See other Business/Finance Articles

Title: Market WrapUp (11-05-07)

Source:

Financial Sense Online

URL Source: http://www.financialsense.com/Market/wrapup.htm

Published: Nov 5, 2007

Author: Rob Kirby

Post Date: 2007-11-05 19:04:15 by Arete

Ping List: *unUsual Suspects* Subscribe to *unUsual Suspects*

Keywords: None

Views: 1668

Comments: 57

Financial Sense ® Home l Market Monitor l Market WrapUp l Storm Watch l About Us l Contact Us Today's Market WrapUp 11.05.2007 Mon Tue Wed Thu Fri Kirby Archive Musical Chairs at Citibank It’s out with the old and in with the new, or perhaps better stated, the ‘recycled.’ This past weekend Citibank Chairman, Charles Prince resigned. His replacement is none other than Robert Rubin. For those of you who with short memories, Mr. Rubin is a former Chair of Goldman Sachs, former U.S. Treasury Secretary in the Clinton Administration and last but not least – widely credited with the design, implementation and beating-of-the-drum of the heralded U.S. ‘strong dollar policy.’ Since Rubin’s tenure as Treasury Secretary it has become “custom” from that point forward that all who have followed him reiterate this theme – singing the strong dollar mantra. This dogma of the ‘strong dollar policy’ has come to be understood by many market participants as saying one thing while doing something-else completely opposite. A Paradox in Principle In an article written back in 2003 by TheStreet.com’s Aaron Task titled, Strong Dollar Is a Policy in Name Only, Task opines, Other than "I love you" and "You're under arrest," few three-word English phrases have as much significance as "strong dollar policy." Of late, however, singing the tune of the strong dollar policy tends to fly in the face of realities with the U.S. Dollar Index probing new historical lows. As recently as August 2006, current U.S. Treasury Secretary, Hank Paulson reiterated the familiar tune, "I believe that a strong dollar is in our nation's interest and that currency values should be determined in open and competitive markets in response to underlying fundamentals" Despite Mr. Paulson’s proclamation in support of a strong dollar, anecdotal evidence would tend to suggest otherwise: With Robert Rubin now beating the drum over at Citibank – that of Chairman – let’s hope that his assumed intentions of restoring the financial behemoth to financial strength and probity are followed up with a degree of transparency and meaningful change. Today’s Market Overseas equity markets began the week on a sour note with Japan’s Nikkei Index falling 248 points to 16,268. North American markets also stumbled with the DOW losing 51.70 to 13,543.40, the NASDAQ giving up 15.20 to 2,795.18 and the S & P down 7.50 to 1,502.15. NYMEX crude oil futures fell 1.28 to 94.65 per barrel. Interest rates ended a volatile day by rising 2 basis points across the curve with the benchmark 5 yr. bond ending the day at 3.97% and the 10 yr. bond finishing the day at 4.34%. On foreign exchange markets, the U.S. Dollar Index gained .08 to 76.38. The precious metals complex ended the day mixed with COMEX gold futures closing up 1.10 per ounce at 808.60 while COMEX silver futures added .14 to finish at 14.77 per ounce. Meanwhile, the XAU closed down 1.11 at 186.52 and the HUI fell 2.63 to end the day at 436.75. Wishing you all a pleasant evening and happy investing! Rob Kirby Copyright © 2007 All rights reserved. Contact Information Financial Sense ® Home l Market Monitor l Market WrapUp l Storm Watch l About Us l Contact Us

BY ROB KIRBY

Rob Kirby

Kirby Analytics Newsletter

Toronto, Ontario, Canada

Email | Website | WrapUp Archive | Financial Sense Editorial Archive

Copyright © James J. Puplava Financial Sense ® is a Registered Trademark

P. O. Box 503147 San Diego, CA 92150-3147 USA 858.487.3939

(3 images)

Subscribe to *unUsual Suspects*

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: All (#0)

Market WrapUp is Delivered! Other news, views and commentary - U.S. Economy: Services Growth Unexpectedly Quickens PetroChina's Value Tops $1 Trillion, Surpassing Exxon Google Plans Mobile-Phone Operating System to Expand Beyond Web Bond Risk Jumps to Highest Since August on Citigroup Writedowns Weill's Profit Machine Breaks Down on Citi Writedowns PIMCO: Fed "can't afford" to let housing crack Fed's Mishkin: Fed must be ready to take back cuts COTs Still Bullish Silver & Some Gold Stock... But Not All INTUITIVE TRADING: FACT OR FICTION? Part 1 THE WEEK AHEAD IN THE FINANCIAL MARKETS THE ELLIOTT WAVE GOLD DEBATE IS OVER STOCK MARKET UPDATE: US Stocks Long-term Uptrend Remains Healthy BIG BANG THEORY by Peter Navarro IS THERE DANGER IN THIS GOLD RUN? THE GOLD PRICE AND WAR IN THE MID EAST GOLD IS A WIN Win Proposition by Captain Hook

