See other Immigration Articles

Title: Market WrapUp (07-26-05)

Source:

Financial Sense Online

URL Source: http://www.financialsense.com/Market/wrapup.htm

Published: Jul 26, 2005

Author: Ike Iossif

Post Date: 2005-07-26 19:54:01 by Arete

Ping List: *unUsual Suspects* Subscribe to *unUsual Suspects*

Keywords: (07-26-05), Market, WrapUp

Views: 493

Comments: 36

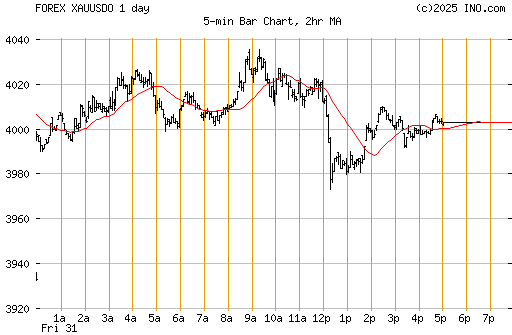

Home l Broadcast l Market Monitor l Top 10 l Storm Watch l Sitemap l About Us Today's WrapUp by Ike Iossif 07.26.2005 Mon Tue Wed Thu Fri Archive SUMMARY Last week I said, "The McClellan Oscillators are at the zero line, the Volatility ratios are at new highs, the Quantifiers have turned down, and the rest of the indicators have diverged negatively; therefore, the odds are better than even that over the next 2-5 trading days we will get a pullback, but given the magnitude of the initial thrust of the move we also ought to expect support to hold." (Current) We have half of the indicators implying that a pullback is to be expected next week, while the other half are implying that further price strength ought to be expected. When you put it all together it means that we ought to expect a choppy and difficult market to trade going forward. This type of market condition precedes market tops of significance, but we do not believe that such top is completed; it has a bit more to go. Nevertheless, we do believe that we ought to expect a pullback sometime this week, and depending upon how deep the pullback turns out to be, we will draw further conclusions with regard to how far we are into the topping process. SUPPORT AND RESISTANCE LEVELS TO WATCH FOR Ike Iossif Copyright © 2005 All rights reserved. Ike Iossif Home l Broadcast l Market Monitor l Storm Watch l Sitemap l About Us l Contact Us Copyright © James J. Puplava Financial Sense™ is a Registered Trademark

WEEKLY CHARTS

Above 10750 it goes to 10900; if it stalls again at 10750, it will re-test the 10500 level.

It is at resistance in the 3700-3725 zone, and we would expect a pullback from this zone.

SP500: It made it up to resistance at 1240. We would expect a

pullback from this level starting in the middle of the week.

NASDAQ: It almost made it to resistance at 2210. We would expect

a pullback from this level, starting in the middle of the week.

HUI: It has resistance at 205, support at 190. Above 205 it goes to 225, and below 190 it goes to 178.

Oil: If it can stay above $55, it will rally to $62.50 and then 67.5. If it closes below $55, it will go to $50.00.

The T.O. is trying to turn up. If it does, we ought to expect higher prices.

The T.O. is trying to turn up. If it does, we ought to expect higher prices.

The trend is UP for NASDAQ.

The trend is UP for the SP. DJIA SP500 NASDAQ 2nd Upside Target 11150 1275 2300 1st Upside Target 10900 1255 2250 Resistance 10750 1240 2210 Support 10450 1220 2140 1st Downside Target 10250 1188 2100 2nd Downside Target 9950 1165 2040

President & CIO Aegean Capital Group, Inc. &

Executive Producer MarketViews.tv![]()

with Ike Iossif

Best Of The Best

Guest Consensus

Current Guest List![]() Expert Page

Expert Page![]() Ike's Bio

Ike's Bio![]() Commentary Archive

Commentary Archive![]() Ahead of The Trend on Newshour

Ahead of The Trend on Newshour

P. O. Box 503147 San Diego, CA 92150-3147 USA 858.487.3939

Disclaimer

(17 images)

Subscribe to *unUsual Suspects*

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: All (#0)

Market WrapUp is Delivered! Other news, views and commentary -- Amazon.com 2Q Net Profit Falls U.S. consumer confidence eases in July GMAC Will to Up to $55B in Auto Loans US Steel Posts 16 Percent Rise in 2Q International Paper 2Q Profit Declines Reuters Reports More Job-Cut Plans Tellabs 2Q Profit Slips 17 Percent Electronic Arts Swings to a $58M Loss Auto Sales Expected to Hit Four-Year High Greenspan Has Spoken, China Is Revaluing And I'm Reevaluating SOCIAL SECURITY - Beware of False Prophets The Savvy Macrowave Investor - Yuan, Smuan Richard W.

