See other (s)Elections Articles

Title: Market WrapUp (7-25-2008)

Source:

FSO

URL Source: [None]

Published: Jul 25, 2008

Author: Tim

Post Date: 2008-07-25 18:35:45 by orangedog

Ping List: *unUsual Suspects* Subscribe to *unUsual Suspects*

Keywords: None

Views: 919

Comments: 43

topmargin="0" leftmargin="0"> Financial Sense ® Home l Market Monitor l Market WrapUp l Storm Watch l About Us l Contact Us Today's Market WrapUp 07.25.2008 Mon Tue Wed Thu Fri Wood Archive In the June 27th WrapUp I explained that Crude Oil was in an unsustainable parabolic spike. Then, on July 15th I had a short-term sell signal that immediately evolved into a sell signal of intermediate degree. The question now is whether or not this intermediate-term sell signal further evolves into marking an even longer-term top, or if it is a mere correction in the path of an even longer-term advance. Monitoring the Cycle Turn Indicator at the various levels will be key at answering this question. Below is a long-term chart of crude oil showing the 1,322 percent advance that occurred from the 1998 low at 10.35, into the recent high at 147.27. Since the July 11th high, crude oil dropped 23.77 into the most recent low. This decline in and of itself does not necessarily mean that crude oil has also made a longer-term top. But, given the nature of the recent parabolic spike along with some of the other statistical factors that I’m watching, this is indeed a window of opportunity. The key item for me at this point is whether or not this intermediate-term decline is successful enough to also turn my monthly Cycle Turn Indicator negative. Also, the other key element is whether or not this occurs within the statistical window surrounding the entire commodity complex that I have been watching and telling my subscribers about for months now. Since we are on commodities, I next want to briefly discuss gold. In doing so I am also going to show you how my Trend and Cycle Turn Indicators can be used to help identify primary and counter-trend moves. The chart below is a weekly chart of gold, which I use for my intermediate-term work. I have also included both my intermediate-term Trend Indicator as well as my Cycle Turn Indicator. If we begin at the low last August, note that both the Trend and the Cycle Turn Indicator were negative as that low was made. Then, the first week in September both indicators turned up as gold began to climb out of the cycle low that was associated with that price low. With the Trend Indicator positive, this told us that the longer-term trend had turned back up. As price continued to move up, note that the Trend Indicator remained positive all the way up into the March high capturing that entire advance. When the Cycle Turn Indicator turned down at various points along the way it was signaling counter-trend cyclical moves within the context of the longer-term up trend. Then, when the Cycle Turn Indicator turned back up, another buying opportunity was confirmed. To say this another way, the fact that the Tend Indicator remained positive during the downturns, seen by the Cycle Turn Indicator, told us that these dips were buying opportunities. But, once the Trend Indicator rolled over below its trigger line in late March, it told us that the trend at this level had turned down. This also told us that as long as the Trend Indicator remained negative that any rally was to be considered a counter-trend move. The week of July 18th the Trend Indicator came within a hair of crossing back above its trigger line. However, this crossover never quite materialized and this past week the weekly Cycle Turn Indicator turned negative. As a result, the current picture suggests that the May to July rally was a counter-trend affair at this level. Until the Trend Indicator turns back up, the trend at this level remains negative and any bounce must still be considered a counter-trend move. As for equities, from a Dow theory perspective we still have a mixed bag. The longer-term primary bearish trend change that was confirmed on November 21, 2007 remains intact. This confirmation occurred when the blue horizontal line on the chart below was jointly violated by both averages. Since that violation, both an upside and a downside Dow theory non-confirmation has evolved. The upside non-confirmation occurred when the Transports moved above their previous secondary high point and ultimately into all time new highs in June, but with the Industrials failing to better their previous secondary high point this upside non-confirmation was born. To clarify, this upside non-confirmation is marked in red and has a bearish bias that until corrected will remain intact. At the same time, we also still have a downside non-confirmation, which is noted in green. This downside non-confirmation occurred when the Industrials moved below their previous secondary low point, while the Transports held above their corresponding secondary low. Downside non-confirmations are indicative of an upside reversal, which is now underway. To date, the November 21st bearish primary trend change remains intact and takes precedence over everything else. The upside non-confirmation is also bearish. But the downside non-confirmation was last to occur, and given the fact that non-confirmations tend to indicate trend reversals, we must also respect this fact as well. At present, price is advancing out of what I believe to be a secondary low point. From a Dow theory perspective, the key is whether or not this advance is sufficient enough to invalidate the existing primary bearish trend. From a cyclical perspective, which has nothing to do with Dow theory, the key is the cyclical structure of the market and the Cycle Turn Indicator at the intermediate and longer-term levels. Tim W. Wood Copyright © 2008 All rights reserved. CONTACT INFORMATION Financial Sense ® Home l Market Monitor l Market WrapUp l Storm Watch l About Us l Contact Us >

