See other Resistance Articles

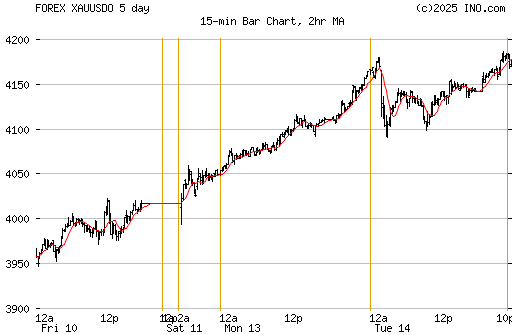

Title: gold fixing to retrace, commodities selling off

Source:

[None]

URL Source: http://www.ino.com

Published: Mar 17, 2008

Author: none

Post Date: 2008-03-17 21:02:32 by gengis gandhi

Keywords: None

Views: 299

Comments: 24

as I pointed out over the weekend, gold and commodities are way fucking overbought. If you are going long now you are going to take a haircut. If gold busts 990, which I think likely, you can expect it to retrace to about 950 and from their to 900. They gapped it up today at the open and it filled its gap, which indicates that the smart money is moving away and taking profits while joe and susie taterfuck are running in to buy the top. many other commodities today closed limit down, meaning they are selling like twelve bastards and even oil is topping. smells a whole lot like a bottom forming, but we shall see. here is some gear from ino.com about the commodities today. of course, its not as sexy as running around apeshit stocking up on brass casings and jim beam and hiding in the basement, but it is what it is. May silver closed lower on Monday and below the 10-day moving average crossing at 20.189 hinting that a double top with the March 6th high might have been posted today. The low-range close sets the stage for a steady to lower opening on Tuesday. Stochastics and the RSI are bullish but diverging hinting that a short-term top might be in or is near. If May extends this winter's rally, monthly resistance crossing at 22.51 is the next upside target. Closes below the 20-day moving average crossing at 19.487 are needed to confirm that a short-term top has been posted. First resistance is today's high crossing at 21.440 then monthly resistance crossing at 22.51. First support is today's low crossing at 19.800 then the 20-day moving average crossing at 19.488. May copper closed sharply lower on Monday and below the 20-day moving average crossing at 382.64 confirming that a short- term top has been posted. The low-range close sets the stage for a steady to lower opening on Tuesday. Stochastics and the RSI remain neutral to bearish signaling that sideways to lower prices are possible near-term. If May extends this week's decline, the 38% retracement level of the December-March rally crossing at 358.50 is the next downside target. First resistance is last Friday's high crossing at 390.00. Second resistance is March's high crossing at 402.40. First support is today's low crossing at 365.40. Second support is the 38% retracement level crossing at 358.50. FOOD & FIBER http://quotes.ino.com/exchanges/?c=food May coffee closed sharply lower on Monday and below the 62% retracement level of the May-February rally crossing at 13.805. Today's broad based sell off in commodities in general largely contributed to today's huge decline in May coffee. Nevertheless, the low-range close sets the stage for a steady to lower opening on Tuesday. If May extends this month's decline, the 75% retracement level of the May-February rally crossing at 13.081 is the next downside target. Stochastics and the RSI are neutral signaling that sideways to lower prices are possible near-term. Closes above last Friday's high crossing at 15.990 are needed to confirm that a short-term low has been posted. May cocoa closed sharply lower and below the 20-day moving average crossing at 27.06 on Monday confirming that a short- term top has been posted. The low-range close sets the stage for a steady to lower opening on Tuesday. Stochastics and the RSI are diverging and are turning neutral to bearish signaling that sideways to lower prices are possible near-term. If May extends today's decline, the 38% retracement level of the August-March rally crossing at 25.19 is the next downside target. Closes above the 10-day moving average crossing at 27.79 would confirm that a short-term low has been posted. May sugar closed sharply lower on Monday and below the 50% retracement level of the August-February rally crossing at 12.24 as it extends this month's decline. The low-range close set the stage for a steady to lower opening on Tuesday. Stochastics and the RSI are neutral signaling that sideways to lower prices are possible near-term. If May extends this month's decline, the 62% retracement level of the August-February rally crossing at 11.57 is the next downside target. Closes above the 20-day moving average crossing at 13.96 are needed to confirm that a short-term low has been posted. May cotton closed limit down on Monday as it renewed this month's decline. The low-range close sets the stage for a steady to lower opening on Tuesday. Stochastics and the RSI remain neutral to bearish signaling that sideways to lower prices are possible near-term. If May extends this month's decline, the February 22nd gap crossing at 75.12 is the next downside target. Closes above the 10-day moving average crossing at 82.07 would confirm that a short-term low has been posted. GRAINS http://quotes.ino.com/exchanges/?c=grains May corn closed down 20-cents at 5.39 1/4. May corn closed limit down on Monday due to broad-based commodity selling amid speculative liquidation linked to economic turmoil. Traders are looking to reduce exposure in investments in the midst of a global credit crunch. Today's low-range close sets the stage for a steady to lower opening on Tuesday. Stochastics and the RSI are diverging and are turning bearish signaling that sideways to lower prices are possible near-term. Closes below last Monday's low crossing at 5.27 1/4 are needed to confirm that a short-term top has been posted. If May extends this winter's rally, 6.10 is the next upside projected target. First resistance is the 20-day moving average crossing at 5.52 3/4. Second resistance is last week's high crossing at 5.79 1/2. First support begins with today's low crossing at 5.39 1/4. The second support begins with last Monday's low crossing at 5.27 1/4. May wheat closed down 60-cents at 11.31 1/2. May wheat closed limit down on Monday as fears about the economy caused long liquidation in a number of markets. Traders are now more focused on risk aversion than market supply-demand fundamentals. Today's decline lead to a close below the 20- day moving average crossing