97 degrees here today. Supposed to be close to 100 for the next two days before cooling down into the lower 90's for the weekend. Gasoline prices holding fast at 2.139. Richard W.

I haven't been able to figure out why Bush keeps pounding the table on the unpopular idea of privatizing social security accounts. At first I thought that it was just a payoff to Wall Street for their support, but then I thought, who is going to buy all those stocks and bonds the PPT must now be holding. Can't sell them back into the market cause that would cause price declines and reverse the original intent of not letting the market fall. The only place to dump that large a portfolio is onto the taxpayer. Voila! Private accounts. Richard W.

July 27 (Bloomberg) -- SK Corp., Asia's fifth-largest oil refiner, may post its smallest quarterly profit in a year because crude oil costs rose faster than the company's fuel and petrochemical prices. Net income in the three months ended June 30 probably rose 3 percent to 305 billion won ($297 million) from 296.4 billion won a year earlier, according to the median estimate of seven analysts surveyed by Bloomberg. The Seoul-based company is scheduled to report earnings tomorrow. Soaring costs as crude oil prices gain may prevent Chief Executive Shin Heon Cheol from extending last year's surge in earnings. Net income in 2004 rose more than 100-fold on record earnings from processing oil. China's imports of petrochemicals are slowing as refiners in the country expand their plants and raise output. [Excessive futures contracts?] SK Corp. May Post Smallest Profit in a Year on Higher Oil Costs State effect uncertain from split of AFL-CIO DJs were paid to play that tune Asian Central Banks Start Bond Funds to Lure Local Investors Sen. Clinton Calls for Party Truce, United Front Intel plans $3bn 300mm-wafer fab factory in Arizona Australian Dollar Falls Before Second Quarter Inflation Report Panel Completes Inquiry on Leader of U.N.'s Oil-for-Food Program Mars Talks Up Cocoa's Medicinal Potential Hot condo market dampens house sales [Boston] Inco Reports 2nd-Qtr Profit, Reduces 2005 Forecast [Higher Nickel Prices] Sunset Law for Federal Agencies on the Horizon No PepsiCo bid for Danone, French regulator says No WTO agreement on farm liberalisation talks Fidelity May Face SEC Suit Over Gifts Canadian Dollar Drops Most in Three Weeks Against U.S. Currency New Rules Would Limit Tax Work By Auditors Danaher Agrees to Buy Leica Geosystems for SF1.16 Bln Mexican accused of leading document-fraud ring Lines drawn on CAFTA-DR European Economies: German, Italian Confidence Rises US rejects stronger trade measures on China Lessons of history Brazil Scales Back Bond Sale Because of `Volatility' U.S. concedes loss to EU at WTO, mulling appeal

Filled up on 202.9 this afternoon. We've had heat indices in the 105-110 range for about a week.

That has been one of Coxe's pet gripes about the Canadians. Forward selling energy at bargain prices causing lost revenue and earnings as prices continued to rise. Richard W.

I guess the South Koreans may have gotten sucked into this practice as well. Still, not many companies can boast of a hundred fold increase in earnings. Besides, if Southwest Airlines was a winner, someone had to be a loser.

Iran oil bourse wins authorization

Remember that Chinese company that was selling oil and then had to buy it back at higher prices? They fell for the Wall Street flimflam of $30 oil too. Richard W.

Losing millions of dollars when managing Chinese GSEs can lead to a more fundamental form of termination. Not exactly a golden parachute.

Spitzer needs to get a life.

So who selected Celine Dion to be the graphic that goes with the article? I should think it would be nearly impossible to select just one artist.