Another Look at Crude Oil, the Dow Theory Double Non-Confirmation and Gold

Another Look at Crude Oil, the Dow Theory Double Non-Confirmation and Gold

BY TIM W. WOOD

Tim W. Wood, CPA

Email l Bio | Market WrapUp Archive![]()

Copyright © James J. Puplava Financial Sense® is a Registered Trademark

P. O. Box 503147 San Diego, CA 92150-3147 USA 858.487.3939

Disclaimer

Subscribe to *unUsual Suspects*

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: orangedog (#0)

July 25 (Bloomberg) -- Legg Mason Inc. reported a second straight quarterly loss as subpar investment returns led to $18.4 billion in customer redemptions and the Baltimore-based company bailed out money funds saddled with bad debt. Legg Mason rose as much as 4.6 percent in New York trading on signs the worst may be over. Chief Executive Officer Mark Fetting said he doesn't expect to raise more capital to support the company's money funds. Customer withdrawals were down from $19.2 billion in the prior quarter. Investors had slashed Legg Mason's market value by almost 50 percent this year as bond funds run by its Western Asset Management unit and stock funds managed by Bill Miller and Bruce Sherman lagged behind benchmarks. BlackRock Inc., T. Rowe Price Group Inc. and Janus Capital Group Inc. gathered a combined $37.3 billion in deposits this quarter as they turned in high- ranking returns. * * * Investors pulled $11 billion from Legg Mason's stock funds, primarily from Miller's Legg Mason Capital Management division; Sherman's Private Capital Management unit; and ClearBridge Advisors, the division carved from Legg Mason's acquisition of Citigroup Inc.'s asset-management business. Investors took another $11 billion bond funds during the quarter. The withdrawals were partly offset by about $4 billion deposited into money-market funds and other cash products. The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

July 25 (Bloomberg) -- Standard & Poor's may downgrade the subordinated bonds of Fannie Mae and Freddie Mac, surprising investors who had anticipated the securities would be supported by any Treasury rescue plan. The potential cut would affect $19.2 billion of AA- rated subordinated debt at Fannie Mae and Freddie Mac, according to data compiled by Bloomberg. The cost to protect the bonds from default rose for the first time in three days. S&P said it may also downgrade $26 billion of preferred stock, pushing down the securities in New York trading. The AAA ratings on the companies' senior debt were affirmed with a stable outlook. New legislation authorizing a backstop of the mortgage- finance companies leaves it up to the Treasury Secretary to decide whether to honor preferred dividend payments or to repay subordinated bondholders before the government, S&P analyst Victoria Wagner said in a telephone interview. That ``ambiguity'' casts a cloud over the securities, she said. Once analysts have fully analyzed the final legislation, the ratings may be cut one or two levels, she said. ``We had factored in some federal support for these securities, but now I think the financial risks are now outweighing support and have to be reflected in the rating,'' Wagner said. * * * Fannie Mae dropped 47 cents, or 3.9 percent, to $11.55 in New York Stock Exchange composite trading. Freddie Mac dropped 54 cents, or 6.1 percent, to $8.27. Freddie Mac's 5.57 percent preferred stock fell 1.9 percent, and Fannie Mae's 5.5 percent preferred shares dropped 10 percent. The plunge in the stocks is ``adding to the already-stressed business cycle'' and may make it difficult for the companies to raise capital, Wagner said. ``We feel that given the changing market dynamics and the changing legislation landscape, that that heightened risk should be more of a factor in our current,'' Wagner said. The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

DETROIT — Chrysler is getting out of the car leasing business. The company told its dealers on Friday that it would stop leasing vehicles to customers through its finance arm as of Aug. 1, a move that comes as falling resale values of gas-thirsty trucks and sport utility vehicles cost Detroit automakers billions of dollars. It also comes a day after the Ford Motor Company took a $2.1 billion write-down, part of an $8.7 billion second-quarter loss, related to leases at its finance arm, the Ford Motor Credit Company., A co-president at Chrysler, James E. Press, said the carmaker would focus on traditional financing offers rather than on lease subsidies. Leasing carries more risk for the automakers, and in many cases low interest rates have made it less appealing to customers than it was years ago. Chrysler dealers can still offer leases through companies other than Chrysler Financial. “There was a time when leasing was really very attractive,” Mr. Press said on a conference call. “We really reached a point today, in this environment, where the economic advantages of leasing have really disappeared.” The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