at 11.39 1/2 confirms that last week's high marked a double top with February's high. The low- range close sets the stage for a steady to lower opening on Tuesday. Stochastics and the RSI are turning bearish signaling that sideways to lower prices are possible. If May extends this week's decline, March's low crossing at 10.56 is the next downside target. May Kansas City Wheat closed down 60-cents at 12.00. May Kansas City Wheat closed limit down on Friday and below the 10-day moving average crossing at 12.22 3/4 signaling that a double top with February's high was posted last week. The low-range close sets the stage for a steady to lower opening on Tuesday. Stochastics and the RSI are turning bearish signaling that sideways to lower prices are possible near-term. If May extends this week's decline, the 20-day moving average crossing at 11.94 1/2 is the next downside target. Closes below the 20- day moving average crossing at 11.94 1/2 are needed to confirm that a major top has been posted. May Minneapolis wheat closed down 59 3/4-cents at 13.90. May Minneapolis wheat closed sharply lower on Monday and below the 10-day moving average crossing at 14.26. The low- range close sets the stage for a steady to lower opening on Tuesday. Stochastics and the RSI are turning neutral signaling that sideways to lower prices are possible near-term. If May renews this month's decline, the 62% retracement level of the November-February rally crossing at 12.10 1/2 is the next downside target. Closes above the 20-day moving average crossing at 15.31 are needed to confirm that a short-term low has been posted. SOYBEAN COMPLEX May soybeans closed down 50-cents at 13.02 3/4. May soybeans closed limit down on Friday as traders and trading funds dumped commodities in general due to heightened concern over the financial crisis. With the exception of a few markets most commodities were sharply lower today as traders headed for the exits to lower their risk exposure in markets in general. This is a money game as the market's attention has shifted from current market fundamentals. Today's decline below the reaction low crossing at 13.25 has opened the door for a possible test of the 38% retracement level of the 2007-2008 rally crossing at 12.54 1/4. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. Today's low-range close sets the stage for a steady to lower opening on Tuesday. Closes above the 20-day moving average crossing at 14.44 1/4 are needed to confirm that a short-term low has been posted. May soybean meal closed down $20.00 at $323.80. May soybean meal closed limit down on Monday and below January's low crossing at 329.50. The low-range close set the stage for a steady to lower opening on Tuesday. Stochastics and the RSI are bearish signaling that sideways to lower prices are possible near-term. If May extends this month's decline, the 38% retracement level of the 2006-2008 rally crossing at 319.40 is the next downside target. Closes above the 20-day moving average crossing at 365.30 would signal that a short-term low has been posted. May soybean oil closed down 200 pts. at 58.56. May soybean oil closed limit down on Monday as it extends this month's decline. The low-range close sets the stage for a steady to lower opening on Tuesday. Stochastics and the RSI are oversold but remain bearish signaling that sideways to lower prices are possible near-term. If May extends this week's decline, the 38% retracement level of the August-March rally crossing at 57.36 is the next downside target. Closes above the 20-day moving average crossing at 64.17 would confirm that a short-term low has been posted. LIVESTOCK http://quotes.ino.com/exchanges/?c=livestock April hogs closed up $0.90 at $55.92. April hogs posted an inside day with a higher close on Monday as it consolidated some of last Friday's decline but failed to fill the gap crossing at 56.90. The mid-range close sets the stage for a steady opening on Tuesday. Stochastics and the RSI are oversold but are neutral signaling that sideways to lower prices are possible near-term. If April extends this winter's decline, weekly support crossing at 53.90 is the next downside target. Closes above the 20-day moving average crossing at 59.51 are needed to confirm that a short-term low has been posted. First resistance is the 10-day moving average crossing at 57.08. Second resistance is the 20-day moving average crossing at 59.51. First support is last Friday's low crossing at 54.70 then weekly support crossing at 53.90. May bellies closed down $0.55 at $79.52. May bellies closed lower on Monday as it extends last week's breakout below October's low crossing at 81.80. The low-range close sets the stage for a steady to lower opening on Tuesday. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If May extends this month's decline, monthly support crossing at 74.00 is the next downside target. Closes above gap resistance crossing at 84.05 would confirm that a short-term low has been posted. April cattle closed down $1.27 at 89.22. April cattle closed lower on Monday renewing this month's decline. The low-range close sets the stage for a steady to lower opening on Tuesday. Stochastics and the RSI are oversold but are neutral signaling that additional weakness is possible near- term. If April extends this month's decline, monthly support crossing at 87.12 is the next downside target. Closes above the 20- day moving average crossing at 92.27 are needed to confirm that a short-term low has been posted. April feeder cattle closed down $0.80 at $101.70. April Feeder cattle closed lower on Monday as it extends this winter's decline below broken support marked by January's low crossing at 102.70. The low-range close sets the stage for a steady to lower opening on Tuesday. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If March extends this month's decline, monthly support crossing at 98.99 is the next downside target. Closes above the 20-day moving average crossing at 105.29 are needed to confirm that a short-term low has been posted. Learn about these markets from hundred of experts. Check out InvestorFLIX at http://www.investorflix.com/ E X T R E M E F U T U R E S Updated every 10 minutes around the clock. More at http://quotes.ino.com/analysis/extremes/futures/