"Presently, the trend of Treasury yields is constructive, but that trend is in the context of very overbought conditions in bonds, born of increasing concerns about mortgage delinquencies and securitized debt. Meanwhile, stock valuations are quite high even without normalizing for profit margins. Normalizing for profit margins, the current P/E on the S&P 500 would be well above 20. To get an idea of where valuations are adjusting for the level of profit margins, it's notable that the price/revenue multiple on the S&P 500 is currently about 50% higher than it was before the 1973-74 and 1987 plunges. While it's not a grand assumption to expect profit margins to normalize, we need not make that assumption to conclude that stocks are richly valued here. Even if current profit margins are sustained indefinitely, stocks would still be priced to deliver unsatisfactory long-term returns."

"Look at last Wednesday's report on third-quarter gross domestic product. Our government would have us believe that inflation was running at only 0.8%, which allowed the growth of real GDP to be 3.9%. If the government had calculated the annualized rate of inflation to be 3.9% (probably a low estimate), then real GDP growth would have been zero. One number cannot be incorrect without the other number being incorrect." "So while the government and the Fed pretend the U.S. doesn't have inflation problems, countries around the world are acknowledging their own and trying to deal with them. Of course, we have the weakest currency, so whatever problems the rest of the world has, we have in spades, though we've jiggered the statistics to mask that."

"Speaking of the inevitable result, Bloomberg reports that a mortgage fund managed by Cheyne Capital Management Ltd. Has just announced that it will fail to pay the interest immediately due on the commercial paper it issued to buy mortgages. Here’s the problem: If it tried to pay the interest, it would have to sell assets to raise the money. If it were to sell assets in an illiquid market, they would fall in value, making the collateral in the fund worth less. I’ll bet this company can’t wait for that call from the managers of the new super fund, that is, if it owns any top-rated mortgages." "Can you see how exquisite the conundrum is for the "investors" who lent money to this firm? If they ask for their rightful interest, their principal will fall. If they don’t ask for interest, they have no income. If they can’t sell the assets, in truth they have no principal." "The emperor has no clothes, but so far the stock market floats merrily unconcerned in a haze of unprecedented optimism. Someday that optimism will melt as fast as it did in the mortgage market."

The Candian dollar keeps chugging along. Today the CAD is buying 1.071 US dollars. Jim Rogers finally gets around to mentioning investing in Canada -

But, Yo Axe, what's up with GoldSpring, Inc. ? It was up 160% last week and did the 19+% today.

Boy, Prechter is really revelling with this situation. It's an all to common one though .... 'Damned if you do and damned if you don't' Then there is the one that the 'Elite of the Planet' have been trying to sell for decades if not generations, 'you're a damned fool if you buy gold. It has no return, only an expense for storage'.

This reminds me of the people who didn't want to look at their brokerage statements during the last market nosedive. Financial "let's pretend" games for the delusional.

Credit Suisse believes a change in the dynamics surrounding gold supply and demand may trigger ‘a quantum upward change in the gold price.’ Is there any other kind of jump than a "quantum" jump. Everybody seems to like the word "quantum", most notably Soros & Rogers. Gap up sounds better to me. Back later - have to see what the Steelers are doing.

There is always the 'quantum dump'. But then that's something we don't want to see or talk about either. Especially when the subject is dah Dollah. In order to make things more simple, I have put in the last FIBO cycle, the 3rd one going from 85.00 to 75.00. Easily seen is that the Dollar approached the triple triple mark of 76.46 and bumped its head. Now that we have another 'crazy' Monday behind us, look for dah Dollah to drop not dump into the channel. Here's the 3 sets of FIBOs again for reference. Courtesy of P. 'Fearless Leader' da Wit

Sister-in-law so far likes Singapore better than Switzerland. Stores are open 'till 10pm, and everybody speaks English. But she's only been there a few days. I reminded her to not litter.

#2. To: All (#1)

#3. To: All (#2)

#4. To: All (#3)

#5. To: All (#4)

#6. To: Axenolith, Arete (#1)

Don't mean to snub you Richard.

#7. To: Arete (#4)

"Can you see how exquisite the conundrum is for the "investors" who lent money to this firm?

#8. To: Arete, imawit (#4)

"Can you see how exquisite the conundrum is for the "investors" who lent money to this firm? If they ask for their rightful interest, their principal will fall. If they don’t ask for interest, they have no income. If they can’t sell the assets, in truth they have no principal."