Fitch: Massive House-Price Losses in Non-Conforming Areas to Come Fitch Ratings, arguably the only rater with their act together other than Egan-Jones, just finished with its ResiLogic enhancements. Its new mortgage loss model will be released today. In it, its new National, State and MSA-level economic and house price forecasting will make their modeling ‘far more predictive and forward-looking.’ That is a nice way to put it. BIG PROBLEM - This more micro look at the housing market in the 25 MSA’s that in the past have contained the most ‘non-conforming (Jumbo) lending, is coming up with massive house price losses in key areas with San Diego dropping as much as 47% over the next 5-years! San Francisco is looking at an additional 33%. These are your heavy Alt-A areas. Fitch is getting ahead of the curve this time around. I have been telling you for a few months now that according to my proprietary data while subprime defaults are falling slightly, Alt-A defaults have been soaring in the past four months led by Pay Option ARMs. Prime defaults have also spiked. Their estimates are dire, but I feel could still be on the conservative side given the absolute lack of non-conforming financing, massive supply, sales not picking up substantially this summer selling season, over 40% of all sales coming from the foreclosure stock, values only falling for about a year and defaults in Alt-A and Prime mortgages substantially picking up steam. * The MSAs represent the 25 areas that have historically exhibited the most non conforming mortgage lending activity. ‘Some MSAs such as San Diego and San Francisco, CA are expected to experience home price declines by as much as 47% and 33% over the next five years, while home prices in MSAs such as San Antonio, TX are expected to appreciate by 7%, over five years,’ said Somerville. The home price forecasts are imbedded in the state and MSA level risk indicators and will be updated quarterly. ResiLogic’s new model looks to be robust and takes into consideration many of the things that are top on my list of risks. The systems new capabilities include: * Introduction of MSA and national macroeconomic risk multipliers; This new model will negatively impact Fitch’s loss assumptions and credit enhancement levels for Residential Mortgage Backed Securities. This is mostly your Prime and Alt-A RMBS and not the subprime, meaning if S&P and Moody’s update their systems, round 2 of the mortgage and housing implosion could kick off with Alt-A and Prime leading the way. - Best Mr Mortgage Fitch will host a webcast next week to discuss its new U.S. RMBS modeling criteria (separate press release will follow). In the coming months, a commercialized version of ResiLogic (ResiLogic 2.0) will be made available by Fitch Solutions.

The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

Four past and present British Airways executives are to be charged with price-fixing in a landmark criminal prosecution that will send tremors through leading multinationals, the Financial Times has learnt. The cartel case, only the second ever brought by the UK’s Office of Fair Trading, leaves senior figures from one of Britain’s biggest corporate names facing the threat of up to five years in jail. The OFT’s action, the latest in a crackdown on price-fixing in industries ranging from supermarkets and tobacco to construction, raises the prospect that other executives could face prosecution. The watchdog has decided to charge the four men over a conspiracy between BA and Virgin Atlantic between 2004 and 2006 to fix the price of passenger fuel surcharges on transatlantic flights. Those to be charged are: Andrew Crawley, BA’s head of sales; Martin George, former commercial director and board member; Iain Burns, former head of communications and Alan Burnett, former head of UK and Ireland sales. The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

I'm not too sure technical anaylisis of crude oil charts is effective, especially now. There's too much government manipulation of the markets. If you look at the crude oil chart, you'll see a big rundown prior to the 2006 election, smaller ones before the 2004, 2002 and 2000 pretend elections. Also you have geopolitical events, seasonality issues and the inevitable Xmas drops to lure the sheepsters out to the stores for their annual shearing. I think we're entering an era where essential commodities, such as energy, food and other consumer staples will continue to rise without end, with temporary drops to quell the flock when it suits the government's agenda.

Makes sense esp. in light of the debt ceiling raised to $$$ 10.6 Trillion. http://befuddledmonkey.blogspot.com/2008/07/us-debt-ceiling-to-rise-to-106- trillion.html

I've never understood what the purpose of the debt ceiling was, since they don't hesitate to raise it when they approach the ceiling. If they would have required a super majority of voters to approve raising the ceiling it might be less symbolic.

Rivers of blood were spilled out over land that, in normal times, not even the poorest Arab would have worried his head over." Field Marshal Erwin Rommel

