value was close or at parity then, but either way a 39.88% annualized average rate of return is nothing to sneeze at :-)

Peas porridge hot, peas porridge cold, peas porridge is what you'll eat because it's what the damn STATE tells you to!

#50. To: sourcery (#47)

What did you have in mind?

How about some sort of party/celebration commemorating 5 years of The Wrap Up?

#51. To: Arete (#42)

Here's an old one:

#52. To: Soren (#51)

Oil at $27. Ha!

#53. To: Soren, Arete (#51)

So, more than 5 1/2 years already. Those price quotes were surreal.

| Government Warning: The Attorney General has determined that Federal Regulation may be hazardous to your health |

#54. To: Arete (#50)

Not sure. Perhaps a special "Market WrapUp Anniversary Thread." Perhaps a virtual party, with the participants connected via Skype (chat or voice.) Let's give it some thought.

What did you have in mind?

| Government Warning: The Attorney General has determined that Federal Regulation may be hazardous to your health |

#55. To: sourcery (#53)

Yes, but rohry was posting the WrapUp back then. Not sure when I took over. I'm not much of a party planner but if you come up with something, I'm good at participation. LOL

So, more than 5 1/2 years already.

#56. To: Arete (#55)

Ooof. I had completely forgotten about rohry. And I no longer remember how/ why you took over from him.

Yes, but rohry was posting the WrapUp back then.

| Government Warning: The Attorney General has determined that Federal Regulation may be hazardous to your health |

#57. To: sourcery (#56)

He just simply tired of posting the WrapUp and I decided that it was worth my time to keep it going. That was it.

And I no longer remember how/ why you took over from him.

Top • Page Up • Full Thread • Page Down • Bottom/Latest