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: gengis gandhi (#0)

I don't know what you are smoking but from where I sit Gold is extremely undervalued now. I am buying right now all I can.

God is always good!

that really doesn't surprise me in the least.

Many believe in either intelligent design or evolution...but I am opting for unintelligent design, where god is a retarded kid who likes setting army men on fire and leaving his toys out in the rain. Gengis Gandhi, Troubled Genius

Everytime someone a "pump and dump" CNBC or Cramer type hammers gold or gold stocks I love it first because I don't own enough and every down turn gives me a chance to own more gold or stocks at a cheaper price for instance Silver Weaton was off 7% today even after reports it had secured a 600,000 oz per year deal with a Arizona Silver mine for under $4.00 per oz....bring it on... I'll back the truck up on this one till the cows come home

unless you have it in your basement, its all paper.

Many believe in either intelligent design or evolution...but I am opting for unintelligent design, where god is a retarded kid who likes setting army men on fire and leaving his toys out in the rain. Gengis Gandhi, Troubled Genius

I bought canadian 99% pure maple leaf one ounce coins when gold was around 400. silver ingots and rounds when it was below ten. people buy precious metals as a hedge against a catastrophe, but if its only paper you really are at the disadvantage of any other paper asset. you can't make em pay up if you want the hard asset.

Many believe in either intelligent design or evolution...but I am opting for unintelligent design, where god is a retarded kid who likes setting army men on fire and leaving his toys out in the rain. Gengis Gandhi, Troubled Genius

I have plenty physical just making a point that every time they hammer it I buy it!

Well, Cramer sure had it right on BSC now didn't he. /s

"Cheney considered the hunting trip when he shot his friend in the face successful."- Sodie Pop

If gold is overbought at this point, a 24 hour chart won't show it. Anything is possible. With credit money vanishing into thin air, monetary contraction may make gold drop in price like any commodity, however, if competing investments all go sour, gold could be propped up by absorbing a sea of investors looking for alternatives as they abandon contemporary investments. So gold could conceivably rise in $ price even in a deflationary environment. Or if not, it should at least fair better in everything but green cash. (Assuming deflation). I think even if you are right gold remains a safe investment, compared to most of what's out there.

Pinguinite.com EcuadorTreasures.ec

This would be my strategy.

And the men who loan money to governments, so called, for the purpose of enabling the latter to rob, enslave, and murder their people, are among the greatest villains that the world has ever seen. And they as much deserve to be hunted and killed (if they cannot otherwise be got rid of) as any slave traders, robbers, or pirates that ever lived. ... Lysander Spooner

I watched that the question asked was his money safe at BS Cramer said yes and it was he did not ask about BS stock....lot of folks have money at BS but not in its stock as a aside had Cramer told him to sell....thousands of those who work for BS would be blaming every thing on him

Yeah the ole catch 22...that's what happens when you're a sell-out, isn't it?