NAB will shock Wall Street The National Australia Bank's decision to write off 90 per cent of its US conduit loans will have dramatic repercussions around the world. Wall Street will be deeply shocked when they understand the repercussions of what NAB has done. It is clear global banks have nowhere near provided for their exposures to US housing loans which in the words of John Stewart are experiencing a “meltdown”. We are now way beyond sub-prime. NAB says that it is suffering a 55 per cent loss on American housing loans – an event that has never happened in the history of a developed country in recent memory. This is an unprecedented event and means that the cost of bailing out the US financial system is now far beyond the highest estimates. A US recession is now locked in, but more alarmingly, 55 per cent loan losses point to the possibility of a depression. It means the cost of bailing out housing exposures to the two mortgage insurers will be so great that it will leave no room to bail out anything else and there are several US banks that are now in big trouble. NAB says that the dislocation in the residential market is separate from the corporate market, but the flow on is inevitable. While global banks have been writing down their balance sheet assets, ,b>few have tackled their conduit exposures which are off balance sheet but to which they are ultimately liable. This morning at around 6am I wrote that we had been experiencing a 'dead cat bounce'. I had no idea that NAB would trigger the downturn and confirm what I had written. And of course Wall Street will receive a deep shock when it wakes up. How did NAB get caught in $1.2 billion mess? They had a number of big clients who wanted to invest in these US housing loans. They were sucked in by the 'triple A rating' given to the securities by the rating agencies. They did not take into account that the monoline insurers who guaranteed some of the loans had no substance. To become a player NAB took out $1.2 billion in these triple A securities and 90 per cent of it has been lost. Many Australian institutions are very angry. NAB is paying out far too much in dividends and should be conserving capital. The American bank it purchased, Great Western, was a good idea but it is now clear it overpaid for it. Fortunately it only has a small exposure to the bad loans. But what’s happening to the NAB is not the main game. The global banks have been marking to market the assets they held on their balance sheet, but,b> the vast amounts held in so called 'conduit trust accounts' have not been written down because they were not marketable. NAB wrote them down when they saw the bad mortgages. US banks have written down $450 billion in bad housing loans. The revelation from NAB means that they will now certainly need to take provisions to $1,000 billion. But write-downs of $1,300 billion and perhaps even more are on the cards. Where will the equity come from to cover these bad loans? The world has never attempted a rescue effort of this size and it will make liquidity in the globe very tight.

The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

Holy shit, Shirley!

speaking of which..our last month's utility bill was $461...the highest it's ever been. well, just got this month's and it's $589!! water alone was $288. now, i know that we've not used that much more water, if any, than last month. that's how much they've increased the cost.

For a month?! I hope that's for at least a quarter or longer. The water requires energy to pump and clean so I'm not surprised that it's rising. As for staples versus nonessentials, there's more old junk than ever up at the flea market with less useful stuff than ever. You used to be able to pick up a box of nails or screws for a buck, but now that box is $8 at Lowes and won't show up at the flea market at all.

Money problems do not come from a lack of money, but from living an excessive, unrealistic lifestyle

Drink beer.

that is for one month. :/

Criminy! Do you know what the consumption was? My normal consumption is about 3,000 gallons/month. Yours might be listed in gallons, cubic feet (7.48 gal), units (100 cuft or 748 gal) or something else. Water cost here including sewage, taxes, etc. is 1.1 cents/gal. A $288 water bill here would be for over 26,000 gallons or almost 1,000 gal/day.

It sounds like you have a leak somewhere in your plumbing.. The number of gallons you used should be on your bill. I'd check to be sure it isn't larger than normal.

That's what I was thinking. My water bill has never been more than $30 or $40 for a family of 4.

i take that back that we didn't use more water this month than last. i just compared the consumption. hubby informed me that we've had 38 days at 100 degrees with very little rain, so he's been running the sprinkler system more. (and the summer's only half over) we need a rain dancer.

i had my husband check the meter outside last night and it wasn't running. if it were, that would indicate a leak, correct? still, the number of gallons used seems outrageously high.

My take is ... Holy Shit Batman, somebody turned on the fan.

I guess it depends on how your meter is calibrated. A slow leak might not show up on some meters. A sprinkler system sounds more likely though. They can pump a lot of water.

Ack! As I mentioned, ours went from $167. to $474. to God only knows what the next one will be... We did have the guys from http://www.efficientattic.com spray the underside of the roof decking with something they claim will reduce the attic temp. by eighty percent, but the biggest killer here was the water/wastewater charge.

Ladies and Gentlemen, we are at the 'flation' fork in the road. Will it be in- or de-? My unsophisticated guess is in-flation. Here is why. We, the US, the World, the Planet is standing right at the fork in the road and the choice will not be to bankrupt the system nor the US Government. For decades the US has been running on deficit financing, especially by the government. But all have been doing it, from individuals, corporations, Wall Street and of course the government. 'IT' will continue, especially by the US Government. Now I will only look at the real estate market. The unrealized wealth was the fact that one could acquire real estate easily. That real estate would then increase in value whether from flation, improvements or desirability. Over the decades while this was going on more wealth was created and that wealth was realized thru re-financing or selling. Regardless of how and what the transfer was there was an increase in wealth and an increase in money as new financing was put into place to cover higher and higher values. Wall Street figured this out and realized they could essentially print their own money by coming up with larger and larger financings which then got made into bonds. Those bonds and financings that are due sometime in the future are the new money. Hey, just like the government does, in its partnership with the FED. That wasn't too hard to figure out, huh. But they were collateralized assets. The US has faith in the US as collateralization for Dollars. A little harder to figure on than the black and white or real estate as collateral. Collateral which is dropping in value like a rock. Now that those bonds and financings and of course the collateral itself, the real estate are dropping in value, the US Government will print the real dollars, money to prop up and bail out those collateralized assets. i.e. the Fannie & Freddie bailout bill going thru Congress. That is highly inflationary because it is giving a false, higher value to assets that are worth 10¢ on the Dollar. See posts #2 & #9 above. This along with the deficit spending that the US Government has been doing for the last many decades means, more US Dollars being printed and put into the system that are backed by nothing or worse yet backed by bonds which are now worth 10¢ on the Dollar. That's instant devaluation and the money to prop it up is now on the street in circulation. Yes Ladies and Gentlemen ... we will have in-flation! And regardless of whether it is in-flation or de- flation, both will put everyone into both realized and unrealized poverty. Unrealized wealth is no longer an option or a possibility. The unrealized portion of our poverty is in the Trillions. And it will be realized. Only the time component is uncertain.