#9. To: imawit, Arete (#7)

#10. To: Dukie (#9)

Is there any other kind of jump than a "quantum" jump.

#11. To: Arete (#1)

| Semper Libertas Virtute perennis |

#12. To: Arete (#3)

Well, the 1/4 point was a "compromise", fighting inflation would force rates to 8 or 10% and putting the brakes on the housing slump (for Pimco in the link above) would require a crack bowl, not the current punch bowl which will only cause some more sane and sellable part of the market to go drunk on mergers.

Why in the hell was the central bank easing the federal funds rate with (1) the dollar at a new low, (2) oil at $90, (3) gold at $800, (4) virtually every commodity on the planet going wild and (5), despite government statistics to the contrary, inflation raging?

Money problems do not come from a lack of money, but from living an excessive, unrealistic lifestyle

#13. To: All (#10)

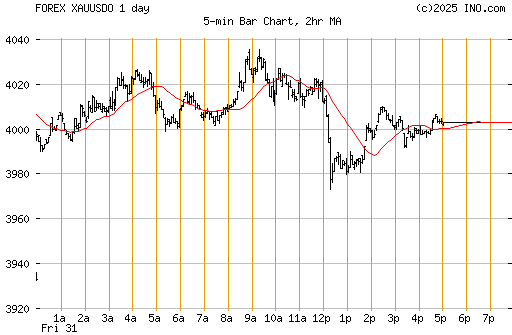

At one point everything was going swimmingly ... then it wasn't. Well gold went past the target did all of the serpentine about it stuff but left out closing above it. Hey, like I said, crazy Monday. However the 6 month chart now shows that it needed this Monday to put the next fuchsia line in play. And that says Target tomorrow. It's getting harder and harder to know where the lime lines go because INO only has a 6 month before they jump to the 1yr and StockCharts is worthless. They average too heavily and by doing so obscure what really happened each day. Here's the daily POG. Looks like another very major characteristic change. I barely got da Boyz target on the screen. It's buried in 'fat chance' land. There have been some very easily noticed huge characteristic changes in the last 7 trading days. I would hazard a statement that it looks like it may be all over for da Boyz. Especially now that the Yen is also rising against the Dollar and Japan is saying their rates need to rise too. You don't think that they're still stuck on being the land of the rising sun do you ? Here's a peak at the whole up tick, no jumps and no gap ups. Just pure launch. As you can see I really had to squeeze to get this on the screen. Probably because it's all linear, no log interpretations. Courtesy of P. 'Fearless Leader' da Wit

Now for gold.

#14. To: imawit (#6)

People are probably buying craploads to come out with significant quantities after a reverse split. I know I want to, heck up to what, 10000 shares, it's transaction costs :-) Other side of a split with positive cash flow and what, 1/2 million plus ounces or more proven, they should be a 3 or 4 dollar stock eventually... Hell, if it was a 1 for 10 reverse split with $1000 ounce gold, that would give them a book of around 8 bucks a share (someone might want to check that math, it's "on the fly" math).

You know how this all ends right? It ends with all of us screaming and thrusting bayonettes and bullets into each others guts while fat elites from both "parties" sit back behind their walled compounds and governmment complexes and count the money and wealth they skimmed off us before we begin to "cull" ourselves...

#15. To: Axenolith (#14)

I was crawling all around over the weekend and couldn't find anything. Not a mention of proven let alone forecast or predicted ounces. Anyway I bought some today and made the 19+%. Not bad for the time it took to make a dozen or so keystrokes.

... 1/2 million plus ounces or more proven ...

#16. To: All (#15)

I didn't have to wait til 7-8am NYT. Easily seen is that POG has found the last fuchsia line and is adhering to its command. I even more get the notion that it's all over for da Boyz. At this point they can only slow it down. They have no ability to reach their target as shown in the daily above and that number is $776. Courtesy of P. 'Fearless Leader' da Wit

Well it came early tonight.

#17. To: All (#5)

On its way to ICU -

#18. To: All (#17)

Today's Gold -

#19. To: All (#18)

Local gas n go is charging $2.89 for regular. Costco only marginally lower at $2.87.

#20. To: All (#18)

Hi Ho -

#21. To: Arete (#19) (Edited)

We're running 20 cents above you up here. Looks like the Oilgizer Bunny is off & running again today too. I wonder when somebody is going to blame this rise on the holiday driving season?

Mike Flaherty: Yeah, it's been there a long time. I wish I knew which corner.

#22. To: Esso (#21)

Oil will come down when the dollar goes up.

#23. To: Arete (#22)

In smoke? Oil will come down when the dollar goes up.