"Cheney considered the hunting trip when he shot his friend in the face successful."- Sodie Pop

When ever he trashes something I own I buy more yesterday case in point they/he (Street.Com) downgraded Silver Weaton this on the same day that SW announced it had secured 600,000 oz per year silver contract with a Arizona mine at a price of $3.90 per ounce....

gold went down 22 today. you can tell alot off a 24hour chart if you know how to read one. If you can read tape you can tell what will happen tommorow oftentimes. This is how I called today's upside move.

Many believe in either intelligent design or evolution...but I am opting for unintelligent design, where god is a retarded kid who likes setting army men on fire and leaving his toys out in the rain. Gengis Gandhi, Troubled Genius

whatever I am a smoking: you really should get some. gold yesterday in single biggest decline, down 50.00 moving lower today. commodities broadly selling off, dollar gaining against euro. like I said, if you're going long on gold that to me is not a surprise at all.

Many believe in either intelligent design or evolution...but I am opting for unintelligent design, where god is a retarded kid who likes setting army men on fire and leaving his toys out in the rain. Gengis Gandhi, Troubled Genius

you do that. silver is heading down some more. I will be sure to short that to take the easy money from the rubes. 'often wrong, but never in doubt'

Many believe in either intelligent design or evolution...but I am opting for unintelligent design, where god is a retarded kid who likes setting army men on fire and leaving his toys out in the rain. Gengis Gandhi, Troubled Genius

fucking snapperheads. buying gold paper is like going to the ammo store and saying "I want some 7,62's certificates cuz I think civil unrest is likely" then when the balloon goes up you go to the shop to redeem your ammo certs and, shucks and golly, they're not honoring those right now. wow.

Many believe in either intelligent design or evolution...but I am opting for unintelligent design, where god is a retarded kid who likes setting army men on fire and leaving his toys out in the rain. Gengis Gandhi, Troubled Genius

Yeah, well you called it.

"Look well therefore to this Day!" ~ Kalidasa

never get tired of hearing that one! thats the beauty of trading. no room for debate as to who was right. no gray area. btw, I am wrong quite a bit, but thats part of the business.

Many believe in either intelligent design or evolution...but I am opting for unintelligent design, where god is a retarded kid who likes setting army men on fire and leaving his toys out in the rain. Gengis Gandhi, Troubled Genius

I'm glad that the markets are closed for Good Friday - not sure how much more of their whip-sawing I could have handled...

I am waiting for 1500 an Oz then I will get in big time.

The way they beat it down this week, your wallet is safe.

You saw thru my fib, huh???? I need to learn lying better.

http://www.goldseek.com/ "Look well therefore to this Day!" ~ Kalidasa

whipsaw is another way of exploiting a trading range. write calls all day long or run spreads. also can have small stops.

Many believe in either intelligent design or evolution...but I am opting for unintelligent design, where god is a retarded kid who likes setting army men on fire and leaving his toys out in the rain. Gengis Gandhi, Troubled Genius

#2. To: RickyJ (#1)

#3. To: gengis gandhi (#2)

#4. To: robnoel (#3)

#5. To: robnoel (#3)

#6. To: gengis gandhi (#5)

#7. To: robnoel (#3)

#8. To: gengis gandhi (#0)

#9. To: gengis gandhi (#5)

people buy precious metals as a hedge against a catastrophe, but if its only paper you really are at the disadvantage of any other paper asset.

#10. To: angle (#7)

#11. To: robnoel (#10)

#12. To: angle (#11)

#13. To: Pinguinite (#8)

(Edited)

#14. To: RickyJ (#1)

#15. To: robnoel (#12)

#16. To: noone222 (#9)

#17. To: gengis gandhi (#16)

#18. To: angle (#17)

#19. To: gengis gandhi. traders. buyers. all (#18)

#20. To: lodwick (#19)

#21. To: Cynicom (#20)

#22. To: lodwick (#21)

, your wallet is safe.

#23. To: lodwick (#21)

Widespread reports of Physical Silver Shortages (SilverSeek.com) -- More Reports Coming into GoldSeek.com now on some Physical Gold Shortages... GoldSeek.com | 21-Mar-Fri

#24. To: lodwick (#19)

Top • Page Up • Full Thread • Page Down • Bottom/Latest