Excellent analysis...you and Edgar Steele are on the same page.

Thats crazy! Here is mine for last month. Electric-$185 Gas-$20 Water-$45

Mark If America is destroyed, it may be by Americans who salute the flag, sing the national anthem, march in patriotic parades, cheer Fourth of July speakers - normally good Americans who fail to comprehend what is required to keep our country strong and free - Americans who have been lulled into a false security (April 1968).---Ezra Taft Benson, US Secretary of Agriculture 1953-1961 under Eisenhower

You and all are welcome. Now for the miners data. Your turn to analyze. I have changed it quite a bit. What has happened is the the gold highlighted boxes for the miners are those miners that are in the GDX Index. Those miners that are in bold red and the gold highlighted boxes are in both the HUI and the GDX. Only FCX is the in the HUI only. I now have a sort for 2008 for the HUI and the GDX separately. As can be seen the top miners are generally the same for both indexes. By playing the top miners, one can easily beat the HUI Index or the GDX ETF. Now for the overall miner's handicap. POG was down -2.63% and POS -3.98% and therefore the miners as a group were down -7.09%. They all went in the same direction, yay. Quick note: Aurelian (ARU.TO) is being bought out by Kinross (KGC), that's why the big jump. Probably also the reason for the 17% dump by KGC. Well GSPG is still the shooting star of the whole crowd. I'm going to show more on them in a later post. KBX and the crowd are falling back further. Like everybody is saying, there are some really good miners here that are just getting sliced and diced into oblivion. Look what happened to BVN. They did a stock split and wound up lower. What usually happens is the opposite. Next week I'll have the value corrected for the stock split so that the percentage for BVN will be correct for the year. Giving everyone a chance, here is the sort for the winners for the week only. Wow, if you gained 0% or lost 0% (just making fun) you wound up pretty highly ranked. Courtesy of P. 'Fearless Leader' da Wit

Yep. If you got the return 'of' your principal, you are a genius these days.

State nearly done recovering money invested with Noe Friday, July 25, 2008 3:14 AM Liquidators have nearly finished selling off the coins, collectibles and other items that Thomas W. Noe bought with state money, and they now have recovered more than the $50 million invested with the convicted coin dealer. The professional fees, liquidation costs and other related expenses so far are nearly $7.7 million, and total expenses could reach $9.5 million, according to figures released to The Dispatch this week by the Ohio Bureau of Workers' Compensation. Still, the bureau ultimately expects to get back more than what it invested with Noe, causing some observers to suggest that too much was made of the Noe scandal when the bureau lost $216 million on a risky hedge fund. But officials say the recovery in Noe's case doesn't account for the more than $13 million that he was convicted of stealing for personal use, or the money the bureau should have earned had the investment been managed properly for the past 10 years. The bureau calculated that had the $50 million been invested in a conservative money-market fund, three-month U.S. Treasury bills or a stock-index fund, it would have earned between $13.7 million and $16.5 million. "Mr. Noe should not expect to somehow profit from the fact that we were successful," said William T. Bodoh, the retired bankruptcy judge who oversaw the liquidation with Chicago-based Development Specialists Inc. This week, liquidators turned over $12.1 million to the bureau, the final major payment expected. There are a few loose ends to wrap up but the significant recovery work is done, Bodoh said. That brings the total returned to the state so far to $55 million. It includes $7.9 million that Noe gave the bureau over the years as "profits," which authorities said really was bureau money that Noe gave back and called profits. The liquidators also expect to collect up to an additional $1.75 million in the upcoming months from the remaining payments due from the sale of collectibles, legal settlements and about 100 remaining coins yet to be auctioned. There also will be additional fees, expenses and possible payments to settle claims that are expected to range from $380,000 to $1.8 million. That would leave a range of final net proceeds of between $53.5 million and $54.9 million. "The efforts to recover these assets on behalf of Ohio's employers and injured workers should be recognized as an important accomplishment on the road to recovery for the BWC," Administrator Marsha Ryan said in a statement. Starting in 1998, the bureau gave $50 million to Noe, a prominent and politically connected coin dealer from the Toledo area, to invest in coins. But the controversial investment was shut down in 2005, and Noe's lawyers admitted there was a "shortfall" of up to $13 million. It was part of a series of scandals that helped Democrats recapture all but one statewide office in 2006. Noe was convicted of theft and other charges in 2006 and sentenced to 18 years in prison. Pending an appeal, he would start serving that sentence this fall after he is released from federal prison for unrelated illegal campaign contributions. Liquidators participated in a series of coin auctions and reached other deals to sell the coin-fund assets, including the recent $7.6 million sale of stock that Noe had purchased in Florida coin-grading company Numismatic Guaranty Corp. That sale also sent $150,000 to Lucas County and $50,000 to Franklin County to help cover prosecution costs related to Noe's case.