Thats's a luxury/risk they can afford seeings as how they're sitting on loads of raw resource that costs more to produce than oil was selling for ~2.5 years ago. For them, it's not like they have to worry about running out anytime soon.

Hey, look at that cute little critter...Yaaaa! GET IT OFF! GET IT OFF!!!!

Boy, you can say that again with emphasis. Schumer got schmucked and Snow got snowed. 2% revaluation and no expectations of any further devaluations, the announcement made today by the Chineseses.

You Borrowed it Twice (You Only Live Twice) You borrowed it twice or so it seems, And debt is a stranger that'll beckon you on, But this dream is for you, so don't think of the price. And debt is a stranger that'll beckon you on, But this dream is for you, so don't think of the price. (Those are all real links. If you click on nothing else at least check out the last "danger" link. It claims it is a parody! We'll see, lol.)

When prosperity comes, do not use all of it. - Confucious I clicked on them all. Thanks for the post. It was great. We're running on debt. Richard W.

“I have no regrets,” snarled Greenspan as he was led away in handcuffs. “I was only following orders.” Yet the Fed Chairman later broke down and confessed to the crimes, pleading guilty." Alan Greenspan Charged With Killing Off Middle Class, Setting Stage for Economic Collapse Richard W.

Sure to join other classics like: (If you see flies at the entrance to the burrow, the ground hog is probably inside)

Well, it appears that someone "gets it" other than us nerds, gnomes and TA (as opposed to T&A) specialists (did I leave anyone out?), even if the painful message must be sugar-coated as a spoof ... very creative, Mark.

A whole lot of people get it but they will never admit it because it is too important to keep the sheepsters in the dark and heading toward the cliff. Richard W.

Humm . . . Richard W.

Sometimes I wonder if any of the prominent economists have a clue with all their concern about "protectionism". The playing field has always been tilted against us insofar as the integrity of our legal structure (ignoring for the moment the disgusting, parasitic trial lawyers) and the openness and access to our capital and consumer markets is contrasted to the closed and discriminatory Asian consumer markets. Even the Europeans are more protectionist than are we. The Asians probably think we're shallow, stupid or craven and we aren't doing much to convince them otherwise. We do GATT and NAFTA (and now CAFTA?) with nary a care about the middle class because the corporate interests see advantage and the politicians think only in slogans and about campaign contributions. Goods are bad enough. Outsourcing and open borders are killers. We are all sheepsters now (Remember Nixon's "We are all Keynesians now?") ripe for the shearing. Or so I think AND there's my rant for the day.

The only thing wrong with that ariticle is, it is written for Spoof.

The national median sales price of a new home fell 5.5 percent to $214,800 from $227,400 in May. The average sales price on a new home fell to $267,400 in June from $287,400 the previous month. ... U.S. June new home sales climb to record Very interesting ...

Fannie Watch:

Amazon's share price swelled 12% as the latest "Harry Potter" installment aided the 26% sales surge. Earnings beat estimates, the relative success overshadowing a net decline caused by higher taxes.

(If you see flies at the entrance to the burrow, the ground hog is probably inside)

Could be that the high end market has stalled out. There's been a huge run the high end around here, and there are more people selling their bottom of the barrel condos than ever before. Plus there is discounting from asking prices over the last month or two.

(If you see flies at the entrance to the burrow, the ground hog is probably inside)

Naural Gas - Richard W.

Yes it is. Maybe we'll soon be seeing "employee discounts" on new homes too. Going to put a lot of pressure on the flippers who are now directly competing for sales with the builders. Richard W.

Regarding "You Borrowed it Twice". Dude, that was great! I'm jealous....

#2. To: All (#1)

#3. To: All (#2)

#4. To: Arete (#1)

#5. To: Arete (#2)

#6. To: DeaconBenjamin (#4)

[Excessive futures contracts?]

#7. To: Arete (#6)

Forward selling energy at bargain prices causing lost revenue and earnings as prices continued to rise.

#8. To: Arete (#0)

#9. To: DeaconBenjamin (#7)

#10. To: Arete (#9)

#11. To: DeaconBenjamin (#4)

DJs were paid to play that tune

The Roman Emperors American people could have any single bureaucrat killed removed from office, but ultimately they required the cooperation of the bureaucracy in order to rule.