The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

#24. To: Arete (#19)

Here it's $3.09 - $3.19 for the past week.

#25. To: angle, Esso (#24)

I still have faith that the central planners will manage to save Christmas shopping season with lower gasoline prices. They still have a couple of weeks to engineer a major energy market top before pulling the rug out from under the oil market. I will be shocked, to put it mildly, if it doesn't happen this year. It would be like Santa died.

#26. To: angle (#24)

I filled up at $2.79 Sunday morning. It has since gone up a dime.

Here it's $3.09 - $3.19 for the past week.

#27. To: DeaconBenjamin (#23)

I see that chicky-poo is ready for the cost of natural gas & heating oil this winter.

Mike Flaherty: Yeah, it's been there a long time. I wish I knew which corner.

#28. To: Esso (#27)

The weatherman says that it is going to be in the 30's the next 3 nights. That's cold for this early in the season.

#29. To: Esso (#27)

Inflation 1923-24: A German woman feeding a stove with currency notes, which burn longer than the amount of firewood they can buy.

The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

#30. To: Arete (#25)

I'm thinkin' that if it doesn't happen by Thanksgiving, it ain't gonna happen.

I still have faith that the central planners will manage to save Christmas shopping season with lower gasoline prices. They still have a couple of weeks to engineer a major energy market top before pulling the rug out from under the oil market. I will be shocked, to put it mildly, if it doesn't happen this year. It would be like Santa died.

Mike Flaherty: Yeah, it's been there a long time. I wish I knew which corner.

#31. To: Esso (#30)

Well, we've been getting these background stories about an "early" shopping season so maybe we don't get the traditional black Friday kickoff with all the staged Wal-Mart media reports showing out of control crowds bursting through their doors at opening.

#32. To: Arete (#31)

The plan here is to dump as much cash as possible before it melts away. Spent about a grand on equipment in the last month. Met with my roofer last week when he flew back into town on a break. We'll probably be putting a new roof on my house as soon as he gets finished up with the job he's on in Alabama. Probably get my wife the flat-panel TeeVee she's been wanting this year too, if they have some deals. Figure I better use it or lose it.

Mike Flaherty: Yeah, it's been there a long time. I wish I knew which corner.

#33. To: Arete (#31)

Took a few minutes after the open put the HUI is now above VooDoo target of 443.

BINGO !

#34. To: All (#33)

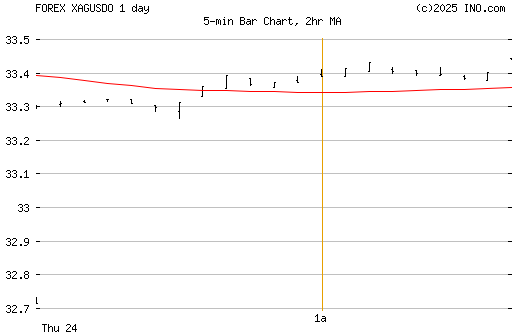

Both gold and silver have registered intraday indications that they are already on their next FIBO growth cycle. The broad gauge is now showing a triple in both. That's the 0 to 100% growth cycle. Next FIBO leg up.

#35. To: All (#31)

NEW YORK (Reuters) - IndyMac Bancorp Inc (IMB.N: Quote, Profile, Research), one of the largest independent U.S. mortgage lenders, on Tuesday posted a quarterly loss more than five times larger than it had projected, hurt by mounting delinquencies and a collapse in investor demand to buy its home loans. The third-quarter net loss totaled $202.7 million, or $2.77 per share. It was IndyMac's first quarterly loss since the fourth quarter of 1998. Profit a year earlier was $86.2 million, or $1.19 per share.

#36. To: All (#35)

IndyMac shares are up almost 10% on the bad news. Go figure.

#37. To: imawit (#10)

Good afternoon Mr. da Wit. Wow, you Richard have the metals smokin' today. Partly on the basis of your TA, I added some Ag at the Asian opening price on Sunday. We're looking good. A tip of the hat to you.

#38. To: Arete (#19)

Best price I saw in the Pittsburgh vicinity today was the 2.999 ( trying to hide $3 ). How'd you like those Steelers throwback uniforms, Richard ?

Gasoline

#39. To: Dukie (#37)

Thanks. Just noticed that my FIBOmeter on gold didn't show up so here it is. We're looking good. A tip of the hat to you.

#40. To: Arete (#1)

How long have you been posting the WrapUp now? I seem to recall getting involved about 5 years ago (on TOS.)

| Government Warning: The Attorney General has determined that Federal Regulation may be hazardous to your health |

.

.

.

Comments (41 - 57) not displayed.

Top • Page Up • Full Thread • Page Down • Bottom/Latest