The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

Foreign drugmakers close labs in Japan A sense of crisis is growing among the Japanese pharmaceutical industry in the face of closings of laboratories of foreign drugmakers and China’s emphasis on the biomedical industry as a national strategy. Bayer AG shut down its Kobe research center and GlaxoSmithKline closed its lab in Tsukuba, Ibaraki Prefecture, last year. The Kobe research center prided itself on technical skills that led the company to successfully produce induced pluripotent stem (iPS) cells from human skin. Novartis Pharma KK reportedly plans to shut its research office in Tsukuba within this year. Since the start of the 21st century, China has successfully lured foreign pharmaceutical companies, including the Roche group, Astrazeneca Co, Novartis Pharma and GSK, to Shanghai thanks to its campaign to allocate money, human resources and locations for foreign companies to establish operation sites. ‘‘Corporations are expanding the places of their research and development activities in seeking attractive resources,’’ said Takashi Yagi, chief researcher of the Office of Pharmaceutical Industry Research established by the Japan Pharmaceutical Manufacturers Association. ‘‘The time has come for corporations to choose nations to engage in research.’’ Calling the closures of foreign drug research facilities ‘‘a matter of concern,’’ Yagi and other Japanese pharmaceutical industry officials put together a report calling for Japan to become a more attractive place for investment. Makoto Shimazaki, chief of Bayer’s public relations department, cited a change in the environment of developing new drugs as the reason for the discontinuation of the research center. He explained that the issue of patent hurdles for the method of selecting candidate material for a new drug and each newly discovered gene and protein became a heavy burden on research and development costs. As a result, the area of research has naturally narrowed down and drug firms headquartered in Europe with research centers in Japan and the United States are closing down their Japanese research arms. Novartis Pharma has integrated its basic research functions in the United States while transferring its development operations to Tokyo, while Pfizer said it will do its basic research in the United States and Britain. Yagi said China has given priority to its science and technology budget. The number of students finishing graduate school doubled in the three years starting 2002 and students returning home from studying abroad numbered more than 40,000 a year. Mikio Sasabayashi, a former chief researcher of the Office of Pharmaceutical Industry Research who worked with Yagi and now works for Banyu Pharmaceutical Co, said universities, public research institutions, foreign-affiliated firms and venture capital companies have formed a ‘‘bio valley’’ in China. ‘‘Just being in the same place is boosting productivity in the area as a whole,’’ he said. Yagi said Japan needs to grapple with the problem of attracting foreign enterprise through promotion of joint international research and by fostering venture-capital companies.

The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

"Mr. Noe should not expect to somehow profit from the fact that we were successful," said William T. Bodoh, the retired bankruptcy judge who oversaw the liquidation with Chicago-based Development Specialists Inc. So, do you think Ohio will prosecute the pension fund investors who lost money, if earning beyond your principal will not protect you from prison?

The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

Here is the HUI. I followed the daily movement of gold by carving out a bottom on Thursday and breaking the downtrend by having an up day on Friday. That bottom on Thursday is also a slightly higher low. Could there be a 4th slightly higher high ? It is trending that way since May. With the last downtrend the 394 FIBO line was not touched at all. The RSI is showing some reaction from by curling upwards. Really not too much to say. Things are looking up for the miners but that is conjecture on the future which can wait a few more days for more development. Courtesy of P. 'Fearless Leader' da Wit