#12. To: Tauzero (#11)

#13. To: Arete (#6)

That has been one of Coxe's pet gripes about the Canadians. Forward selling energy at bargain prices causing lost revenue and earnings as prices continued to rise.

#14. To: Arete (#1)

The Savvy Macrowave Investor - Yuan, Smuan

#15. To: Arete, All (#0)

The best luxury car and the house of your dreams.

You sift through the loans and the terms seem tame,

Till interest rates rise and so ends the game.

Don't think of the danger because it's a time bomb.

Debt made one dream come true, and you borrowed it twice.

Don't think of the danger because it's a time bomb

Debt made one dream come true, and you borrowed it twice.

The nation is prosperous on the whole, but how much prosperity is there in a hole? - Will Rogers

#16. To: markm0722 (#15)

#17. To: Robin (#16)

#18. To: markm0722 (#15)

You Borrowed it Twice

Oil From Russia For Euros

Goldfinger and Silvertoe

Dollars Aren't Forever

The Man with the Gold(en Gun)

The Spy Who Loaned Me Money

For Euros Only

...

#19. To: markm0722 (#15)

The Spoof: Alan Greenspan Charged With Killing Off Middle Class, Setting Stage for Economic Collapse

#20. To: Phaedrus (#19)

Well, it appears that someone "gets it"

#21. To: All (#20)

#22. To: Arete, All (#20)

#23. To: Arete (#17)

Alan Greenspan Charged With Killing Off Middle Class, Setting Stage for Economic Collapse

![]() One if by land, two if by sea...how many if they are already here?

One if by land, two if by sea...how many if they are already here?

#24. To: Arete, All (#21)

#25. To: arete (#24)

#26. To: AdamSelene (#25)

#27. To: Phaedrus (#24)

#28. To: All (#21)

#29. To: Phaedrus (#24)

Very interesting ...

#30. To: markm0722 (#15)

| Gold and silver are real money, paper is but a promise. |

#31. To: AdamSelene (#25)

Bush better hurry and get those private SS accounts before the government get stuck holding a bunch of worthless FNM stock. Richard W.

#32. To: imawit (#31)

Miners just can't seem to get any traction today. Looks like taking my profits on MDG last Thur was a good idea at least in the short term. Richard W.

#33. To: All (#32)

Fire destroys ONGC's drilling platform, 3 killed Richard W.

#34. To: All (#33)

Richard W.

#35. To: purpleman, All (#18)

I have to run with that one if you don't mind, lol. For euros only, you can buy me in the night. You'll buy what no-one else can buy because the price is high. For euros only, the nights are never cold. You'll buy what no-one else can buy because the price is high. (Although I suspect before this is over the Euro is in as much trouble as the dollar. My reference to silver mines is based on the historical willingness to mine at a loss, silver mines need cheap energy clearly to maximize profits, and that many silver mining stocks have run up quite a bit in the last few years. You have to be a big believer in silver's near-term fundamentals to feel comfortable there. I'm bullish on silver itself though for the long-term. I think perhaps it is the better place to be in the risk/reward equation. Just an opinion though obviously.)

For Euros Only

For euros only you'll never need to lie.

You can buy so much of me, so much of me that's true.

I'm just oil pumped out as bubbling crude.

For euros only, only for euros.

For euros only, only for euros.

The energy you need in me, the heat that you've freed in me.

Only euros, only for euros.

You really know me, that's one reason I am sold.

Maybe I'm an open book unlike most silver mines.

And you won't need to read between the lines.

For euros only, only for euros.

For euros only, only for euros.

The wars that are over me, with wild abandon are fought for me.

Only euros, for euros only.

When prosperity comes, do not use all of it. - Confucious

The nation is prosperous on the whole, but how much prosperity is there in a hole? - Will Rogers

#36. To: markm0722 (#35)

You've got me smilin' wide ... the line above reminds me ... oh nevermind ... ;-}

... the heat that you've freed in me.

Top • Page Up • Full Thread • Page Down • Bottom/Latest