Here is GSPG with an overlay of FIBO lines as I employ them. The lines portray a growth pattern that according to Fibonacci, follows Mother Nature and the way of the physical universe as scientifically observed and demonstrated by all life on Planet Earth and maybe throughout the entire Universe. Because of this kind of correlation and success in doing my brand of TA, I prefer to continue employing Fibonacci in this fashion rather than by employing it strictly for pull back and correction phenomena in the market place. There are a lot of lines here to sort thru but by just observing each 100% to 0% cycle by itself, it becomes quite evident how the pricing reacts to each line in the classic manner that Fibonacci observed and put into formulae. Note: StockCharts does not employ enough digits past the decimal point to give good readings as to the price labels on the FIBO lines. Because of this I also create a mathematical table employing enough digits to get true readings. Those true numbers readings appear in what I call the FIBOmeter. Here is what that looks like. There is a top row with several FIBOmeter cycles, one after the other. Below that is just one of those cycles expanded, the one that is currently in play. Next target, 4.95¢ after the current target of 4.13¢ is achieved.

dah Dollah is giving some 'bad' signals. Friday is stayed in the lime line channel but it produced a Doji, Star Symbol. This is an indication that the market has no commitment in either direction. It is typically a presage to a change in direction and in this case it looks like the Southern Cross which can only be seen in the southern hemisphere. The bottom of that red cross also punched thru the bottom of the lime line channel. Are we about to see a lower low compared to the May 8th peak ? Courtesy of P. 'Fearless Leader' da Wit

The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

Swiss national bank placed 68 tonnes of gold in the market in first half ZURICH, July 25 (Reuters) - The Swiss National Bank placed 68 tonnes of gold in the market in the first half of the year as part of a programme to sell a total of 250 tonnes by the end of September 2009, the central bank said on Friday. The central bank said this meant roughly another 37 tonnes of tonnes of gold were yet to be sold as part of the programme. In June 2007, the SNB said it would sell 250 tonnes of gold by September 2009, in line with the agreement among European central banks to limit gold sales to 500 tonnes a year.

The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

Why? And what are they getting in trade for their gold? This sounds totally nutty to me.

Why? To frighten investors from investing in gold knowing that such dumping by the central banks was coming. And what are they getting in trade for their gold? We know they are getting paper. We don't know what other benefits may accrue.

The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

POG also had a Doji. It is more of a true star though. To get further inference, the chart shows that Thursday made a bottom. Friday was both above the lime line and the fuchsia line. The fuchsia line says that Monday's minimum target is above the FIBO line of $935.89. We shall see. I put the latest lime line one day earlier to actually tighten up and make Monday's performance to maintain this trend tougher. No slack given on gold as in the Dollar. So far no action of note in Asia. Courtesy of P. 'Fearless Leader' da Wit

To give some relativity to what happened I have left the old red downtrend line in from da Boyz. As can be seen, not until Friday did POS break away from the pull of this red downtrend line. I have put in the lime and fuchsia line standardly. Those say that POS is at the bottom of a new uptrend and that $17.56, the 50dma has to be met for both of these lines to stay valid. Courtesy of P. 'Fearless Leader' da Wit

Central bank to take riskier assets as collateral OTTAWA — The Bank of Canada says it is prepared to accept some of the riskiest assets on the market, giving it more power to fight the credit crisis. For the first time, the central bank will accept as collateral for emergency loans asset-backed securities of the type at the heart of the crisis of confidence that has seized financial markets for the past year. Governor Mark Carney revealed yesterday in the Canada Gazette how he intends to use new powers granted him by Finance Minister Jim Flaherty in legislation that cleared Parliament in June. It was left up to Mr. Carney to decide which assets would be acceptable to the central bank. The change aligns the Bank of Canada with other major central banks, including the U.S. Federal Reserve and the European Central Bank, and clears the way for Mr. Carney to more forcefully attack a problem that he says has subsided in Canada for now. "This is a positive development as it brings the Bank of Canada's powers more in line with that of its peers, and it reduces the risk of further credit market problems in Canada," said Eric Lascalles, an economist at Toronto-Dominion Bank. Mr. Carney indicated frustration during parliamentary testimony earlier this year as the Fed and others took extraordinary steps to inject liquidity into frozen credit markets, accepting a wide range of assets as collateral in return for billions of dollars worth of short-term loans. Canada's central bankers were left to fight the fire with what amounted to a garden hose by comparison. That's because Canadian law forbade the central bank from accepting anything but the safest of assets in return for emergency loans. In his testimony to Parliamentary committees, Mr. Carney indicated the credit crisis was worse than it needed to be as a result of the limits on the central bank's discretion. The heads of Canada's biggest banks felt the same, and lobbied Ottawa to expand the Bank of Canada's powers. At emergency auctions for short-term loans, the central bank said it will now accept collateral commercial paper, including asset-backed commercial paper, with a term of maturity of no more than 365 days, and other Canadian-dollar, asset-backed securities. The central bank also will accept securities issued or guaranteed by the federal government; provincial governments; the U.S. government; and any state in the Organization for Economic Co-operation and Development. The list of assets also includes Canadian-dollar corporate and municipal bonds, Canadian-dollar bankers' acceptances with maturities of no more than 365 days and Canadian-dollar promissory notes with a term to maturity of no more than 365 days.

The U.S. Constitution is no impediment to our form of government.--PJ O'Rourke

Comments (42 - 43) not displayed.

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#2. To: All (#1)

#3. To: All (#2)

#4. To: All (#3)

* Ability to analyze seasoned loans and to take into account loan payment history and house price changes since loan origination;

* Additional penalties for loans originated with stated income or no income/no asset documentation programs;

* Additional penalties for loans originated with second liens;

* Reduced credit for loans with mortgage insurance

#5. To: All (#4)

#6. To: orangedog, Arete (#0)

#7. To: Esso (#6)

food and other consumer staples will continue to rise without end

#8. To: angle (#7)

#9. To: angle (#7)

#10. To: DeaconBenjamin (#9)

#11. To: Esso (#6)

I think we're entering an era where essential commodities, such as energy, food and other consumer staples will continue to rise without end

#12. To: christine (#11)

water alone was $288.

#13. To: christine (#11)

water alone was $288

#14. To: purpleman (#12)

#15. To: christine (#11)

water alone was $288.

#16. To: christine (#11)

water alone was $288. now, i know that we've not used that much more water, if any, than last month. that's how much they've increased the cost.

#17. To: Esso (#15)

Water cost here including sewage, taxes, etc. is 1.1 cents/gal. A $288 water bill here would be for over 26,000 gallons or almost 1,000 gal/day.

#18. To: Esso (#15)

#19. To: duckhunter (#16)

#20. To: Esso (#10)

Holy shit, Shirley!

#21. To: christine (#19)

i had my husband check the meter outside last night and it wasn't running. if it were, that would indicate a leak, correct?

#22. To: christine (#11)

our last month's utility bill was $461...the highest it's ever been. well, just got this month's and it's $589!! water alone was $288. now, i know that we've not used that much more water, if any, than last month. that's how much they've increased the cost.

#23. To: All (#20)

unrealized wealth to unrealized poverty!

#24. To: imawit. all (#23)

And regardless of whether it is in-flation or de- flation, both will put everyone into both realized and unrealized poverty. Unrealized wealth is no longer an option or a possibility. The unrealized portion of our poverty is in the Trillions. And it will be realized. Only the time component is uncertain.

#25. To: christine (#11)

#26. To: lodwick (#24)

Excellent analysis...

#27. To: imawit (#26)

#28. To: lodwick (#27)

If you got the return 'of' your principal, you are a genius these days.

#29. To: All (#28)

#30. To: lodwick (#27)

The bureau calculated that had the $50 million been invested in a conservative money-market fund, three-month U.S. Treasury bills or a stock-index fund, it would have earned between $13.7 million and $16.5 million.

#31. To: DeaconBenjamin (#30)

Next portion of the wrapup.

#32. To: All (#31)

Wanted to share this with y'all.

#33. To: All (#32)

Uh Oh!

#34. To: imawit, deaconbenjamin (#33)

#35. To: All (#34)

(Edited)

#36. To: DeaconBenjamin (#35)

In June 2007, the SNB said it would sell 250 tonnes of gold by September 2009, in line with the agreement among European central banks to limit gold sales to 500 tonnes a year.

#37. To: lodwick (#36)

#38. To: lodwick (#36)

Here's another take on the Australian write down on Friday.

#39. To: All (#38)

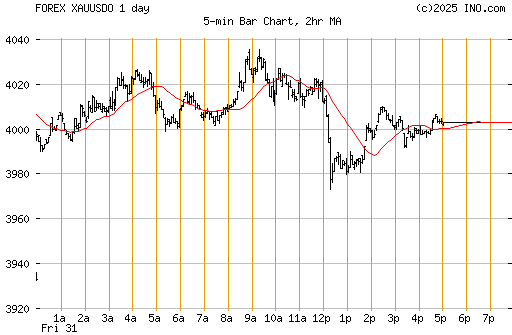

With that note, here's gold.

#40. To: All (#39)

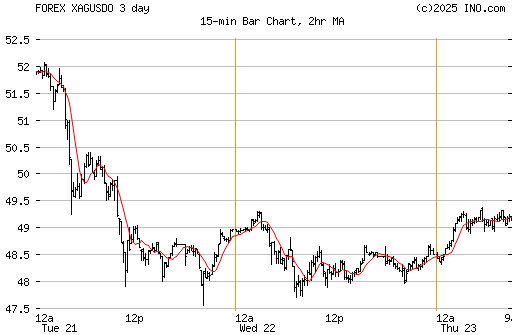

Silver has really taken a hit in the last two weeks.

#41. To: All (#35)

.

.

.